|

|

|

|

|||||

|

|

One of the most celebrated sales pitches of all time occurred when then-Apple (AAPL) CEO Steve Jobs first unveiled the iPhone, which would eventually become the company - and the world’s - most impactful product. In a clever unveiling, Jobs began by telling the audience that “Today, Apple is going to reinvent the phone.” Next, in a lengthy and repetitive build-up, Jobs displayed a widescreen iPod with a touch screen, a new mobile phone, and an internet communications device. Finally, Jobs spilled the beans, saying, “Are you getting it? These are not three separate devices!” The iPhone would go on to become Apple’s best-selling product, as consumers could have a mini-computer, MP3 player, and camera packed into a single device capable of fitting in their pocket.

Although the financial industry is very different from the smartphone market, history is repeating itself as consumers yearn for all-in-one product offerings. Below are areas that are being combined or are in the process of being combined among financial industry leaders.

· Stock Trading: Following the Global Financial Crisis of 2008 and the nasty bear market that followed, retail interest in investing waned. However, the COVID-19 pandemic fueled a historic resurgence in retail investing among younger generations.

· Crypto Trading: Crypto trading has exploded due to education, deregulation, and rising prices of top assets like Bitcoin and Ethereum.

· Sports Betting: With the advent of online betting and deregulation in the US (sports betting is legal in 38 states), sports betting has increased dramatically.

· Prediction Markets: Prediction markets have also surged in popularity, offering bettors with unique betting opportunities on elections, interest-rate moves, and economic data.

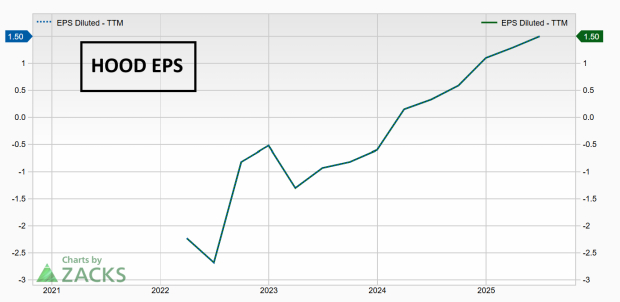

Initially, Robinhood (HOOD) gained popularity by becoming the first broker to offer commission-free trading. However, HOOD has evolved into an app for equity trading, options trading, investing, saving, credit, sports betting and crypto. HOOD arguably has the wide-range of offerings of any financial services company and is thus the biggest winner. Shares have more than quadrupled over the past year, and EPS has grown steadily since the company went public in 2022.

Intercontinental Exchange (ICE) operated major exchanges such as the NYSE. Beyond providing data and analytics products, ICE also has a stranglehold over various energy, commodity, and fixed-income markets. ICE has also entered the mortgage market with its acquisition of Ellie Mae. Finally, ICE recently made a bold $2 billion bet to enter prediction markets with a bold investment in Polymarket. Polymarket allows customers to bet on everything from politics to sports. Though Polymarket has been banned in the US, betting markets will reopen to US users a in late November.

Coinbase (COIN) is the leading crypto exchange in the United States. However, the company is expanding with its Coinbase Wallet, which allows developers to build on its ecosystem. Additionally, its stablecoin partnership with Circle Group (CRCL) is bearing fruit. The USDC stablecoin has seen transaction volume soar to a staggering $5.9 trillion, suitable for a more than five-fold increase. The recent passage of the GENIUS ACT, a regulatory framework for stablecoins, should only further bolster growth.

As first-movers gain clients, single-dimension sports betting companies like DraftKings (DKNG) and Flutter (FLUT) are likely to be losers. For these firms to move into other markets, they will need to jump major regulatory hurdles, rebrand, and incur significant costs.

Bottom Line

The success of the iPhone demonstrated the power of combining multiple functions into a single, seamless product. Companies like Robinhood, ICE, and Coinbase are now doing the same in finance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 17 min | |

| 2 hours | |

| 3 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Warren Buffett's company invests in The New York Times 6 years after he sold all his newspapers

AAPL

Associated Press Finance

|

| Feb-17 | |

| Feb-17 |

Berkshire Hathaway Takes Stake In New York Times, Cuts Apple, Amazon Holdings

AAPL

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite