|

|

|

|

|||||

|

|

Carter's, Inc. CRI is scheduled to release third-quarter 2025 results on Oct. 27, before the opening bell. The branded marketer of apparel exclusively for babies and children in North America is likely to witness a decline in the top and bottom lines when it reports third-quarter numbers.

The Zacks Consensus Estimate for third-quarter revenues is pegged at $751 million, indicating a decline of 0.98% from the figure reported in the year-ago quarter. The consensus estimate for quarterly earnings, which has remained unchanged at 78 cents per share in the past 30 days, indicates a decrease of 52.4% from the year-ago quarter’s figure.

The company has a trailing four-quarter earnings surprise of 7.5%, on average. In the last reported quarter, CRI’s bottom line missed the Zacks Consensus Estimate by 60.5%.

Carter’s continues to navigate a challenging macroeconomic and retail environment as it enters the third quarter of 2025. Persistent inflationary pressures and elevated interest rates remain key headwinds for the company’s core demographic, families with young children. Although the second quarter indicated stabilization in business trends, discretionary spending constraints continue to weigh on apparel demand. The company is focused on balancing affordability with value perception through selective pricing adjustments, particularly as consumers remain cautious with household budgets. Despite these pressures, Carter’s ongoing brand revitalization and new leadership-driven initiatives provide a framework for gradual recovery in the second half of the year.

In the U.S. Retail segment, momentum has modestly improved, supported by better traffic and solid back-to-school trends, though pricing investments earlier in the year pressured gross margins. Management cited a 2% comp gain in July and stronger baby category sales, up double digits, as bright spots heading into the second half.

However, continued consumer selectivity and a promotional marketplace are likely to have restrained top-line acceleration. Wholesale trends are expected to have remained roughly flat year over year, with stronger off-price channel sales offset by margin pressure from clearance activity. International growth, led by Canada and Mexico, remains a positive contributor but is likely to face FX-related headwinds that are expected to temper reported results.

In addition, the company has been witnessing higher selling, general and administrative expenses (SG&A) as a percentage of sales, owing to fixed cost deleverage from lower sales, with investments in brand marketing and retail stores, higher distribution expenses and rising transportation costs. The higher SG&A expense rate is expected to have strained operating margins and reduced profitability.

Moreover, the company has been witnessing a tough retail landscape and the adverse effects of foreign currency translations. These factors, along with reduced online traffic, are expected to have particularly dented its top-line performance in the quarter under review. Our model predicts a sales decline of 3.2% in the U.S. Retail and a rise of 0.4% in the U.S. Wholesale.

On the flip side, Carter’s has been making efforts to overcome such challenges by doubling down on strategic initiatives aimed at improving long-term performance. The company has been enhancing its merchandise assortments to better align with evolving consumer preferences and focusing on refining its inventory management to ensure more efficient stock levels. It has been implementing measures like improved pricing and optimized inventory management, apart from strengthening its e-commerce capabilities.

Our proven model does not conclusively predict an earnings beat for Carter's this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Carter's currently has an Earnings ESP of 0.00% and a Zacks Rank #5 (Strong Sell).

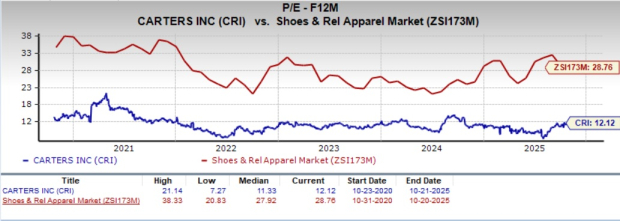

From a valuation perspective, Carter’s offers an attractive opportunity, trading at a discount relative to historical and industry benchmarks. With a forward 12-month price-to-earnings ratio of 12.12X, which is below the five-year high of 21.14X and the Shoes and Retail Apparel industry’s average of 28.76X, the stock offers compelling value for investors seeking exposure to the sector.

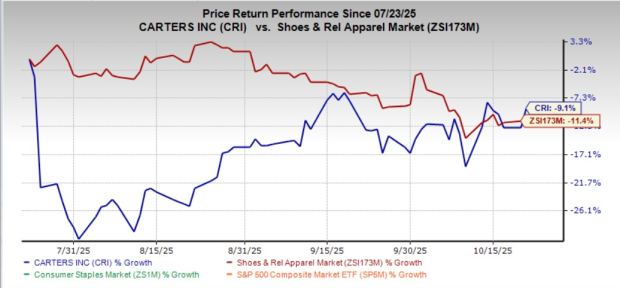

The recent market movements show that CRI’s shares have lost 9.1% in the past three months compared with the industry's 11.4% decline.

Here are a few companies that have the right combination of elements to post an earnings beat this time around:

Carnival Corp. CCL currently has an Earnings ESP of +1.45% and sports a Zacks Rank of 1. CCL is likely to register top and bottom-line growth when it reports fourth-quarter fiscal 2025 results. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for its quarterly revenues is pegged at $6.36 billion, indicating a 7.2% increase from the figure reported in the year-ago quarter. The consensus estimate for CCL’s fiscal fourth-quarter earnings is pegged at 24 cents per share, implying a 71.4% surge from the year-ago quarter’s actual. The consensus mark has risen 20% in the past 30 days.

Boyd Gaming BYD currently has an Earnings ESP of +1.25% and a Zacks Rank of 3. BYD is likely to register a top-line decline when it reports third-quarter 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $865.8 million, indicating a 9.9% decline from the figure reported in the year-ago quarter.

The consensus estimate for Boyd Gaming’s third-quarter earnings is pegged at $1.55 a share, implying 1.9% growth from the year-ealier quarter. The consensus mark has increased a penny in the past 7 days.

Ralph Lauren Corporation RL currently has an Earnings ESP of +1.98% and a Zacks Rank of 2. RL is likely to register top and bottom-line growth when it reports second-quarter fiscal 2026 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $1.9 billion, indicating 9.9% growth from the figure reported in the year-ago quarter.

The consensus estimate for Ralph Lauren’s fiscal second-quarter earnings is pegged at $3.44 a share, implying 35.4% growth from the year-earlier quarter. The consensus mark has moved up 1.5% in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 hours | |

| Mar-07 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 | |

| Mar-04 | |

| Mar-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite