|

|

|

|

|||||

|

|

Virtual healthcare platforms are redefining patient access to care, with Hims & Hers Health, Inc. HIMS and LifeMD, Inc. LFMD leading this digital shift. Hims & Hers delivers affordable, subscription-based treatments across sexual health, mental wellness, dermatology and weight management through its telehealth platform connecting patients to licensed providers and personalized products. LifeMD, a direct-to-patient telehealth company, offers integrated virtual and in-home care supported by a nationwide medical network, pharmacy and diagnostics infrastructure. Its brands — LifeMD, Rex MD and ShapiroMD — serve diverse needs from primary care to weight loss, complemented by enterprise collaborations and its software subsidiary, WorkSimpli.

While HIMS emphasizes consumer accessibility, LFMD focuses on vertical integration and care continuity. With both companies showing promise with rising digital health demand, the question arises: which stock is the better buy at this moment? Let's delve deeper.

HIMS (down 16.9%) has outperformed LFMD (down 42%) over the past three months. In the past year, Hims & Hers has rallied 111.4% compared with LifeMD’s gain of 43.4%.

Meanwhile, HIMS is trading at a forward 12-month price-to-sales (P/S) ratio of 4.04X, above its median of 2.50X over the past three years. LFMD’s forward sales multiple sits at 1.04X, below its last three-year median of 1.08X. While LFMD appears cheap when compared with the Medical sector average of 2.31X, HIMS seems to be expensive. Currently, Hims & Hers and LifeMD stocks have a Value Score of D and C, respectively.

Hims & Hers is rapidly broadening its clinical reach through targeted launches in high-demand areas like men’s health, menopause and weight management. Its entry into personalized hormone therapies, including branded oral testosterone, and the Hers menopause and perimenopause specialty underscores a disciplined approach to expanding its total addressable market while leveraging existing telehealth infrastructure. These initiatives deepen engagement with current subscribers and diversify recurring revenue streams, positioning HIMS as a multi-specialty digital healthcare leader.

Hims & Hers’ strategic focus on AI-driven personalization — anchored by the appointment of Mo Elshenawy — represents a core differentiator. By integrating AI into diagnosis, treatment matching and fulfillment workflows, HIMS aims to standardize high-quality care globally while improving efficiency and scalability. This technology-centric approach not only enhances clinical precision but also strengthens customer retention through intelligent, data-informed care pathways.

Through acquisitions like ZAVA in Europe and planned expansion into Canada, Hims & Hers is building a geographically diversified, vertically integrated platform. These moves extend its regulatory footprint and enable control over compounding, pharmacy fulfillment and diagnostics. Supported by its $870 million convertible note issuance, HIMS is channeling capital toward AI infrastructure and international scaling — a strategy that solidifies long-term growth visibility and operational leverage across markets.

LifeMD’s strategic focus on expanding into high-growth healthcare categories — particularly weight management and men’s health — is a key driver for the stock. The company’s GLP-1 weight management program, supported by partnerships with Novo Nordisk and Withings, offers branded medications like Ozempic and integrated in-home monitoring devices, enhancing clinical oversight and patient retention. These programs complement LFMD’s core telehealth and primary care services, enabling recurring subscription revenue while strengthening brand credibility in medically supervised treatments.

LifeMD’s investment in a wholly owned pharmacy and fulfillment facility in Pennsylvania marks a turning point in its operating efficiency. This facility integrates prescription fulfillment within the telehealth ecosystem, streamlining the patient experience from consultation to delivery. The in-house model also enables cost savings, compounding capabilities and better quality control, while reducing reliance on third-party networks. This vertical integration supports scalability across new clinical categories and contributes to margin expansion over time.

LifeMD’s B2B telehealth partnerships and its WorkSimpli SaaS subsidiary add diversification beyond core telemedicine. Collaborations with firms like Medifast and ASCEND Therapeutics leverage LFMD’s virtual care platform for branded healthcare access, generating high-margin enterprise revenues. Meanwhile, WorkSimpli’s digital document services ensure a steady cash-generating base. Together, these complementary streams mitigate healthcare cyclicality and reinforce LifeMD’s evolution into a tech-enabled, multi-vertical digital health platform.

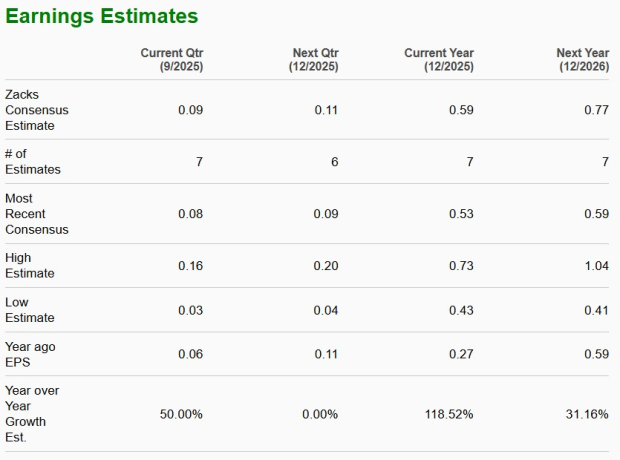

The Zacks Consensus Estimate for HIMS’ 2025 earnings per share (EPS) suggests a 118.5% improvement from 2024.

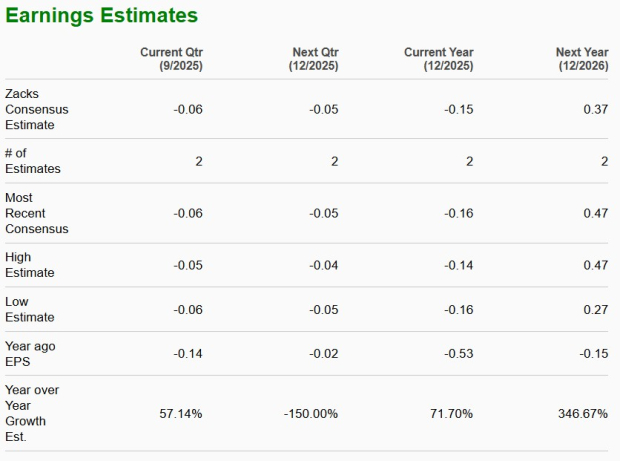

The Zacks Consensus Estimate for LFMD’s 2025 loss per share implies an improvement of 71.7% from 2024.

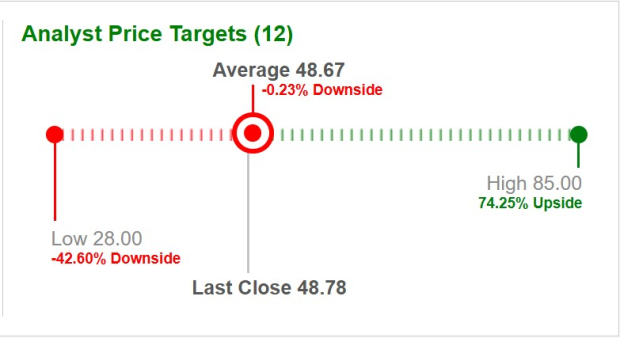

Based on short-term price targets offered by 12 analysts, the average price target for Hims & Hers comes to $48.67, implying a decline of 0.2% from the last close.

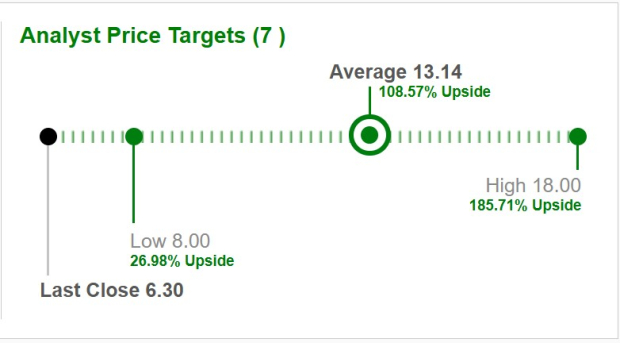

Based on short-term price targets offered by seven analysts, the average price target for LifeMD comes to $13.14, implying an increase of 108.6% from the last close.

While both Hims & Hers and LifeMD are promising players in the direct-to-consumer and digital health space, HIMS, a Zacks Rank #3 (Hold) firm, presents a more stable and financially sound investment opportunity at this stage. With strong profitability and margins along with consistently growing user engagement, Hims & Hers offers a capital-efficient model that generates substantial free cash flow and delivers steady returns. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

LifeMD, also a Zacks Rank #3 stock, is rapidly growing and expanding its clinical footprint. The company offers integrated virtual and in-home care, which looks promising. However, LFMD faces execution risk due to its smaller scale and higher customer acquisition costs, which can pressure margins and slow profitability. For investors seeking lower execution risk, financial predictability and a proven track record, Hims & Hers emerges as a more compelling choice.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite