|

|

|

|

|||||

|

|

The engineering and construction landscape within the energy-infrastructure sector is undergoing a meaningful shift as utilities, data-center operators and industrial customers rush to expand capacity, modernize grids and secure reliable power solutions. At the center of this transformation are two major U.S.-listed contractors, Quanta Services, Inc. PWR and Fluor Corporation FLR, both deeply embedded in power generation, transmission, utilities work and large-scale EPC services. Their strategic roles in supporting electrification, the rise of energy-intensive technologies and the build-out of modern infrastructure make the comparison particularly relevant now.

Yet while they operate in overlapping markets, each company is navigating the current cycle in its own way. One is leaning into a platform built around execution certainty, craft labor and integrated solutions for utility and technology customers. The other is reshaping itself through a more asset-light approach, sharpening its focus on reimbursable work and pursuing opportunities across mining, LNG, power, government services and global EPC programs. With both positioned to benefit from long-term infrastructure demand, the question becomes which firm stands out at this moment.

Let us dive deep and closely compare the fundamentals of Quanta and Fluor to determine which one may offer more upside now.

PWR is gaining momentum across its core end markets, supported by investment in electric infrastructure, renewable energy and rising demand from large load customers. The Electric segment remained the primary contributor, accounting for 80.9% of total revenues in the third quarter of 2025. Segment revenues reached $6.17 billion, marking 17.9% year-over-year growth. Grid modernization efforts, rising needs from data center and industrial customers and steady activity in renewable energy and battery storage work helped drive this strong performance as early-stage projects moved toward full construction.

Solid demand trends were also reflected in the company’s record backlog. PWR closed the third quarter of 2025 with $39.2 billion in backlog, up from $33.96 billion a year ago, reinforcing durable visibility across utility, renewable and technology-driven markets. Remaining performance obligations expanded as well, supported by increased activity in the Electric segment and sustained customer investment tied to manufacturing, electrification and higher load requirements. This strong foundation enabled the company to lift its full-year revenues and free cash flow outlook while maintaining a healthy pipeline of multi-year projects.

However, some near-term challenges remain, particularly within large generation and EPC-style programs that carry greater execution complexity. The company also experienced timing variability in certain pipeline-related work, which can create quarter-to-quarter fluctuations. These factors introduce manageable pockets of uncertainty but do not change the broader strength of the company’s demand environment.

Looking ahead, PWR expects ongoing strength across its utility, renewable and technology customer base as electricity needs continue to rise. Expanding power requirements from data centers, manufacturing, electrification and other high-load applications are likely to support incremental investment in transmission, substation, generation and related infrastructure. With growing adoption of its total solutions platform and increasing visibility from multi-year programs extending into 2026, the company appears well-positioned to benefit from long-term infrastructure and energy-transition trends.

This Texas-based engineering, procurement, construction and maintenance services provider is capitalizing on healthy activity across its key end markets, supported by strong execution in Energy Solutions, continued progress in Mission Solutions and improving trends within Urban Solutions. The company pointed to solid momentum in LNG, energy transition initiatives, mining and emerging demand tied to power and data centers. This broad activity base helped reinforce stable performance across its global portfolio.

Stronger-than-expected performance across multiple segments and disciplined project execution prompted the company to raise its full-year guidance, owing to improved visibility on reimbursable work and better-than-planned contributions from LNG, mining and government programs. At the end of the third quarter of 2025, total backlog stood at $28.2 billion, with 82% consisting of reimbursable projects, reflecting a healthier, lower-risk mix that supports more predictable performance. These factors collectively strengthened confidence in the company’s near-term outlook.

However, certain challenges remain, particularly related to legacy fixed-price projects that still require careful management. Some international markets continue to face a slower contracting environment and project timing within Urban Solutions is influenced by customer decision cycles. While these issues create pockets of uncertainty, the company emphasized that they remain contained and manageable within its wider portfolio.

Looking ahead, the company expects constructive conditions across LNG, clean energy, mining, mission-critical government work and emerging opportunities tied to electrification and power demand. As customers advance capital spending related to energy security, industrial expansion and long-term infrastructure needs, the company sees a strengthening pipeline of engineering and EPC opportunities. With an improving backlog mix and expanding end-market visibility, the company appears well-positioned for continued growth in the years ahead.

As witnessed from the chart below, in the past six months, Quanta’s share price performance stands above Fluor’s and the Zacks Engineering - R and D Services industry.

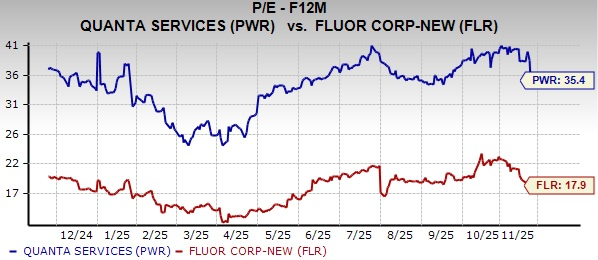

Considering valuation, Quanta is currently trading at a premium compared with Fluor on a forward 12-month price-to-earnings (P/E) ratio basis.

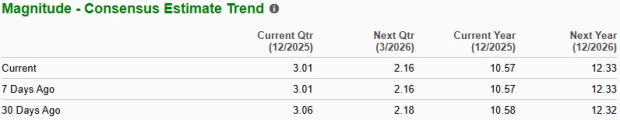

The Zacks Consensus Estimate for PWR’s 2025 and 2026 earnings estimates implies year-over-year improvements of 17.8% and 16.7%, respectively. Its 2025 EPS estimate has decreased over the past 30 days, while the same has increased for 2026.

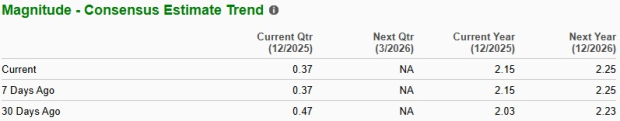

The Zacks Consensus Estimate for FLR’s 2025 EPS indicates a 7.7% year-over-year decline, while the 2026 estimate indicates an increase of 4.5%. The 2025 and 2026 EPS estimates have increased over the past 30 days.

Both Quanta and Fluor carry a Zacks Rank #3 (Hold), with each supported by different fundamental drivers. Fluor has benefited from improving execution, a stronger mix of reimbursable work and better visibility across LNG, mining and government programs, though legacy fixed-price projects and timing variability in certain end markets remain areas to watch.

Quanta offers steadier long-cycle exposure tied to utility infrastructure, grid modernization and rising power needs from data centers and large load customers. Its record backlog provides solid multi-year visibility, even as large generation and EPC-style programs introduce their own execution complexities.

Investors may prefer to monitor how upcoming awards, project timing and end-market trends unfold for both companies, as these factors will play a key role in shaping their trajectories over the next few quarters.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite