|

|

|

|

|||||

|

|

Molson Coors Beverage Company TAP is expected to register top and bottom-line declines when it reports third-quarter 2025 earnings on Nov. 4, before market open. The Zacks Consensus Estimate for revenues is pegged at $3.02 billion, indicating a 0.6% decline from the prior-year reported figure. The consensus mark for earnings has moved down 1.7% in the past seven days to $1.72 per share, indicating a drop of 4.4% from the year-ago reported figure.

In the last reported quarter, this leading alcohol company delivered an earnings surprise of 12.02% It has a trailing four-quarter negative earnings surprise of 0.3%, on average.

Our proven model does not conclusively predict an earnings beat for Molson Coors this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

TAP currently has a Zacks Rank #4 (Sell) and an Earnings ESP of -1.53%.

TAP’s Americas business, which comprises operations in the United States and Canada, has been reeling under the pressures of the tough macroeconomic conditions in the United States. This has significantly impacted the U.S. beer industry, leading to lower beer industry volumes, reduced consumer demand among lower-income and Hispanic households, and the negative impacts of lost contract brewing arrangements.

The U.S. beer industry, and Molson Coors in particular, continues to face notable pressure as financial and brand volumes remain soft. U.S. brand volumes reflect broader beer category contraction, particularly in mainstream segments, with consumer trade-down and shifting preferences weighing on performance. While core power brands like Coors Light and Miller Lite retained strong shelf space gains in the second quarter of 2025, volumes continue to be pressured by weaker overall industry trends and heightened promotional activity.

Canada is also witnessing challenges, as softness in the economy and competitive intensity limit top-line growth despite ongoing premiumization led by Miller Lite and flavored innovations. These factors are expected to have impacted the top-line performance in the to-be-reported quarter.

Adding to these demand pressures, Molson Coors is also absorbing a sharp spike in aluminum costs. Management pointed specifically to the unprecedented 180% spike in Midwest Premium aluminum costs since January, which is expected to add $40-$55 million in extra costs for the year.

Molson Coors Beverage Company price-eps-surprise | Molson Coors Beverage Company Quote

Combined with U.S. beer volumes that remain down roughly 5% year over year and no signs of a near-term rebound in consumer confidence, these factors forced the company to reset expectations for the remainder of 2025, with impacts expected in the third quarter. Unlike other commodities, the Midwest Premium is particularly difficult and expensive to hedge, leaving Molson Coors more exposed to volatility in this market.

However, Molson Coors’ Acceleration Plan has supported market share gains through innovation and premiumization. Strategic investments in core brands and expansion efforts are likely to have cushioned the performance in the to-be-reported quarter. TAP’s revitalization plan, focused on streamlining operations and reinvesting in brands, has driven sustainable growth. Investments in iconic brands and the above-premium beer segment, alongside expansion into adjacent markets, are expected to have positively impacted its performance.

TAP has enhanced digital capabilities across commercial, supply chain and workforce functions while expanding brewing and packaging operations in the U.K., driven by the success of its Madri brand.

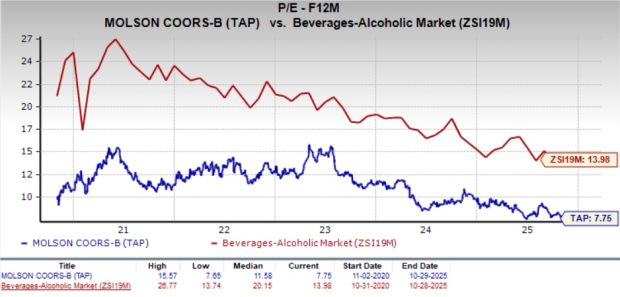

From a valuation perspective, Molson Coors offers an attractive opportunity, trading at a discount relative to historical and industry benchmarks. With a forward 12-month price-to-earnings ratio of 7.75X, which is below the five-year high of 15.57X and the Beverages - Alcohol industry’s average of 13.98X, the stock offers compelling value for investors seeking exposure to the sector.

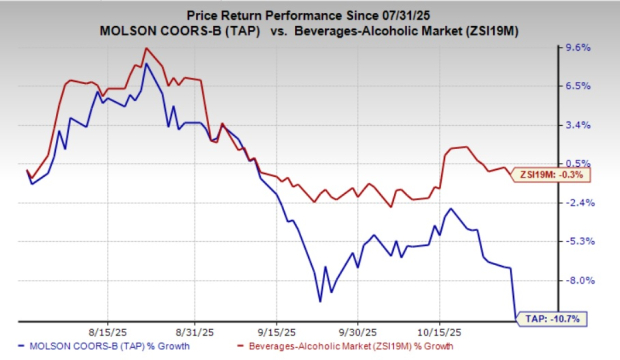

The recent market movements show that TAP shares have lost 10.7% in the past three months compared with the industry's 0.3% decline.

Here are three companies, which, per our model, have the right combination of elements to post an earnings beat this reporting cycle:

Vital Farms VITL has an Earnings ESP of +8.84% and currently flaunts a Zacks Rank of 1. VITL is anticipated to register increases in its top and bottom lines when it reports third-quarter 2025 results. The Zacks Consensus Estimate for Vital Farms’ quarterly revenues is pegged at $191 million, indicating growth of 31.7% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Vital Farms’ bottom line has been unchanged in the past 30 days at 29 cents per share. This implies a surge of 81.3% from the year-ago quarter’s reported figure. VITL delivered an earnings beat of 35.8%, on average, in the trailing four quarters.

Corteva CTVA has an Earnings ESP of +4.82% and a Zacks Rank of 3 at present. CTVA is likely to register growth in its top line when it releases third-quarter 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $2.5 billion, which implies a rally of 7% from the figure reported in the prior-year quarter.

The consensus estimate for Corteva’s bottom line has been unchanged at a loss of 49 cents per share in the past 30 days. The estimate indicates loss per share is expected to be flat with the year-ago quarter’s actual. CTVA delivered a negative earnings surprise of 4.4%, on average, in the trailing four quarters.

Monster Beverage MNST currently has an Earnings ESP of +0.82% and a Zacks Rank of 3. The company is likely to register increases in the top and bottom lines when it reports third-quarter 2025 numbers. The Zacks Consensus Estimate for quarterly earnings per share is pegged at 48 cents, suggesting a 20% rise from the year-ago period’s reported number. The consensus mark has been unchanged in the past 30 days.

The consensus estimate for Monster Beverage’s quarterly revenues is pegged at $2.1 billion, which indicates growth of 12.1% from the prior-year quarter’s actual. MNST has a trailing four-quarter earnings surprise of 0.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 10 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite