|

|

|

|

|||||

|

|

The U.S. housing market remains challenged by high mortgage rates, affordability pressures and uneven buyer sentiment. Yet within this landscape, Opendoor Technologies OPEN and Zillow Group Z represent two of the most disruptive forces in digital real estate. Both companies are pioneering platforms that aim to simplify the home-buying and selling process—Opendoor through its direct “instant cash offer” model and Zillow through its integrated housing super app that unites listings, financing and rentals.

While their approaches differ, the two firms share a common goal: digitizing residential real estate transactions at scale. Each has demonstrated resilience through cyclical downturns and continues to evolve strategically. But their near-term trajectories diverge—Opendoor is transitioning its model toward agent partnerships and platform distribution, while Zillow is leveraging its entrenched consumer brand and app dominance to expand transaction monetization.

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

Opendoor’s transformation is gaining traction. In the second quarter of 2025, the company delivered $1.6 billion in revenues, above guidance and achieved its first quarter of adjusted EBITDA profitability ($23 million) since 2022. This milestone underscores the benefits of disciplined underwriting, reduced operating expenses and better unit economics even amid a sluggish housing backdrop.

A major growth catalyst is Opendoor’s evolution from a single-product homebuyer to a multi-product, agent-distributed platform. Its “Key Agent” program and Cash Plus offering enable partner agents to extend cash offers while sharing in listing commissions—a capital-light approach that broadens Opendoor’s reach without overextending its balance sheet. Early pilots doubled customer conversion rates, and listing-agreement conversions are five times higher than the company’s direct-to-consumer flow.

Strategically, this agent-led model, combined with Opendoor’s AI-driven pricing engine trained on millions of home data points, enhances scalability and risk management. The appointment of Kaz Nejatian, Shopify’s COO, as CEO in September 2025 further signals a decisive pivot toward an AI-first real estate platform—supported by co-founders Keith Rabois and Eric Wu returning to the board and investing $40 million in new equity.

Still, challenges persist. Transaction volumes remain pressured by weak affordability and slowing clearance rates, with second-quarter 2025 home acquisitions declining 63% year over year, and management expects sequential revenue declines through year-end. With spreads elevated to manage risk, short-term margins may compress again. Yet the balance sheet is fortified with $789 million in cash and extended maturities to 2030, providing stability during this strategic transition.

Innovation remains Zillow’s hallmark. Tools like BuyAbility, which helps buyers shop based on affordability and Offer Insights, uses real-time data to evaluate bid strength, strengthen engagement and agent productivity. The Follow Up Boss CRM, now enhanced with AI-supported smart messaging and lead routing, deepens Zillow’s role in professional workflows. On the consumer side, immersive features such as SkyTour 3D home viewing and Zillow Showcase listings enhance user experience and drive traffic—averaging 243 million monthly users, roughly four times the next-largest competitor.

Zillow’s performance continues to outpace industry transaction growth—its For Sale segment revenues grew 9% in the second quarter of 2025, while Rentals surged 36% and Mortgage revenue jumped 41%, driven by rising loan originations. The company’s Enhanced Market strategy, which integrates listings, agents and mortgage services, is yielding tangible results — 27% of customer connections now flow through this upgraded experience, with a goal of surpassing 35% by year-end.

Zillow delivered another strong quarter in the second quarter of 2025, with 15% revenue growth to $655 million and 15.7% growth in adjusted EBITDA to $155 million, exceeding guidance. It also generated positive GAAP net income of $2 million, a testament to cost control and operating leverage even as the housing market stayed largely flat.

However, monetizing these users at scale remains the long-term challenge. Zillow’s transaction integration is still in early stages, and competition in digital mortgage and rental platforms is intensifying. Near-term margins could also be tempered by marketing investments to expand Enhanced Markets. Nonetheless, its leading brand equity, deep user base and expanding high-margin rental business give Zillow an enviable competitive position heading into 2026.

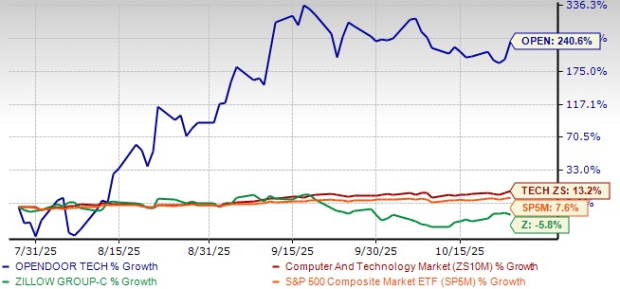

Over the past three months, Opendoor stock has skyrocketed 240.6%, vastly outperforming both the broader Zacks Computer and Technology sector and the S&P 500.

By contrast, Zillow stock has lost 5.8% during the same period, lagging its peers and the benchmark. The sharp divergence reflects investor enthusiasm around Opendoor’s return to profitability and leadership reboot, versus tempered sentiment toward Zillow amid slower margin expansion and valuation concerns.

OPEN & Z Stock Performance (3-Month)

On a forward 12-month basis, Opendoor trades at just 1.22X price-to-sales, a steep discount to both Zillow’s 6.5X and the Zacks Computer & Technology sector average of 7.05X. This wide valuation gap suggests that while Opendoor carries higher operational risk, it also offers asymmetric upside if execution on the agent-led model delivers sustained profitability. Zillow’s richer multiple reflects its brand leadership and steadier earnings, but leaves less room for re-rating in the near term.

Estimate revisions highlight diverging earnings trajectories. For Opendoor, the Zacks Consensus Estimate for 2025 loss per share has narrowed to 24 cents from 35 cents in the past 60 days, implying progress toward break-even. The company’s 2026 loss is expected to further narrow to 23 cents per share, with revenue forecasted to decline 16.7% in 2025 before rebounding 14.6% in 2026 as the platform matures.

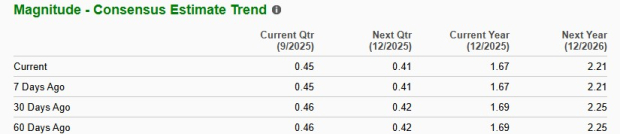

For Zillow, the Zacks Consensus Estimate for 2025 EPS slipped to $1.67 from $1.69 over the past month but still reflects 21% year-over-year growth, followed by an expected 32.3% increase in 2026. Revenue growth projections of 14.8% in 2025 and 14.5% in 2026 indicate consistent, balanced expansion with earnings leverage.

Both Opendoor and Zillow are adapting effectively to a sluggish housing cycle by embracing platform diversification and technology-driven transaction models. Yet their risk-reward profiles differ sharply.

Opendoor’s lean valuation, cost discipline and pivot to capital-light, agent-driven revenue streams set the stage for operating leverage once volumes recover. The new CEO’s AI pedigree and the founders’ renewed involvement add strategic credibility. The challenge lies in weathering a tough macro backdrop while scaling its distributed platform profitably.

Zillow’s dominant consumer reach, strong rental growth and integrated ecosystem of listings, mortgages, and agent tools create durable moats and recurring revenue potential. It remains a steadier play on digital housing modernization but already trades at a premium, limiting near-term upside.

Both stocks currently carry a Zacks Rank #3 (Hold), reflecting balanced risk-reward dynamics. However, given Opendoor’s accelerating execution, first EBITDA-positive quarter in three years, leadership reinvigoration and discounted valuation, the stock appears the more compelling buy candidate today. Zillow offers consistency and scale, but Opendoor provides turnaround momentum and greater upside leverage to any eventual housing market recovery. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 21 min | |

| 4 hours | |

| 9 hours | |

| 9 hours | |

| 11 hours | |

| 13 hours | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite