|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Innodata Inc. INOD and SoundHound AI, Inc. SOUN are two emerging players carving out their spots in the artificial intelligence ecosystem. While both companies fall under the broader AI theme, their core offerings highlight different but complementary aspects of the industry. Innodata specializes in data engineering and training data services, which serve as the backbone for building and refining AI models. SoundHound, on the other hand, focuses on voice-enabled AI and conversational intelligence, tapping into the growing demand for seamless human-machine interactions.

As AI adoption accelerates across industries, investors are increasingly looking for exposure to companies that support the infrastructure and applications fueling this growth. INOD and SOUN represent distinct approaches to monetizing AI, one centered on powering model development and the other on enabling end-user experiences. The key question for investors is which of these niche AI stocks offers the stronger long-term opportunity.

Innodata is carving out a critical role in the AI ecosystem by positioning itself as more than just a provider of raw data. Its expertise lies in delivering high-quality, complex training datasets and supporting services that are essential to advancing generative AI models. The company is deeply aligned with the needs of leading technology firms that are racing toward breakthroughs in superintelligence, autonomy and large-scale deployment of AI systems. By supplying “smart data”, tailored to improve accuracy, safety and reasoning in AI models, Innodata is building a reputation as a trusted partner rather than a commodity vendor.

What makes the story especially compelling is Innodata’s growing traction with marquee technology customers. The company has steadily expanded engagements with its largest client while winning new, meaningful projects with other major tech firms. This success reflects not only the demand for the services but also the trust it has earned in handling critical data engineering challenges. As AI adoption accelerates, these relationships are likely to deepen, opening the door to larger, long-term revenue pools.

In addition to serving frontier model developers, Innodata is positioning itself at the forefront of emerging opportunities, such as Agentic AI and robotics. These next-generation applications will require sophisticated simulation data, trust-and-safety monitoring and advanced evaluation frameworks, areas where Innodata has already begun investing. Management believes these markets could ultimately surpass traditional post-training data services in size, giving the company an early lead in what may be the next big wave of AI adoption.

Another strength is that Innodata’s growth has been organic, driven by its capabilities rather than acquisitions. This not only lowers execution risk but also highlights the scalability of its model. The company continues to reinvest in delivery capacity, platform development and AI consulting services to compound long-term value. For investors seeking exposure to the infrastructure side of AI, the data, testing and safety layers that underpin model performance, Innodata represents a differentiated play with significant potential to expand as enterprises and tech giants accelerate their AI roadmaps.

SoundHound has built strong momentum across its three strategic pillars, automotive, enterprise AI and restaurants, creating a diversified foundation for growth. Its partnerships with major automakers, including global OEMs, show the company’s ability to scale generative AI-powered assistants into vehicles across multiple regions. The introduction of Voice Commerce, which allows in-car ordering and payments, has added another differentiating feature that resonates with both OEMs and merchants. This ecosystem approach gives SoundHound the potential to capture recurring revenues as usage deepens.

The company’s proprietary Polaris foundation model is a major competitive advantage. Management emphasized that Polaris outperforms peers on both accuracy and latency while operating at a lower cost, which has translated into higher close rates with customers. By migrating acquisitions and legacy solutions onto Polaris, SoundHound has not only improved customer outcomes but also reduced expenses, strengthening both customer loyalty and operational efficiency. The integration of Vision AI alongside Polaris further expands the use cases, creating a more immersive multimodal conversational experience that competitors are still struggling to match.

SoundHound is also demonstrating execution strength through successful acquisitions and cross-selling opportunities. Subsidiaries brought under its umbrella have been revitalized, turning from pre-merger decline into growth engines. The company has secured new wins in restaurants with major chains such as Chipotle, IHOP and Red Lobster, while continuing to expand with existing clients. SoundHound’s healthcare and financial services contracts, including relationships with top-tier institutions, reinforce its ability to penetrate multiple industries. With channel partnerships now accelerating adoption, SoundHound is building distribution leverage that can compound growth further.

Despite these advances, SoundHound still faces the challenge of balancing growth with profitability. Heavy investment in R&D, sales and integration has kept adjusted EBITDA in the red and management acknowledged that lumpy enterprise deals can cause quarterly volatility. Gross margins, while improving sequentially, remain pressured by acquisition-related costs and product mix. Until Voice Commerce and other agentic AI solutions reach meaningful scale, investors may see uneven results and continued near-term losses, which could temper enthusiasm even as long-term demand trends remain highly favorable.

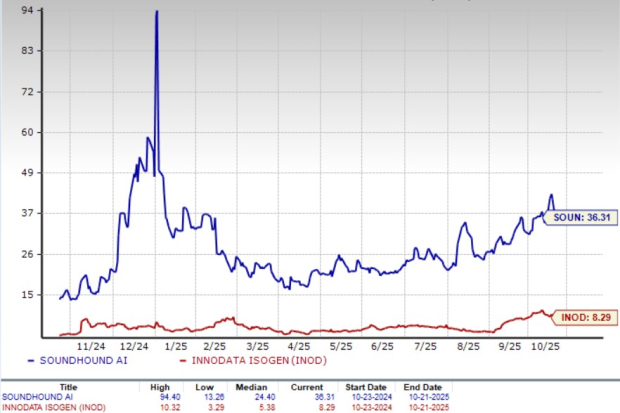

INOD stock has surged 124% in the past six months compared with the S&P 500’s growth of 27.2%. Conversely, SOUN’s shares have jumped 108.3% in the same time frame.

INOD is trading at a forward 12-month price-to-sales (P/S) ratio of 8.29X, above its one-year median of 5.38X. On the other hand, SOUN’s forward sales multiple sits at 36.31X, above its one-year median of 24.4X.

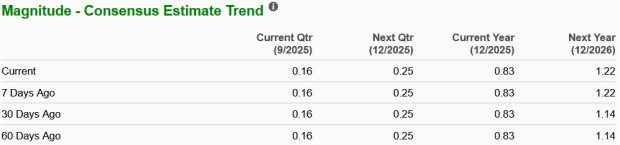

The Zacks Consensus Estimate for INOD’s current-year earnings per share has remained stable at 83 cents in the past 60 days. However, the consensus mark for the next year's earnings per share has increased to $1.22, as shown in the chart.

The Zacks Consensus Estimate for SOUN's current year loss per share has remained stable in the past 60 days. However, the loss estimate for next year has narrowed, as shown in the chart.

Both Innodata and SoundHound are carving unique positions in the AI landscape, but they are at very different stages of maturity. Innodata stands out as a stronger buy given its role in powering the foundation of AI with high-quality training data and trusted partnerships with leading tech companies. INOD’s focus on trust, safety and next-generation applications like Agentic AI and robotics gives it a scalable growth path supported by organic momentum.

SoundHound, meanwhile, has built an impressive platform in voice AI with strong partnerships and expanding use cases, but its path to profitability remains uncertain due to heavy investment needs and margin pressures.

For investors, this makes Innodata a more compelling choice today, while SoundHound is better suited as a hold until it demonstrates clearer earnings visibility and steadier financial performance. INOD sports a Zacks Rank #1 (Strong Buy), whereas SOUN carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite