|

|

|

|

|||||

|

|

UnitedHealth Group Incorporated UNH and Humana Inc. HUM are two of the most prominent players in the U.S. health insurance space. Both operate in the managed healthcare space, offering health plans, Medicare Advantage (MA) services and a broad range of healthcare solutions to millions of Americans.While both companies offer compelling narratives, one clearly stands out as the more attractive choice in today’s market.

The Centers for Medicare & Medicaid Services (CMS) recently announced a 5.06% hike in MA payments for fiscal year 2026, significantly higher than the initially proposed 2.23%. This revision is expected to deliver a notable boost to the health insurers’ bottom lines, though it comes at an estimated $25 billion cost to taxpayers. Now, let’s dive deep and closely compare the fundamentals of these two stocks to determine which one offers the better investment opportunity at the moment.

UnitedHealth, with a market cap of $480 billion, operates through two core segments: UnitedHealthcare, which provides health benefits, and Optum, which delivers data-driven healthcare services. This dual-engine model is a key competitive advantage, generating steady revenue from insurance premiums while driving long-term growth through technology and service innovation. Its UnitedHealthcare business catered to 50.68 million people as of Dec. 31, 2024.

In recent quarters, UnitedHealth has consistently exceeded expectations, fueled by strong revenue growth from Optum and a steadily expanding membership base in its insurance division. Its fourth quarter 2024 results beat analyst forecasts, and its management reaffirmed robust forward guidance despite broader macroeconomic challenges. Notably, the company beat earnings estimates in each of the past four quarters with an average surprise of 2.5%.

UnitedHealth Group Incorporated price-eps-surprise | UnitedHealth Group Incorporated Quote

Financially, UnitedHealth is in a solid position. It ended 2024 with $29.1 billion in cash and short-term investments, more than sufficient to cover its short-term borrowings and current portion of long-term debt, which stands at $4.6 billion. Its total debt-to-capital ratio of 43.9% is slightly above Humana’s 42.4% but still well within a healthy range.

UNH also maintains a consistent track record of returning capital to shareholders, highlighted by its $16 billion in shareholder payouts in 2024, $9 billion in share repurchases and $7.5 billion in dividends. Meanwhile, Humana bought back shares worth $817 million in 2024 and paid dividends of $431 million. UnitedHealth’s dividend yield of 1.52% surpasses Humana’s 1.26%, and it is supported by robust operating cash flows, which totaled $24.2 billion in 2024.

Looking ahead, UnitedHealth’s strategic investments in technology and value-based care —particularly through Optum — position it as a leader in healthcare innovation. This focus not only enhances cost efficiency but also drives improved patient outcomes, a critical advantage as the healthcare system continues to shift toward quality-based models.

Humana, with a market capitalization of $30.7 billion, is a well-established healthcare provider known for its strong focus on government-sponsored programs, particularly MA. Over the years, Humana has built a solid reputation as a top-tier MA provider, consistently expanding its membership base. As of Dec. 31, 2024, its Insurance segment covered 16.3 million members.

The company has also demonstrated earnings strength, surpassing analyst estimates in each of the last four quarters with an average earnings surprise of 15.4%.

Humana Inc. price-eps-surprise | Humana Inc. Quote

However, recent challenges have cast some doubt on Humana’s near-term outlook. Earlier, the company issued a profit warning due to unexpectedly high medical costs, largely driven by increased utilization among older beneficiaries, an issue impacting the broader industry. In 2024, Humana’s benefits expense ratio rose 250 basis points year over year to 89.8%, indicating pressure on profitability. In comparison, UnitedHealth’s medical care ratio also worsened but to a lesser extent, rising 230 basis points to 85.5%.

While Humana boasts strong fundamentals and a focused strategy, its lack of diversification and smaller scale relative to UnitedHealth pose key limitations. The company’s heavy reliance on MA leaves it more exposed to policy shifts and demographic changes. Unlike UNH, Humana does not have massive exposure to adjacent growth areas, limiting its ability to hedge risks.

Investors also got spooked last year, as one of its primary MA plans received a downgrade in the government's star-rating system, a move that threatened billions in federal bonus payments. Both Humana and UnitedHealth have since filed respective lawsuits challenging the star ratings against the federal government. So far, court decisions have shown some progress in favor of the insurers.

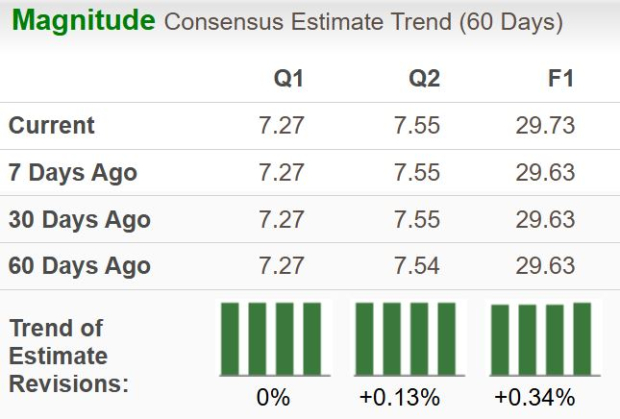

The Zacks Consensus Estimate for UnitedHealth’s 2025 sales and EPS implies a year-over-year increase of 12.7% and 7.5%, respectively. The EPS estimates have been trending northward over the past week.

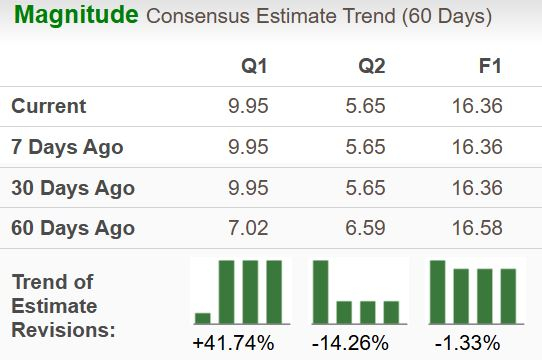

Meanwhile, the consensus estimate for Humana’s 2025 sales and EPS implies a year-over-year rise of only 8% and 0.9%, respectively. The EPS estimates have been trending southward over the past 60 days.

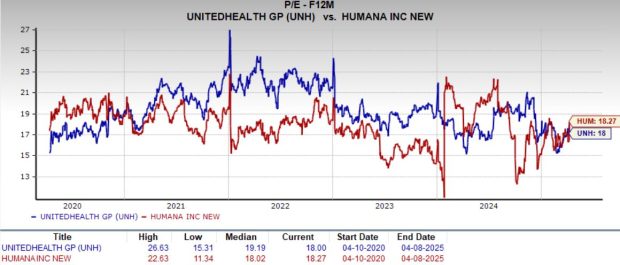

From a valuation standpoint, UnitedHealth may appear slightly more expensive than the industry at first glance, but its premium is well-earned given its size, operational consistency and business diversification. Humana’s stock trades at a slightly higher multiple than UNH. UnitedHealth is currently priced at 18X forward 12-month earnings, compared to Humana’s 18.27X, both above the industry average of 15.55X.

Over the past month, shares of UnitedHealth have outperformed Humana, the industry and the S&P 500 Index.

Both UnitedHealth and Humana are formidable health insurance companies with proven track records, but when comparing the two, UnitedHealth emerges as the better investment opportunity right now. Its diversified revenue streams, consistent earnings performance, and forward-looking strategy through Optum give it an edge.

Humana remains a solid player in MA, but its lesser diversification, recent cost pressures and higher valuation make it a costlier pick in the current environment. As healthcare continues to evolve, investors may find more security and upside potential in UnitedHealth’s broader, more balanced business model.

While UnitedHealth currently carries a Zacks Rank #2 (Buy), Humana has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite