|

|

|

|

|||||

|

|

Cardinal Health, Inc. CAH is scheduled to report first-quarter fiscal 2026 results on Oct. 30, before market open.

In the last reported quarter, the company’s adjusted earnings per share (EPS) of $2.08 surpassed the Zacks Consensus Estimate by 2.5%. Its earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 9.17%.

Let’s check out the factors that might have shaped CAH’s performance prior to the announcement.

Stryker Corporation price-eps-surprise | Stryker Corporation Quote

Cardinal Health is set to open fiscal 2026 with momentum carried over from its strong fourth quarter, though several dynamics are likely to have shaped first-quarter performance. Robust pharmaceutical demand, new customer wins, and rising specialty penetration are likely to have provided a tailwind.

The Pharmaceutical and Specialty Solutions unit, the company’s largest segment, has possibly benefited from steady brand and generics volume growth, alongside increasing contributions from its multi-specialty MSO platforms. Biosimilars and GLP-1 therapies might have continued to play a key role in sustaining revenue growth. Our estimate for the Pharmaceutical and Specialty Solutions segment is pegged at $53.58 billion.

In Global Medical Products and Distribution (“GMPD”), management’s improvement initiatives and expanding Cardinal-branded portfolio should have supported profitability. However, first-quarter margins might have come under pressure from tariff-related costs, which the company has been mitigating through supply-chain diversification, U.S. manufacturing expansion, and selective pricing adjustments. Our estimate for the GMPD segment’s sales is pegged at $3.19 billion.

Meanwhile, the company’s Other segment, comprising its growth businesses (including at-Home Solutions, Nuclear and Precision Health, and OptiFreight Logistics) is expected to have remained a bright spot. The ADS integration in at-Home Solutions, coupled with nuclear expansion into theranostics and PET imaging, likely fueled strong double-digit growth across the portfolio. Our estimate for the Other segment’s sales is pegged at $1.49 billion.

U.S. and international sales are estimated to be $57.82 billion and $437 million, respectively.

However, higher SG&A tied to recent acquisitions, ongoing technology investments, and financing costs from debt-funded deals might have weighed on operating leverage. Regulatory uncertainties around reimbursement in at-home care and competitive bidding risks for diabetes devices remain lingering concerns. Our model estimates adjusted operating margin to be 1.3% in the fiscal first-quarter.

For first-quarter fiscal 2026, the Zacks Consensus Estimate for revenues is pegged at $59.05 billion, implying an improvement of 13% from the prior-year quarter’s reported figure.

The consensus estimate for EPS is pegged at $2.21, indicating an increase of 17.6% from the prior-year period’s reported number.

Per our proven model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP:Cardinal Health has an Earnings ESP of -2.75%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank:The company currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

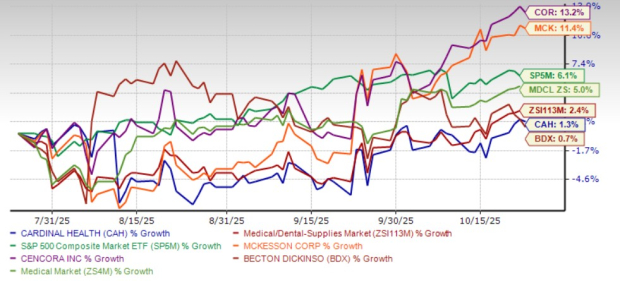

Over the past three months, Cardinal Health’s shares have gained 1.2%, underperforming the Medical - Dental Supplies’ 2.4% rise. CAH’s shares have also underperformed the Zacks Medical sector’s 5% increase and the S&P 500’s 6.1% gain during the period.

Three Months Price Comparison

While peers likeBecton, Dickinson and Company BDX, popularly known as BD, lagged behind Cardinal Health, both McKesson MCK and Cencora COR outperformed it. Shares of MCK, COR and BDX have risen 11.4%, 13.2% and 0.7%, respectively, in the past three months.

From a valuation standpoint, CAH’s forward 12-month price-to-earnings (P/E) is 16.3X, a discount to the industry's average of 16.8X.

The company is trading at a discount to its peers, McKesson and Cencora. However, Cardinal Health is trading at a premium to BD. Currently, McKesson and Cencora’s P/E ratio is 19.4X and 18.9X, respectively, while that for BD is 12.7X.

Cardinal Health is building a durable growth runway anchored in its Pharmaceutical and Specialty Solutions business, supported by consistent brand, specialty and biosimilar momentum. The company’s rapid expansion into multi-specialty MSO platforms, highlighted by the acquisitions of GI Alliance and Solaris Health, significantly scales its physician network across gastroenterology, oncology and urology. These platforms not only diversify revenue streams beyond drug distribution but also strengthen Cardinal’s positioning in high-growth therapeutic areas.

In parallel, Biopharma Solutions, including the Sonexus patient access hub, is expected to grow 20% annually, fueled by technology-enabled services that improve patient onboarding and adherence. The Specialty Networks’ AI-driven analytics platforms, PPS Analytics and SoNaR, further enhance Cardinal’s value proposition with data insights that enable better clinical outcomes.

Outside of specialty, the company’s at-Home Solutions segment, bolstered by the ADS acquisition and ongoing distribution center expansion, is tapping into secular demand for home healthcare. Investments in Nuclear and Precision Health Solutions, particularly in theranostics and PET imaging, create a differentiated position in oncology and urology diagnostics.

Together, these initiatives, alongside supply-chain modernization and Cardinal-branded product growth in GMPD, position CAH for sustained earnings growth and margin expansion over the next several years.

However, execution risks remain. Tariff-related cost pressures, regulatory uncertainty in at-home care reimbursement, and integration complexities from recent acquisitions could weigh on margins. Rising financing costs tied to debt-funded deals and customer concentration risks further challenge long-term visibility, making disciplined execution critical to sustaining Cardinal Health’s growth trajectory.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 33 min | |

| 9 hours | |

| 10 hours | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Mar-01 | |

| Mar-01 | |

| Feb-28 | |

| Feb-28 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite