|

|

|

|

|||||

|

|

The surge in AI workloads has ignited a rush for infrastructure. From hyperscale data centers packed with GPUs to specialized cloud platforms for model training and inference, the AI infrastructure market is now one of the most booming sectors in the tech landscape. As highlighted by the Precedence Research, the global AI infrastructure market is expected to surge from $60.23 billion in 2025 to around $499.33 billion by 2034, at a CAGR of 26.6%. Accelerating uptake of AI across various industries, aimed at boosting efficiency, scalability and innovation, is fueling the upside.

In this space, CoreWeave (CRWV) and Microsoft Corporation (MSFT) both offer cloud infrastructure services for AI workloads. CoreWeave is a pure-play AI-infrastructure specialist, while Microsoft is a tech giant with diversified lines of business, including cloud (Azure), AI and enterprise services.

AI infrastructure is the backbone of the next generation’s innovation, from large language models to autonomous computing. Both CoreWeave and Microsoft are vital players in this transformation. So, let’s deep dive into which might be the smarter bet now, based on growth potential, fundamentals, valuation and risk profile.

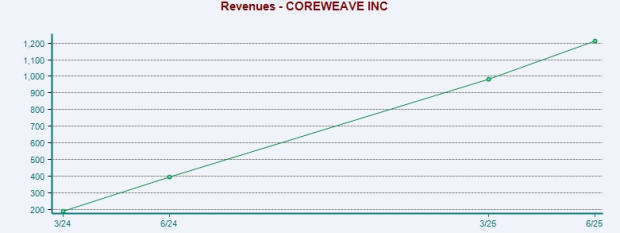

CoreWeave has quickly become a major player in high-performance computing, especially for AI workloads, establishing a presence in the GPU cloud market dominated by hyperscalers like Microsoft Azure, AWS and Google Cloud. As more enterprises see AI as a strategic necessity, the company has become a key facilitator in this shift—supporting both training and inference tasks. Its ongoing efforts to increase capacity and improve services have driven strong growth and better-than-expected sales, even in a supply-constrained market environment. It raised its 2025 revenue outlook to $5.15–$5.35 billion from $4.9–$5.1 billion, driven by continued customer demand and rapid data center expansion.

It went public in March 2025 and has taken aggressive steps such as strategic mergers and acquisitions and securing large commercial contracts. These initiatives not only diversify its offerings but also boost its capital requirements. Recently, it signed an agreement to acquire Marimo Inc., creator of the open-source Marimo notebook, an AI-native, reactive environment for Python. This acquisition enhances CRWV’s integrated AI infrastructure, helping developers build, scale and deploy applications more quickly and efficiently.

The move builds on previous strategic acquisitions, including OpenPipe, focused on reinforcement learning, and Weights & Biases (“W&B”), a leading platform for model iteration and experiment tracking. However, its proposed $9 billion acquisition of Core Scientific has been terminated after stakeholders voted against the deal. The company continues to secure major capacity commitments, including multi-billion-dollar agreements with NVIDIA Corporation (NVDA) and multi-year deals with large AI clients, as well as raising substantial financing facilities and expanding into new markets, including U.S. federal projects.

Recently, it announced plans to enter the U.S. federal market through CoreWeave Federal, which will offer secure, compliant and high-performance AI cloud services to government agencies and Defense Industrial Base partners. The company is aligning its platform with FedRAMP and other key standards while investing in specialized teams and technologies. With proven capabilities and experience in the public sector from its W&B acquisition, CRWV is well-positioned as it enters this market.

Furthermore, CoreWeave has strengthened its ties with NVDA , becoming the first cloud provider to offer NVIDIA RTX PRO 6000 Blackwell Server Edition instances for general availability. This launch adds to one of the industry’s most extensive NVIDIA Blackwell portfolios, including the GB200 NVL72 system and HGX B200 platform. In September, CoreWeave announced a new $6.3 billion order under its existing Master Services Agreement with NVIDIA. Per the order, NVIDIA will purchase CoreWeave’s unused capacity through April 2032, subject to certain terms.

Last month, CoreWeave expanded its partnership with OpenAI to support the training of next-generation AI models, reinforcing its position as a leading cloud platform for advanced AI workloads. The new $6.5 billion deal brings CoreWeave’s total contract value with OpenAI to about $22.4 billion, following earlier agreements in March and May 2025. This month, it also signed an agreement with Meta Platforms to provide cloud computing capacity worth up to $14.2 billion through December 2031, with an option to extend through 2032. These major deals strengthen CRWV’s competitive edge and expand its growing AI infrastructure pipeline.

Despite impressive growth, CoreWeave faces mounting financial and competitive pressures, including a heavy debt load and massive capital spending. It expects capex for the third quarter to be $2.9 billion to $3.4 billion, with full-year capex guidance reaffirmed at $20-$23 billion. The combination of surging CapEx, high interest expenses and supply constraints might amplify near-term financial pressures. Also, intensifying competition from players like Nebius and Microsoft, both rapidly scaling their AI infrastructure capabilities, threatens CoreWeave’s market position and could limit near-term growth momentum.

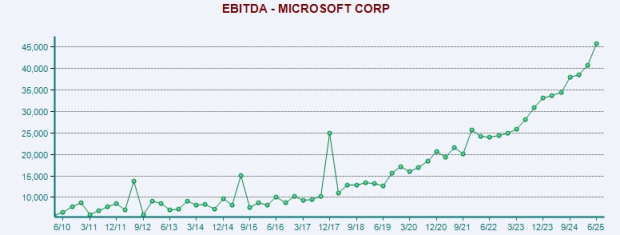

Microsoft delivered strong fiscal first-quarter 2026 results with revenue of $77.7 billion, marking an 18% year-over-year increase (up 17% in constant currency or cc), as the company’s aggressive AI and cloud investments continue to yield tangible financial gains. Its CapEx is set to accelerate significantly. Management has raised its guidance, stating that the growth rate for capital expenditure in fiscal 2026 will now exceed the rate seen in fiscal 2025, overturning prior expectations for a slowdown. The primary catalyst is the explosive demand for AI and cloud compute capacity.

Despite high capital spending, Microsoft’s strong balance sheet enables major long-term investments in AI infrastructure while maintaining flexibility through finance leases. Its cash reserves, credit strength, and steady cash flows uniquely position the company to seize the multi-trillion-dollar AI opportunity and sustain shareholder returns.

To adapt, the company is prioritizing investment in short-lived hardware, specifically GPUs and CPUs, to better match contract terms. However, investors should be aware that quarterly spending will remain volatile due to the variable timing of infrastructure buildouts and finance lease deliveries. Azure and other cloud services revenue rose 40% (up 39% in cc), exceeding expectations on strong growth in core infrastructure demand from major customers. Azure AI services performed in line with expectations, with demand continuing to outpace available capacity despite added infrastructure.

Microsoft plans to boost its total AI capacity by more than 80% this year and nearly double its data center footprint within the next two years. The company introduced Fairwater in Wisconsin as the world’s most powerful AI data center, set to scale to two gigawatts and go online next year. It also deployed the world’s first large-scale NVIDIA GB300 cluster and is developing a unified, flexible infrastructure supporting all stages of the AI lifecycle, from pre-training to inference. However, it expects to remain capacity-constrained through fiscal 2026, with demand continuing to outpace infrastructure expansion, leading to potential missed revenue opportunities for Azure.

Recently, it finalized a new definitive agreement with OpenAI, granting exclusive Azure rights until the achievement of AGI or through 2030, and extending model and product IP rights through 2032. As part of the deal, OpenAI committed to an additional $250 billion in Azure services, an amount not yet reflected in its fiscal first-quarter results, signaling a significant long-term revenue opportunity for Azure.

For the fiscal second quarter, Microsoft projects Azure and other cloud services revenue to grow approximately 37% in cc, as demand continues to outpace available capacity. The company expects to remain capacity-constrained through at least the end of the fiscal year, with infrastructure buildout lagging demand and resulting in potential missed revenue opportunities for Azure. It plans to balance Azure’s growth with expanding needs across first-party applications, AI solutions, R&D initiatives and server refresh cycles.

Nonetheless, MSFT continues to operate in a competitive cloud landscape with legal and regulatory constraints adding to the pressure. It faces intense competition from major rivals and emerging AI-focused players, as Amazon, Google and others aggressively price cloud and AI services below Microsoft’s levels while offering comparable capabilities.

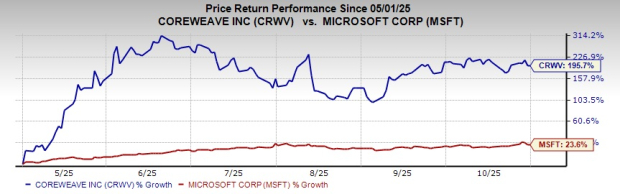

In the past six months, CRWV has skyrocketed 195.7% while MSFT is up 23.6%.

In terms of Price/Book, CRWV shares are trading at 24.09X, higher than MSFT’s 11.38X.

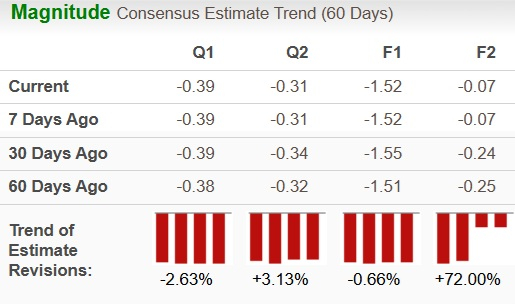

Analysts have revised earnings estimates downward for CRWV's bottom line for the current year.

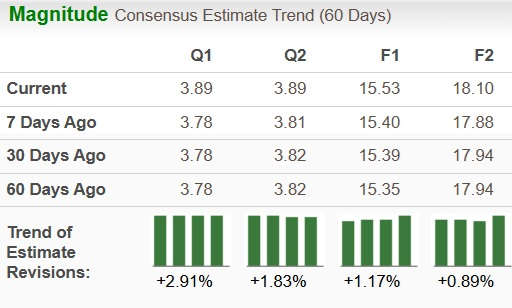

For MSFT, there is a marginal upward revision.

The race to build next-generation AI infrastructure, the massive GPU clusters, data centers and networks powering advanced model training and inference, is intensifying. Both CRWV and MSFT are well poised to capitalize on the growing AI infrastructure demand.

CRWV at present carries a Zacks Rank #2 (Buy), while MSFT has a Zacks Rank #3 (Hold). Consequently, in terms of Zacks Rank and valuation, CRWV seems to be a better pick at the moment. You can see the complete list of today’s Zacks #1(Strong Buy) Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 31 min | |

| 37 min | |

| 43 min | |

| 50 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite