|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The global semiconductor industry continues its impressive growth trajectory, with February 2025 sales reaching $54.9 billion, according to the latest Semiconductor Industry Association report. This represents a substantial 17.1% increase compared to February 2024, marking the 10th consecutive month of double-digit year-over-year growth.

While a slight month-to-month decline of 2.9% from January was observed, the overall industry momentum remains robust, particularly in the Americas region, which saw an astounding 48.4% year-over-year sales increase. Other regions also contributed to the global upswing, with Asia Pacific/All Other rising 10.8%, China growing 5.6%, and Japan increasing 5.1%. Only Europe experienced a decline, with an 8.1% decrease.

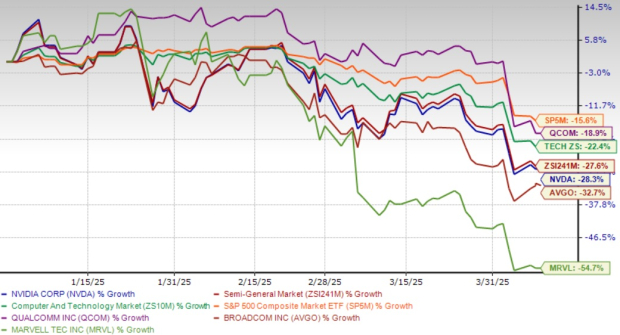

The semiconductor industry players, including Broadcom AVGO, NVIDIA NVDA, Marvell Technology MRVL and Qualcomm QCOM, are poised to benefit significantly from the increasing data center market in 2025, driven by the explosive growth in artificial intelligence (AI) and high-performance computing (HPC), which IDC forecasts to grow by more than 15% in 2025. AI technologies are driving demand for advanced logic process chips and increasing the penetration rate of high-bandwidth memory (HBM), supporting double-digit industry growth.

Memory segment sales in particular are expected to surge more than 24% this year, primarily driven by high-end products, such as HBM3 and HBM3e, required for AI accelerators. The anticipated introduction of next-generation HBM4 in the second half of 2025 is poised to further boost this segment.

Recent tariffs announced by President Trump, including a 54% total tariff on Chinese imports and 32% on Taiwanese goods, have created uncertainty in the semiconductor industry. These geopolitical tensions threaten to disrupt global supply chains, potentially increasing manufacturing costs and complicating trade relationships crucial to chip production and distribution.

Despite recent geopolitical tensions and proposed tariff measures that caused temporary market volatility, the industry's long-term fundamentals remain strong. The semiconductor market is projected to expand from $755.28 billion in 2025 to $2,062.59 billion by 2032, exhibiting a CAGR of 15.4% during the forecast period. Asia Pacific remains the dominant regional market, accounting for 50.94% of the global share in 2024.

Notably, investments in chip manufacturing capacity continue to accelerate, with companies like TSMC expanding both traditional 2nm and 3nm production in Taiwan and 4/5nm facilities in the United States. Overall, wafer manufacturing is projected to increase 7% annually in 2025, with advanced nodes capacity rising 12%.

The growing integration of semiconductors in various applications — from data centers and automotive to consumer electronics and industrial automation — continues to create robust demand.

As AI capabilities expand beyond data centers to edge computing, personal computers, smartphones, and IoT devices, the semiconductor industry is well-positioned for sustained growth, reinforcing its role as the foundation of global technological advancement.

Here we pick four semiconductor stocks that have a favorable combination of a Growth Score of A or B and a Zacks Rank #1 (Strong Buy) or 2 (Buy). The Growth Style Score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth. Per Zacks’ proprietary methodology, stocks with a combination of a Zacks Rank #1 or 2 and a Growth Score of A or B offer solid investment opportunities. You can see the complete list of today’s Zacks #1 Rank stocks here.

Broadcom's $10 billion share buyback program signals strong confidence in its growth trajectory, particularly in AI infrastructure. The company's innovative Sian3 and Sian2M chips deliver industry-leading power efficiency for AI data centers, while its expanding optical interconnect solutions address critical bandwidth demands. With established relationships with Apple and growing adoption of its custom AI chips among cloud providers seeking Nvidia alternatives, Broadcom is strategically positioned to capitalize on semiconductor industry growth. The recent PCIe Gen6 technology innovations further strengthen its competitive edge.

AVGO sports a Zacks Rank #1 and has a Growth Score of B. The Zacks Consensus Estimate for AVGO’s fiscal 2025 EPS has moved up by 0.6% to $6.6 over the past 30 days.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

NVIDIA represents an exceptional investment opportunity in 2025 as the company continues to dominate the AI semiconductor landscape. With its Blackwell platform serving as the foundation for NVIDIA Media2 and powering next-generation digital twins through Omniverse, NVIDIA maintains a technological edge over competitors. The company's ecosystem continues expanding through NIM microservices and AI Blueprints, creating an end-to-end solution spanning data centers to consumer devices. The upcoming Nintendo Switch 2 collaboration demonstrates NVIDIA's ability to monetize its AI technology across diverse markets. As enterprises across industries accelerate their AI adoption, NVIDIA's unparalleled portfolio of hardware and software positions it to capture the majority of this growing market.

NVDA carries a Zacks Rank #2 and has a Growth Score of A. The Zacks Consensus Estimate for NVDA’s fiscal 2026 EPS has moved up by 0.5% to $4.41 over the past 30 days.

Marvell has positioned itself perfectly in the semiconductor industry through its comprehensive portfolio of PAM chips, digital signal processors, and silicon photonics that are essential for AI infrastructure. With AI revenues surpassing $1.5 billion in fiscal 2025 and projected to exceed $2.5 billion in fiscal 2026, Marvell's growth trajectory is undeniable. The recent partnership with TeraHop, demonstrating the industry's first end-to-end PCIe Gen 6 over optics, showcases Marvell's continuous innovation. While Chinese market exposure poses challenges, strong fundamentals, consistent 60%+ gross margins, and leadership in the transition from copper to optical connectivity make MRVL an exceptional investment opportunity in 2025.

MRVL has a Zacks Rank #2 and Growth Score of B. The Zacks Consensus Estimate for MRVL’s fiscal 2026 EPS has moved up by a penny to $2.76 over the past 30 days.

Qualcomm’s strategic acquisition of MovianAI from VinAI significantly expands the company’s AI capabilities and research potential while deepening its decades-long relationship with Vietnam's technology ecosystem. By integrating VinAI's expertise in generative AI, machine learning, computer vision, and natural language processing with its own R&D prowess, Qualcomm is positioning itself at the forefront of AI innovation across smartphones, PCs, vehicles, and IoT devices. Despite competitive pressures, Qualcomm's diversification strategy, strong Snapdragon portfolio, and growing automotive segment make it uniquely positioned to capitalize on the AI revolution.

QCOM carries a Zacks Rank #2 and Growth Score of B. The Zacks Consensus Estimate for QCOM’s fiscal 2025 EPS has moved up by 0.2% to $11.78 over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 24 min | |

| 30 min |

Stock Market Today: Dow Turns Higher As Supreme Court Nixes Trump Tariffs (Live Coverage)

NVDA

Investor's Business Daily

|

| 31 min | |

| 55 min |

Nvidia Stock, After Big Meta Chip News, Sets Up Ahead Of Quarterly Earnings Report

NVDA

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite