|

|

|

|

|||||

|

|

ASML is the only company capable of building the world's most advanced chipmaking machines.

Demand for AI and the hardware that can support it are expanding ASML’s growth runway.

ASML offers one of the most durable ways to gain exposure to AI infrastructure growth.

Most investors chasing profits from the artificial intelligence (AI) boom focus on names like Nvidia, Microsoft, or Palantir Technologies. But behind every AI model and data center lies a less flashy, far more indispensable player: ASML Holding (NASDAQ: ASML). The Dutch company doesn't design chips or train neural networks. Instead, it builds the machines that make manufacturing advanced chips possible.

That quiet position -- at the intersection of physics, precision engineering, and computing -- makes ASML one of the most crucial, and perhaps underestimated, beneficiaries of the AI revolution.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

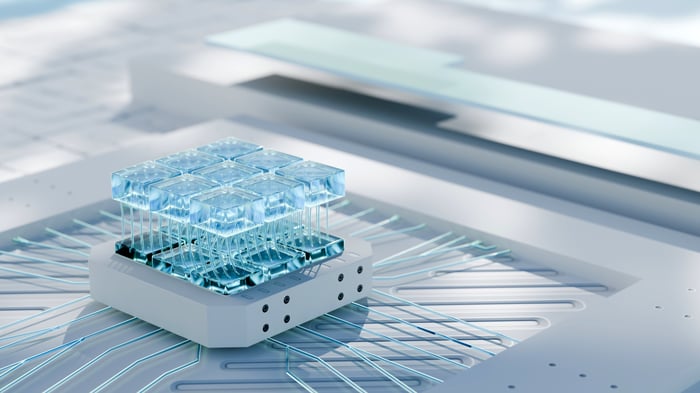

Image source: Getty Images.

Artificial intelligence runs on silicon. Every model, from ChatGPT to Tesla's self-driving systems, depends on powerful, cutting-edge chips that are capable of crunching enormous datasets. Such chips are manufactured by foundry operators such as Taiwan Semiconductor Manufacturing, Samsung Electronics, and Intel -- and all of them rely on ASML's lithography machines to make their most advanced semiconductors.

Lithography is the process of using light to etch microscopic patterns on silicon wafers, forming the transistors and circuitry that power modern chips. ASML's extreme ultraviolet (EUV) lithography machines use incredibly short wavelengths of light, which allows them to etch features just a few nanometers wide. Without EUV, producing cutting-edge chips like Nvidia's H200 or Apple's M3 would be impossible.

ASML holds a technological monopoly in this domain. It is the only company in the world capable of producing EUV lithography systems at scale -- systems that cost upwards of $200 million each and take months to assemble. That dominance places ASML at the heart of global chipmaking -- and, by extension, at the heart of AI's hardware stack.

The global AI buildout is driving an extended surge in demand for computing power. Data centers are expanding, cloud providers are upgrading hardware, and chipmakers are racing to pack more transistors into every square millimeter of silicon.

This trend plays directly into ASML's hands. The only way to deliver faster, more-energy-efficient chips is by using increasingly advanced lithography tools -- and that means more orders for ASML.

According to S&P Global, the company's EUV revenue are set to grown by roughly 40% in 2025, while revenue from its high-NA EUV systems could triple year over year. High-NA EUV is ASML's next-generation lithography technology that can etch even smaller features, allowing for even more transistor-dense, powerful, and energy-efficient chips -- all capabilities increasingly vital for applications like AI, high-performance computing, and mobile processors.

As long as AI demand keeps growing, chipmakers will keep upgrading and expanding their fabs, and ASML will remain the indispensable supplier sitting at the center of that ecosystem.

Investors looking for AI exposure in recent years have often bought chipmakers or software developers, but those bets come with high cyclicality and competitive risk. ASML offers something different -- a pick-and-shovel play that should keep benefiting from the progress of the AI megatrend, no matter which companies win the AI hardware and software races.

Its revenue comes from both equipment sales and recurring service agreements. That means steadier margins, more predictable cash flows, and a longer runway for compound growth. For perspective, ASML generated a 28% net margin in 2024, a high figure by any standard.

Besides, leveraging its solid moat built through many years of research and development, a complex supply chain, and high customer switching costs, the business faces little competitive risk. In short, ASML isn't chasing AI trends. It's enabling them.

ASML sits quietly at the foundation of the AI economy. Every breakthrough in machine learning, every leap in data-center performance, and every next-generation chip is dependent on its machines.

For investors with long time horizons, ASML offers exposure not to the noise of AI hype, but to the infrastructure powering it. With its unmatched technology, global customer base, and decade-long head start, ASML may well be the ultimate AI infrastructure stock -- one built not on speculation, but on the physics that make progress possible.

It's a stock that investors should keep on their watch lists.

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $669,449!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,110,486!*

Now, it’s worth noting Stock Advisor’s total average return is 1,076% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of October 20, 2025

Lawrence Nga has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Apple, Intel, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite