|

|

|

|

|||||

|

|

Both are major players in the enterprise technology and AI space, with Palantir Technologies PLTR focusing on advanced data and AI-driven software platforms and Accenture plc ACN operating as a global IT services and consulting powerhouse deeply involved in digital transformation and AI deployments.

While Palantir specializes in developing cutting-edge platforms such as Foundry, Gotham, and AIP to empower organizations with data-driven intelligence and decision-making capabilities, Accenture integrates AI across industries through its consulting expertise, cloud capabilities, and vast client network. Together, they represent two complementary forces in the AI ecosystem, one providing transformative technology and the other driving large-scale adoption.

PLTR is benefiting from its Artificial Intelligence Platform (AIP), which is rapidly evolving into its primary growth engine. In the second quarter of 2025, U.S. commercial revenues surged 93% year over year. Thanks to AIP, the total U.S. commercial contract value skyrocketed 222% YoY, while the remaining deal value climbed 145% to $2.79 billion. Customer count also grew 43% year over year, underscoring PLTR’s ability to scale rapidly while maintaining high satisfaction.

Palantir’s AIP bootcamps, intensive onboarding and implementation sessions, have been instrumental in accelerating adoption. These programs equip enterprise clients to deploy production-ready AI solutions in record time, drastically reducing the time-to-value and demonstrating the platform’s intuitive interface and scalability.

At its core, AIP enables organizations to embed autonomous AI agents across workflows, shrinking decision timelines and scaling productivity by multiples, not mere percentages. While competitors focus on AI model development, PLTR is winning on deployment, offering turnkey, enterprise-ready solutions that drive real results from day one. The U.S. commercial business has now become Palantir’s most dynamic revenue driver, and AIP is the key accelerant.

Accenture’s bold $3-billion multiyear investment in generative AI (GenAI), initiated in fiscal 2023, is paying off significantly as the company continues to attract a growing roster of clients. The firm is already seeing measurable results; its AI-driven revenues have tripled over fiscal 2024, while GenAI bookings have nearly doubled, reaching $5.9 billion.

Accenture’s strategic partnerships with major technology companies are amplifying its AI capabilities. Its collaboration with Google Cloud is helping build an agentic platform that enables employees and workflows to fully harness Google AI’s power. Likewise, its alliance with Microsoft focuses on developing GenAI-powered cybersecurity solutions aimed at mitigating risks and optimizing operational costs.

We remain bullish on Accenture’s Reinvention Services, introduced in September, which is showing early promise. Nearly 80% of the company’s large deals now include multi-AI-enabled services, reflecting strong client adoption. With its AI Refinery initiative designed to tackle industry-specific challenges through a network of AI agents, Accenture’s GenAI offerings stand out as a key driver of the company’s future growth trajectory.

The Zacks Consensus Estimate for PLTR’s 2025 sales and EPS indicates year-over-year growth of 46% and 61%, respectively. EPS estimates have been trending flat over the past 60 days.

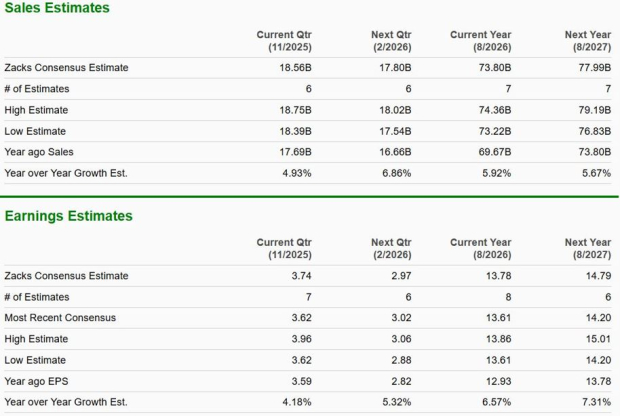

The Zacks Consensus Estimate for ACN’s fiscal 2026 sales and EPS indicates year-over-year growth of 6% and 7%, respectively. EPS estimates have trended upwards over the past 60 days.

While ACN appears attractively valued with a forward 12-month P/E of 18.17X versus its median of 23.47X, suggesting that the stock could be undervalued relative to its historical range, PLTR is trading at a forward 12-month P/E of 229.14X, below its 12-month median of 304.59X.

Both Palantir and Accenture are well-positioned in the expanding AI-driven enterprise landscape; however, their investment profiles differ significantly. Palantir’s high-growth momentum, fueled by its AIP platform, showcases remarkable scalability but comes with a lofty valuation that limits near-term upside. Accenture, on the other hand, offers steadier growth backed by diversified GenAI adoption, global client relationships, and more attractive valuation metrics. While both stocks merit a Hold rating, Accenture appears to be the more balanced and less risky choice for investors seeking sustainable AI exposure with consistent earnings visibility and a proven record of executing digital transformations at scale.

Both PLTR and ACN carry a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 16 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite