|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

As North America embarks on an infrastructure expansion driven by grid modernization, renewable energy growth and data center expansion, companies at the heart of this transformation are drawing investor attention. Two of the most prominent players in this field are Primoris Services Corporation (PRIM) and Quanta Services, Inc. (PWR), both deeply embedded in the construction and engineering networks powering the continent’s energy and utility systems.

Primoris has evolved into a diversified infrastructure contractor with operations across utilities and energy sectors, spanning power delivery, renewables, and natural gas generation, along with expansion in communications and data center construction. On the other hand, Quanta has built a large-scale platform integrating engineering, procurement, and construction services across electric, gas, renewable, and communications infrastructure, expanding through acquisitions and focusing on transmission, grid resiliency, and technology projects with a flexible, decentralized model.

Let us dive deep and closely compare the fundamentals of the two stocks to determine which one is the better investment now.

This Texas-based specialty construction and infrastructure company continues to benefit from strong demand across renewable energy, utilities and communications markets. In the second quarter of 2025, revenue growth was supported by expanding power generation and clean energy projects, while higher utility activity improved margins. The company’s diversified presence across power delivery, renewables and data infrastructure continues to drive stable performance and solid execution across its core segments.

Renewable and power generation markets remain central to the company’s growth strategy. Execution in solar and gas generation projects exceeded expectations in the second quarter, aided by customer demand and favorable market conditions. The company is bidding for more than $2.5 billion in natural gas generation projects and evaluating an additional $20-$30 billion in solar opportunities through 2028, underscoring significant long-term potential. Supportive policy incentives and a growing mix of engineering, procurement and construction work continue to enhance visibility across its clean energy portfolio.

Despite the company’s strong momentum, certain areas continue to face near-term challenges. Activity in the pipeline segment remains subdued as several large-diameter natural gas and liquids projects await final investment approval. Regulatory changes and shifting renewable energy policies are adding some cost and scheduling pressure, creating potential short-term variability in margins and project execution.

A growing backlog continues to strengthen the company’s long-term outlook. Total backlog stood at approximately $11.5 billion at the end of the second quarter of 2025, reflecting a sequential increase of about $100 million. Growth was led by MSA backlog, which expanded more than $600 million, driven by higher power delivery activity within utilities. With steady demand in renewables, power infrastructure and communications, Primoris remains positioned for continued growth into 2026 as it leverages expanded capabilities to capture high-value energy and infrastructure opportunities.

Quanta continues to strengthen its leadership position in utility infrastructure, driven by growing demand for electric transmission, grid modernization and renewable energy connections. The company is benefiting from rising power needs tied to data centers, artificial intelligence and domestic manufacturing expansion. In the second quarter of 2025, strong execution across Electric Power Infrastructure Solutions and Renewable Energy segments supported revenue growth and margin improvement, reflecting consistent customer investment in essential energy and connectivity projects.

The company’s growth momentum remains anchored by large-scale transmission and renewable initiatives. Expanding opportunities in grid hardening, power delivery and high-voltage construction continue to enhance long-term visibility. Quanta’s record backlog of $35.8 billion in the second quarter, supported by $19.2 billion in remaining performance obligations, underscores increasing customer commitments and a multi-year pipeline of work. Key projects such as the Boardman to Hemingway transmission line and various renewable energy programs are expected to support stable growth over the next several years.

Despite steady progress, the company faces some near-term challenges related to project timing and cost dynamics. The Renewable Energy segment saw margin variability due to weather disruptions and labor constraints, while permitting and supply-chain issues continue to affect certain large projects. These factors could lead to short-term fluctuations in profitability, though demand fundamentals remain solid.

Looking ahead, Quanta’s record backlog and expanding scope of work provide a solid foundation for continued growth. The company’s strategic investments in energy transition, grid reliability and communications infrastructure position it well to benefit from sustained spending across utilities and renewable markets. With increasing visibility into long-term revenue streams and disciplined project execution, Quanta remains well-placed to deliver consistent earnings growth and shareholder value through 2026 and beyond.

As witnessed from the chart below, year to date, Primoris’ share price performance stands above those of Quanta and the Zacks Building Products - Heavy Construction industry.

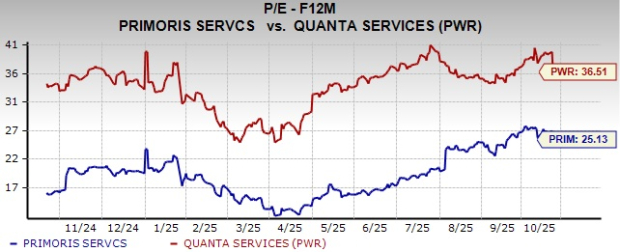

Considering valuation, Primoris stock is currently trading at a discount compared with Quanta on a forward 12-month price-to-earnings (P/E) ratio basis.

The Zacks Consensus Estimate for PRIM’s 2025 EPS indicates 31.3% year-over-year growth, with the 2026 estimate implying an increase of 9.3%. Its 2025 EPS estimate has remained unchanged in the past 30 days.

The Zacks Consensus Estimate for PWR’s 2025 EPS implies 17.8% year-over-year growth, with the 2026 estimate indicating an increase of 16.5%. Its 2025 EPS estimate has remained unchanged in the past 30 days.

Both Primoris and Quanta are well-positioned to benefit from the ongoing wave of infrastructure investment across North America, particularly in grid modernization, renewables and data center development. PRIM continues to perform well with steady execution, margin improvement and a growing backlog supported by strong utility and clean energy demand. However, Quanta stands out for its larger scale, diversified portfolio and stronger visibility in high-voltage transmission and renewable energy projects.

With record backlog, strategic acquisitions and consistent earnings momentum, Quanta is better placed to capture long-term infrastructure opportunities. Primoris carries a Zacks Rank #3 (Hold), while Quanta has a Zacks Rank #2 (Buy), making it the stronger pick for investors seeking exposure to the infrastructure growth theme. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 35 min |

Stock Market Today: Dow Slips After Surprise Jobless Claims; DoorDash Jumps(Live Coverage)

PWR

Investor's Business Daily

|

| 1 hour |

Stock Market Today: Dow Slides After Surprise Jobless Claims; AI Stock Jumps (Live Coverage)

PWR

Investor's Business Daily

|

| 1 hour | |

| 2 hours |

This S&P 500 AI Data Center Play Eyes New Highs On Earnings; 20% Profit Growth Expected

PWR

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 6 hours | |

| 7 hours | |

| Feb-18 |

Walmart To Report Results, Fresh Off New Highs, A New CEO And $1 Trillion Market Cap

PWR

Investor's Business Daily

|

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite