|

|

|

|

|||||

|

|

SAP SE (SAP) is scheduled to post results for the third quarter of 2025 on Oct. 22, after market close.

The Zacks Consensus Estimate for third-quarter earnings is $1.69 per share, indicating a 25.2% increase from the year-ago reported actuals. The Zacks Consensus Estimate for revenues is currently pinned at $10.6 billion, implying a 13.5% jump from the year-ago figure.

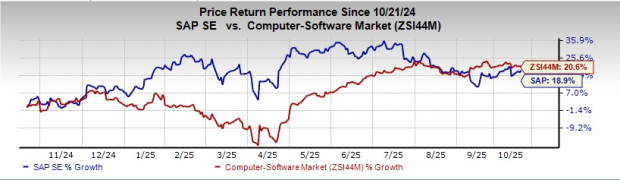

SAP's earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average beat of 7%. Shares of the company have risen 18.9% in the past year compared with the Computers - Software industry's growth of 20.6%.

SAP's third-quarter performance is likely to have been fueled by expanding its Cloud ERP business and prudent control of expenses. Furthermore, the broad uptake of its Rise with SAP and Grow with SAP offerings is a significant factor. Cloud revenue increased 24% on a non-IFRS basis, driven by the Cloud ERP Suite, which grew at more than 30% for 14 consecutive quarters in the second quarter. Operating profit surged 32%, reflecting improved cost management and productivity enhancements.

SAP’s growth strategy centers on four pillars - product innovation, go-to-market transformation, simplification and talent development. The company is leveraging AI to reinvent business processes, guide customers to its Business Suite, streamline operations and enhance workforce capabilities, aiming for sustained growth through 2027. Its SAP Business Data Cloud is set to unify enterprise data and power AI applications with reliable, context-rich information.

Management anticipates faster adoption of Business AI, with 14 AI agents launched in first half of 2025 covering commerce, quoting, customer service, dispute resolution and finance, and plans to expand to 40 agents by year-end. Internally, SAP uses AI to boost productivity, supporting strong operating profit growth and decoupling expense growth from revenue expansion. SAP highlighted that it has incorporated more than 1,300 skills into its AI co-pilot Joule and covered 80% of the business and analytical transactions at the end of 2024. Starting from the third quarter, Joule was accessible across both SAP and non-SAP systems through integration with WalkMe. From the fourth quarter, it will deliver comprehensive answers, supported by SAP’s partnership with Perplexity.

SAP’s strong cash flow allows it to invest in innovation, acquisitions and business growth while continuing to return cash to shareholders through dividends. Its solid free cash flow and cash reserves support sustaining the current dividend of 0.30 in the near term.

SAP SE price-eps-surprise | SAP SE Quote

Nonetheless, SAP remains cautious about the macroeconomic environment while maintaining its financial outlook for 2025. Geopolitical developments and trade policy uncertainties may adversely impact sales cycles, particularly in the U.S. public sector and manufacturing. SAP is focused on closing open opportunities and sustaining momentum in the second half of 2025. Despite strong capital markets, SAP is preparing for potential downside by tightening control over costs and protecting 2025 cash flow. Also, certain business models of SAP are highly dependent on a working cyberspace, which means that any breach in cybersecurity can lead to severe repercussions for the company’s reputation as well as result in a considerable amount of expenditure for settling legal claims.

Our proven model predicts an earnings beat for SAP this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is exactly the case here.

SAP has an Earnings ESP of +2.30% and a Zacks Rank #3 at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Here are some other companies with the right combination of elements to post an earnings beat in their upcoming releases.

Wabtec Corporation (WAB) has an Earnings ESP of +1.32% and a Zacks Rank #2 at present. WAB is scheduled to report third-quarter 2025 earnings on Oct. 22. You can see the complete list of today’s Zacks #1 Rank stocks here.

Wabtec earnings have surpassed the Zacks Consensus Estimate in three of the last four quarters while missing once, with the average beat being 5.4%. The Zacks Consensus Estimate for WAB’s third-quarter 2025 earnings has been revised 0.2% upward in the past 60 days. Shares of Wabtec have gained 2.2% over the past year.

Expeditors International of Washington, Inc. (EXPD) has an Earnings ESP of +1.43% and a Zacks Rank #3 at present. EXPD is scheduled to report third-quarter 2025 earnings on Nov. 4. Expeditors has surpassed the Zacks Consensus Estimate in each of the last four quarters, with the average beat being 15.30%.

The Zacks Consensus Estimate for Expeditors’ third-quarter 2025 earnings of $1.40 implies a decline of 14.11% year over year. Shares of EXPD have declined 0.2% over the past year.

NXP Semiconductors (NXPI) has an Earnings ESP of +1.11% and carries a Zacks Rank #2 at present.

It is set to report third-quarter 2025 results on Oct. 27. The Zacks Consensus Estimate for NXPI’s third-quarter earnings is pegged at $3.11 per share, indicating a decline of 9.8% from the year-ago quarter’s reported figure. Shares of NXPI have declined 6.8% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite