|

|

|

|

|||||

|

|

The demand for next-generation air transportation solutions, particularly electric vertical takeoff and landing (eVTOL) aircraft, has grown rapidly in recent years due to rising urban congestion and the development of innovative mobility technologies. This increasing interest in urban air mobility has directed investor attention toward companies like Eve Holding EVEX and Joby Aviation JOBY, both key players in the eVTOL sector.

Eve, based in Brazil and spun off from aerospace leader Embraer, is capitalizing on its parent company’s deep aerospace expertise. The company has conducted extensive testing of various components and systems for its eVTOL aircraft, with flight testing expected to begin soon. On the other hand, Joby Aviation operates as a vertically integrated company, focusing on both the design and operation of its own air taxi service, supported by major investors.

The evolving nature of the eVTOL aircraft market is evident in its projected growth. Per Markets and Markets, the global market is expected to soar from $0.76 billion in 2024 to $4.67 billion by 2030, indicating an impressive compound annual growth rate of 35.3% during the period.

With the global eVTOL market offering substantial growth opportunities, it is essential to closely evaluate which of these two stocks currently holds the advantage — and more importantly, which presents a more compelling investment opportunity at this time.

Eve Holdings’ expanding backlog of Letters of Intent (LOIs), including its recent agreement with Future Flight Global for up to 54 eVTOL aircraft, demonstrates growing global interest in its technology and products. These LOIs signal strong preliminary commercial demand across key markets such as Brazil and the United States. As the company moves closer to achieving certification, this solid pipeline enhances its growth prospects and reinforces the potential for future revenue generation.

Eve Holdings also maintains a strong liquidity position. The company reported cash and cash equivalents of $41.5 million as of June 30, 2025. At the same time, its short-term debt stood at $0.5 million and long-term debt totaled $154 million. This indicates that while the company remains financially stable in the short term, its long-term sustainability depends on the ability to generate significant revenues before the cash reserves are depleted.

In line with its efforts to start commercial operations, the company announced plans to participate in the White House eVTOL Integration Pilot Program. The program is designed to fast-track the development and deployment of electric air taxis and other advanced air mobility vehicles. This program could benefit Joby Aviation by providing a clear pathway to demonstrate its technology.

Joby Aviation plans to operate its first of five FAA-conforming aircraft later this year and commence flight testing with FAA pilots onboard early next year. As part of its efforts related to air taxi commercialization, Joby Aviation recently completed the acquisition of Blade Air Mobility’s urban air mobility passenger business.

The acquisition provides Joby Aviation access to Blade’s established network of terminals and loyal flyers in key markets, such as New York and Southern Europe. The buyout may expedite Joby Aviation’s entry into commercial service with its eVTOL aircraft once certified. Moreover, the closure of the buyout is likely to provide Joby Aviation a head start over competitors like Archer Aviation.

Following the acquisition, Joby Aviation and Uber Technologies UBER announced plans to bring Blade’s air mobility services to the Uber app by 2026. Joby Aviation and Uber have collaborated on advancing the future of urban air mobility since 2019. In 2021, Joby Aviation acquired Uber’s Elevate division, which was instrumental in shaping the urban air mobility industry and creating key tools for market selection, demand forecasting and multi-modal operations.

As part of its commercialization strategy, Joby Aviation plans to expand its operations earlier this year. The company revealed an expansion of its facility in Marina, CA, which will double the aircraft production capacity at that site. Covering 435,500 square feet, the expanded facility will support Joby Aviation’s efforts to scale its commercial operations. Once fully operational, the Marina site is expected to produce up to 24 aircraft annually as Joby Aviation moves closer to launching its air taxi service. Joby Aviation aims to start commercial air taxi operations in Dubai next year.

At the California International Airshow in Salinas, Joby Aviation recently completed three airshow demonstrations, including round-trip flights between Marina and Salinas. Each flight took off vertically from Marina, transitioned into cruise mode for the short trip to Salinas and then shifted back to a hover for landing, with a pilot onboard.

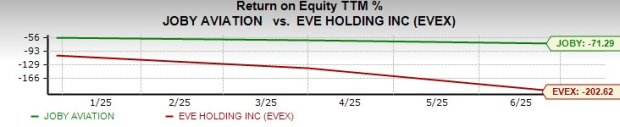

The negative Return on Equity for EVEX and JOBY, as shown in the figure below, indicates that neither of these eVTOL stocks is efficiently generating profits from its equity base.

EVEX has scored better than JOBY in terms of price performance over the past month.

EVEX has a better track record than JOBY in this respect, having outshone the Zacks Consensus Estimate for earnings twice in the last four quarters and falling short on the remaining occasions.

On the other hand, JOBY has failed to beat the Zacks Consensus Estimate for earnings in any of the past four quarters.

Although both JOBY and EVEX are leading contenders in the rapidly developing eVTOL industry, the sector still faces uncertainties regarding long-term viability and public adoption. Without full-scale commercialization, the current demand for urban air mobility remains largely speculative.

The future of customer interest and market acceptance for eVTOLs remains to be seen. Factors such as safety concerns, noise levels and cost competitiveness could pose challenges to public adoption as an alternative mode of transportation.

EVEX, backed by Embraer and supported by a growing number of Letters of Intent, demonstrates strong long-term potential. The company also outperforms JOBY in terms of earnings surprise history and recent price performance.

While both companies face common industry risks, including high operational costs and uncertain demand, Eve Holding currently holds a relative advantage over Joby Aviation. EVEX has a Zacks Rank #3 (Hold), whereas JOBY carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 9 hours | |

| 9 hours | |

| 15 hours |

JOBY Stock On Track To Snap 5-Week Slide On FAA Milestone: Why One Analyst Still Sees A 32% Downside

JOBY UBER

New feeds test provider finance

|

| 19 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

GoTo Foods announces former Roark Capital executive Brett Ubl as new CFO

UBER

Nation's Restaurant News

|

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite