|

|

|

|

|||||

|

|

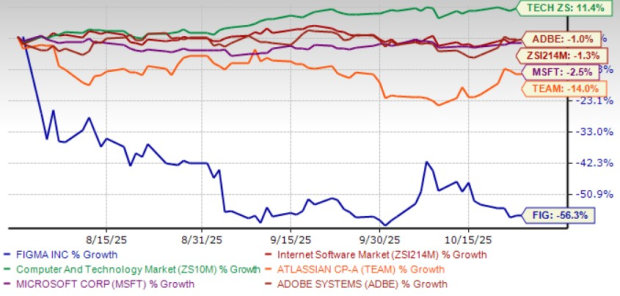

Figma FIG shares have declined 56.3% since it started trading publicly on July 31. FIG shares have underperformed the Zacks Computer and Technology sector’s return of 11.4% and the Zacks Internet Software industry’s decline of 1.3% over the same time frame. Figma’s underperformance can be attributed to modest growth prospects. The company’s investments in AI-powered products like Figma Make are expected to hurt margin expansion in the near term.

So, what should investors do with FIG stock? Let’s find out.

Figma’s prospects are expected to benefit from an innovative portfolio. At its annual Config conference, the company launched four new products — Figma Make, Figma Draw, Figma Sites and Figma Buzz — doubling its product offerings. Figma also launched the Dev Mode MCP server, which speeds up developer workflows by bringing context from Figma Design into any surface that consumes MCP.

Figma Make is the company’s new prompt-to-code product that allows designers to use an existing Figma design or natural language to create a fully functional prototype. Figma Make enables its users to edit, download or export the actual code behind the prototype. The product also allows for multiplayer editing. The product helps designers build working apps and publish them directly to the web. Figma Make now helps in bringing ideas to working apps much faster.

Figma Draw offers more than 20 new tools like textures, effects and improved vector editing. Figma Buzz helps brand and marketing teams build assets at scale using the design teams libraries and brand graphics in Figma. Dev Mode MCP server is a nice addition for developers who accounted for 30% of Figma’s monthly active users in the second quarter of 2025. Dev Mode MCP server speeds up developer workflows by bringing context from design systems into LLM-generated code.

The company has been adding new features to boost user engagement. Figma has added improvements that make it easier and more reliable to navigate files with a keyboard or screen reader. The company made the Figma app available in ChatGPT, and it will be able to recommend and create AI-generated FigJam diagrams based on user conversations. A new feature now allows users to copy any design from a Figma Make preview to the design canvas.

The new set of features is expected to boost Figma’s clientele. The company had 11,906 paid customers with more than $10,000 in annual recurring revenues (ARR) as of June 30, 2025, and 1,119 paid customers with more than $100,000 in ARR as of June 30, 2025.

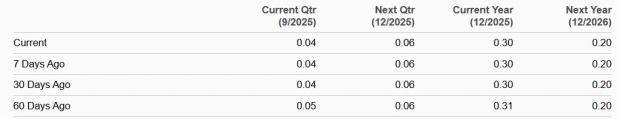

The company now expects third-quarter 2025 revenues between $263 million and $265 million, which suggests 33% year-over-year growth at the midpoint but slower than the 41% growth reported in the second quarter of 2025. The Zacks Consensus Estimate for third-quarter 2025 revenues is pegged at $263.9 million. The consensus mark for earnings is pegged at 4 cents per share, unchanged over the past 30 days.

For 2025, revenues are expected between $1.021 billion and $1.025 billion, which suggests 37% year-over-year growth at the midpoint. The company expects operating income between $88 million and $98 million.

The Zacks Consensus Estimate for 2025 revenues is pegged at $1.02 billion. The consensus mark for earnings is pegged at 30 cents per share, unchanged over the past 30 days.

Figma, Inc. price-consensus-chart | Figma, Inc. Quote

Figma has underperformed close peers, including Adobe ADBE, Microsoft MSFT and Atlassian TEAM since July 31. Shares of Atlassian, Adobe and Microsoft dropped 14%, 1%, and 2.5%, respectively.

Figma faces tough competition from well-established Adobe, Microsoft and Atlassian, as these companies boast of a growing AI-powered revenue base. Adobe’s Firefly and Microsoft Copilot have been playing a crucial role in driving their respective top-line growth and profitability. Atlassian’s focus on adding generative AI features to some of its collaboration software is likely to drive the top line. In comparison, Figma’s AI initiatives are in a much nascent stage.

Figma shares are also overvalued, as suggested by a Value Score of F.

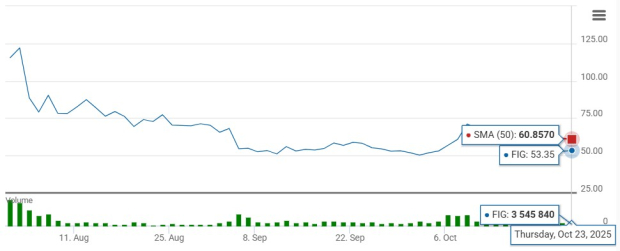

Figma stock is currently trading below the 50-day moving average, indicating a bearish trend.

Figma currently has a Zacks Rank #4 (Sell), which implies investors should avoid the stock right now.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Microsoft Stock Slopes Down To Lowest Point in Months; Is The Stock A Buy Now?

MSFT

Investor's Business Daily

|

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite