|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Hims & Hers Health, Inc. HIMS is scheduled to report third-quarter 2025 results on Nov. 3, after the closing bell.

In the last reported quarter, the company’s earnings per share (EPS) of 17 cents lagged the Zacks Consensus Estimate by a penny. Over the trailing four quarters, its earnings outperformed the Zacks Consensus Estimate on one occasion, missed twice and broke even in the other, delivering an earnings surprise of 13.2%, on average.

Let’s check out the factors that have shaped HIMS’ performance prior to this announcement.

Hims & Hers is expected to benefit in third-quarter 2025 from the continued expansion of its personalized healthcare platform, which has been driving customer engagement and retention. The company’s investments in lab testing and pharmacy infrastructure are enabling deeper customization of treatment plans and faster care delivery, which management expects will increase subscriber lifetime value and conversion of new users into recurring customers. The ongoing rollout of advanced testing capabilities following the acquisition of a blood testing lab also supports HIMS’ entry into hormonal health and preventive care — both key demand drivers expected to strengthen platform stickiness during the quarter.

Additionally, the launch of the men’s hormonal health category, including the branded oral testosterone KYZATREX, introduces a new, high-demand vertical that broadens Hims & Hers’ addressable market and is likely to attract incremental male subscribers in the to-be-reported quarter. Complementing this, the company’s enhanced AI capabilities under its new chief technology officer are expected to streamline fulfillment, automate patient support and improve clinical decision-making — reducing operating friction while enhancing customer experience, which may further bolster user retention and margins through the quarter.

For third-quarter 2025, the Zacks Consensus Estimate for revenues is pegged at $583.7 million, implying an improvement of 45.4% from the prior-year quarter’s reported figure.

The consensus estimate for EPS is pegged at 9 cents, indicating an uptick of 50% from the prior-year period’s reported number.

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold), along with a positive Earnings ESP, has higher chances of beating estimates. This is not the case here, as you can see below.

Earnings ESP: HIMS has an Earnings ESP of -12.79%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hims & Hers Health, Inc. price-eps-surprise | Hims & Hers Health, Inc. Quote

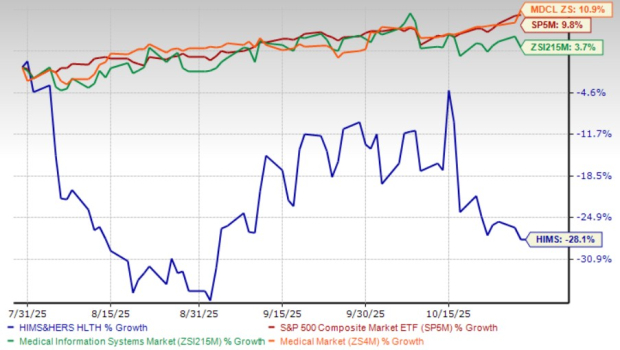

Over the past three months, Hims & Hers’ shares have lost 28.1%, underperforming Medical Info Systems’ 3.7% growth. HIMS’ shares also underperformed the Zacks Medical sector and the S&P 500’s gain of 10.9% and 9.8%, respectively.

Hims & Hers’ peers like Veeva Systems Inc. VEEV and 10x Genomics, Inc. TXG have outperformed the company, while Inspire Medical Systems, Inc. INSP has underperformed the company. VEEV, INSP and TXG’s shares are up 1.6%, down 41.2% and down 4.1%, respectively, in the same time frame.

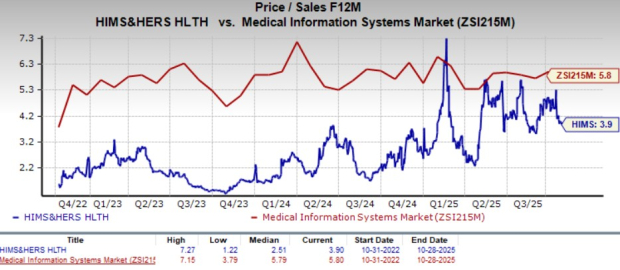

From a valuation standpoint, HIMS’ forward 12-month price-to-sales (P/S) is 3.9X, a discount to the industry's average of 5.8X.

The company is trading at a discount to its peer, Veeva Systems. However, Hims & Hers is trading at a premium to its other peers, 10x Genomics and Inspire Medical. Veeva Systems P/S currently stands at 14X, while the ratios for 10x Genomics and Inspire Medical stand at 2.7X and 2.3X, respectively.

This suggests that investors may be paying a lower price relative to the company's expected sales growth.

Hims & Hers’ long-term investment visibility continues to strengthen as the company expands into women’s hormonal health through its new menopause and perimenopause specialty. This launch positions the company to capture a major untapped segment, addressing the health needs of over a million U.S. women entering menopause each year. By combining its scalable digital platform with provider-led, personalized care, Hers is creating a durable growth engine that extends beyond traditional telehealth. The move also reinforces HIMS’ commitment to closing critical gaps in women’s healthcare access — an area with significant societal and economic implications. This specialty, supported by prescription-based and non-prescription offerings, is expected to materially enhance Hers’ subscription base and set the division on track toward $1 billion in annual revenues by 2026, indicating sustained visibility for top-line expansion and diversification.

Hims & Hers’ broader investment roadmap — including its recent AI infrastructure development, global expansion through ZAVA and planned entry into Canada — creates a long-term foundation for scalable, technology-driven care delivery. The integration of advanced data systems and AI-supported provider tools is expected to improve care outcomes, enhance operational efficiency and unlock higher-margin opportunities across specialties.

There is no denying that Hims & Hers sits favorably in terms of core business strength, earnings prowess, robust financial footing and global opportunities. The stock’s strong core growth prospects are a good reason for existing investors to retain shares for potential future gains.

For those exploring to make new additions to their portfolios, the valuation indicates superior performance expectations compared with its industry and sector peers. It is still valued lower than the broader market, which suggests potential room for growth if it can align more closely with overall market performance. However, as there are no chances of beating estimates, it would not be a wise choice to add the stock to one’s portfolio before the earnings. However, if investors are already holding the stock, it would be prudent to hold on to it at present. The favorable Zacks Style Score with a Growth Score of A suggests continued uptrend potential for HIMS.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 16 min |

Hims & Hers Agrees To Buy Eucalyptus In $1.15 Bil Deal. Stock Rallies.

HIMS

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 9 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite