|

|

|

|

|||||

|

|

Becton, Dickinson and Company BDX, popularly known as BD, recently launched its new AI-enabled BD Incada Connected Care Platform alongside the next-generation BD Pyxis Pro Automated Medication Dispensing Solution. The launch marks a significant step in BD’s Connected Care strategy, integrating data from millions of smart devices into one cloud-based ecosystem to enhance visibility, efficiency and decision-making across healthcare settings.

Built on Amazon Web Services (AWS), the BD Incada Platform leverages AI-powered analytics and natural language insights to unify device data from pharmacy to bedside. Together with the BD Pyxis Pro Solution, it aims to improve medication availability, streamline workflows and strengthen BD’s position as a leader in digital and data-driven healthcare innovation.

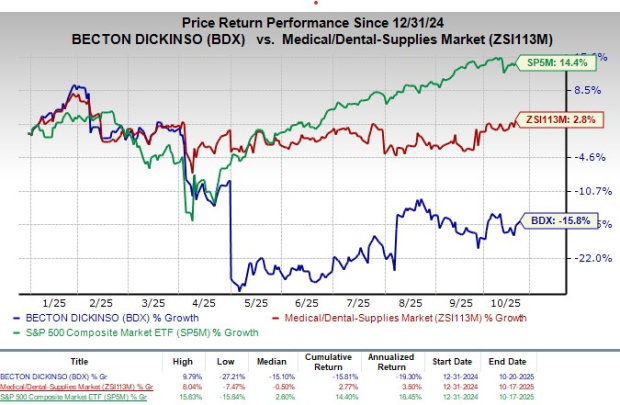

Following the announcement, the company's shares traded flat at yesterday’s closing. In the year-to-date period, shares have lost 15.8% against the industry’s 2.8% growth. The S&P 500 has gained 14.4% in the same time frame.

The BD Incada Platform and Pyxis Pro Solution launch positions BDX for sustained long-term growth by deepening its role in the rapidly expanding digital healthcare ecosystem. By integrating AI, cloud connectivity and real-time analytics across its vast installed base, BD can drive recurring software and service revenues while strengthening customer loyalty. The enhanced visibility, efficiency and medication management capabilities these solutions offer are likely to boost adoption among hospitals and health systems, reinforcing BD’s transition from a device maker to a data-driven healthcare technology leader.

BDX currently has a market capitalization of $52.2 billion.

The BD Incada Platform represents a significant leap in BD’s digital transformation, designed to turn the vast amount of device data it collects into actionable intelligence. Built on AWS infrastructure, the platform enables healthcare systems to gain enterprise-wide visibility into medication workflows, improving both efficiency and patient safety. By allowing clinicians to ask natural language questions and instantly receive AI-driven insights, BD is making real-time decision-making more intuitive and impactful. The ability to customize dashboards and integrate analytics across millions of connected devices positions BD at the forefront of data-enabled healthcare innovation.

Meanwhile, the BD Pyxis Pro Dispensing Solution enhances one of BD’s most trusted product lines with modernized storage, automation and security capabilities. The redesigned, stackable configuration expands capacity without increasing the device footprint, a key advantage for space-constrained hospitals. Its advanced access tools, including RFID scanning and illuminated bins, streamline medication retrieval while minimizing errors. These improvements strengthen BD’s value proposition in medication management — a category that has delivered consistent recurring revenues through software, hardware and consumables.

Together, the Incada Platform and Pyxis Pro Solution deepen BD’s competitive moat by connecting its devices into a unified, intelligent ecosystem. This convergence of hardware and AI analytics opens up high-margin opportunities in cloud services, data insights and subscription-based models, adding durable growth drivers to BD’s portfolio. As hospitals increasingly invest in digital transformation and connected care systems, BD’s ability to deliver integrated solutions that improve efficiency, safety and cost management could support steady margin expansion and long-term shareholder value creation.

Currently, BDX carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Masimo MASI, Merit Medical System MMSI and West Pharmaceutical Services WST. Each stock presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Masimo shares have lost 10.4% so far this year compared with the industry’s 7.4% decline. Estimates for the company’s 2025 earnings per share have increased 1.3% to $5.30 in the past 30 days.

MASI’s earnings beat estimates in each of the trailing four quarters, the average surprise being 13.8%. In the last reported quarter, it posted an earnings surprise of 8.1%.

Estimates for Merit Medical’s 2025 earnings per share have increased 0.8% to $3.63 in the past 60 days. Shares of the company have lost 13.8% so far this year against the industry’s 1.1% growth.

MMSI’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.92%. In the last reported quarter, it delivered an earnings surprise of 17.44%.

Estimates for West Pharmaceutical’s 2025 earnings per share have increased 1.2% to $6.74 in the past 60 days. Shares of the company have lost 18.2% so far this year against the industry’s 1% growth.

WST’s earnings beat estimates in each of the trailing four quarters, the average surprise being 16.81%. In the last reported quarter, it delivered an earnings surprise of 21.85%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 51 min | |

| 1 hour | |

| 4 hours | |

| 9 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Stock Market Today: Dow, Nasdaq Eke Out Gains; Gold, Silver Names Slide (Live Coverage)

MASI +34.22%

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Stock Market Today: Nasdaq, Dow Climb; Airline Name Flies Higher (Live Coverage)

MASI +34.22%

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 |

Stock Market Today: Dow Weakens As Nasdaq Lags; Biotech Name Hits Record (Live Coverage)

MASI +34.22%

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite