|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Coeur Mining CDE is scheduled to report third-quarter 2025 results on Oct. 29, after market close.

The Zacks Consensus Estimate for Coeur Mining’s third-quarter total sales is pegged at $547 million, indicating a jump of 74% from the year-ago quarter.

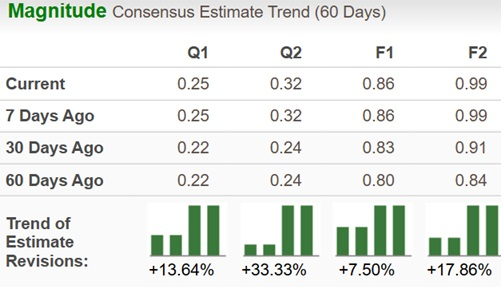

The consensus mark for earnings has moved up 13.6% in the past 60 days and currently stands at 25 cents per share. It suggests 108% growth from the prior-year quarter.

CDE’s earnings beat the Zacks Consensus Estimates in three of the trailing four quarters but missed in one. The company has a trailing four-quarter earnings surprise of 126.47%, on average. The trend is shown in the chart below.

Our proven model predicts an earnings beat for Coeur Mining this time. This is because the stock has the right combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), which increases the chances of an earnings beat.

Earnings ESP: CDE has an Earnings ESP of +1.00%. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the second quarter of 2025, Coeur Mining reported a notable year-over-year increase of 79% in silver production, totaling 4.7 million ounces. This was attributed to solid contributions from all five of its North American gold and silver operations. The quarter also marked the full contribution from the Las Chispas mine, which was added through the SilverCrest acquisition in mid-February 2025. Gold production for the quarter was 108,487 ounces, 38% higher year over year.

The company maintained its 2025 production guidance of 380,000–440,000 ounces of gold and 16.7–20.25 million ounces of silver, suggesting year-over-year increases of 20% and 62%, respectively, at the midpoint.

The Las Chispas mine contributed 1.49 million ounces of silver and 16,271 ounces of gold to Coeur Mining’s second-quarter 2025 numbers. The integration is proceeding smoothly and the mine is expected to contribute 4.25–5.25 million ounces of silver and 42,500–52,500 ounces of gold for the full year. CDE’s third-quarter 2025 results are expected to reflect full-quarter contribution from the mine.

At Palmarejo in Mexico, second-quarter 2025 production reached 27,272 ounces of gold and 1.7 million ounces of silver, up 7% and 9%, respectively, from the prior year. This reflected higher average silver recoveries and increased average gold grade and higher tons milled, driven by higher contributions from Hidalgo development ore following the completion of the Hidalgo portal last year.

Full-year 2025 guidance, however, points to lower output for the mine, with gold and silver production expected to decline 8% and 12%, respectively, at the midpoint. Palmarejo’s third-quarter 2025 performance is likely to fall short of the prior-year quarter, which saw 27,549 ounces of gold and 1.8 million ounces of silver.

The Rochester mine in Nevada continues to outperform with silver and gold production in the second quarter, gaining 26% and 48%, respectively, year over year. Full-year 2025 production is expected to be 7.0 - 8.3 million ounces of silver (up 74% at the midpoint) and 60,000 - 75,000 ounces of gold (up 72%). We expect higher numbers than the third quarter 2024 silver production of 1.1 million ounces and gold production of 9,690 ounces.

Kensington reported gold production of 26,555 ounces in the second quarter of 2025, 14% higher than the prior year quarter. Full-year output is projected at 92,500–107,500 ounces, implying 5% growth at the midpoint. To stay on track, third-quarter 2025 production is expected to exceed 24,104 ounces recorded in the same quarter last year.

At Wharf, gold production was up 9% year over year to 24,087 ounces in the second quarter, driven by higher gold grades. Silver output fell 48% to 36,000 ounces. The mine is expected to deliver 90,000–100,000 ounces of gold and 50,000–200,000 ounces of silver in 2025, both representing declines from 2024. Wharf’s third-quarter gold output is expected to come in lower than the 33,650 ounces reported a year ago. The mine had produced 45,000 ounces of silver in the quarter.

Factoring these trends, the Zacks Consensus Estimate for CDE’s third-quarter silver production stands at 5.0 million ounces, up 66% from 3.02 million ounces in the year-ago period. Gold production is estimated at 111,000 ounces, a 17% increase from 95,000 ounces produced last year.

The quarter also benefited from a favorable pricing environment. Gold prices averaged around $3,500 per ounce, up 41% year over year, supported by uncertainty regarding U.S trade and tariff policies. Solid demand from central banks boosted gold prices. Silver prices averaged around $39.80 per ounce in the quarter, up 34% year over year. The combination of higher prices is expected to have enhanced Coeur Mining’s top-line performance in the quarter. However, higher year-over-year costs at Palmarejo, Kensington and Wharf are expected to have dented these gains somewhat in the quarter.

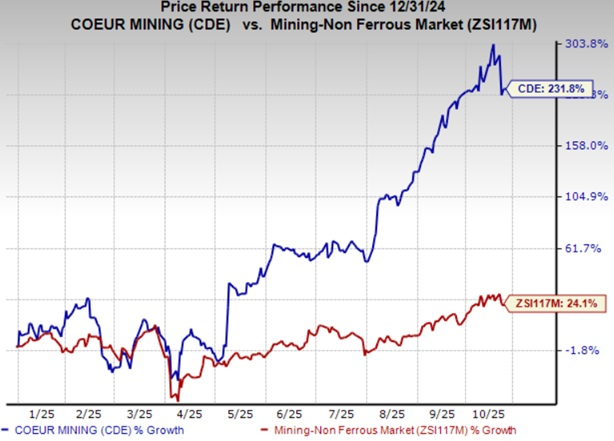

Shares of Coeur Mining have gained 231.8% so far this year compared with the non-ferrous mining industry’s 24.1% growth.

Agnico Eagle Mines Limited AEM, scheduled to release third-quarter earnings on Oct. 29, has an Earnings ESP of +11.44% and a Zacks Rank of 2.

Agnico Eagle Mines’ earnings for the third quarter are pegged at $1.76 per share, indicating a year-over-year jump of 54.4%. Agnico Eagle Mines has a trailing four-quarter average earnings surprise of 10%.

Pan American Silver Corp. PAAS, slated to release third-quarter 2025 earnings on Nov. 12, has an Earnings ESP of +2.21% and carries a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for Pan American Silver’s earnings for the third quarter is pegged at 51 cents per share. The estimate indicates a 59% increase from the earnings of 32 cents per share reported in the year-ago quarter. Pan American Silver has a trailing four-quarter average earnings surprise of 45.2%.

CSW Industrials, Inc. CSW, slated to release second-quarter fiscal 2026 earnings on Oct. 30, has an Earnings ESP of +1.10% and a Zacks Rank of 3 at present.

The consensus mark for CSW Industrials’ earnings is pegged at $2.73 per share. It indicates a year-over-year rise of 20.8%. CSW Industrials has a trailing four-quarter average earnings surprise of 5.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite