|

|

|

|

|||||

|

|

China is the world’s biggest electric vehicle (EV) market. BYD Co. Ltd. BYDDY and NIO Inc. NIO are two noted Chinese EV players.

BYD started as a battery maker in 1995 and has grown into the world’s fastest-growing EV manufacturer and the chief global rival to Elon Musk’s Tesla. It’s leading the game when it comes to affordable EVs. NIO, meanwhile, is a relatively smaller player but is actively focused on growing its market share, building a loyal customer base through features like battery swapping and smart driving systems.

As the Chinese EV market becomes more competitive, both automakers are now at critical junctures. BYD’s growth has slowed lately after years of rapid expansion, while NIO is showing signs of recovery with record deliveries and new models.

Year to date, shares of NIO have jumped more than 60%, handily outperforming BYD stock’s gain of 14.3%. The big question for investors is—which company is a better choice now for exposure in the Chinese EV industry?

BYD’s story is one of relentless innovation and vertical integration. Founded in 1995 as a battery company, it now makes everything from affordable EVs like the Seagull to luxury models under its Yangwang brand. Its signature Blade Battery and the new “Super e-Platform” offer impressive range and charging efficiency—up to 400 kilometers in just five minutes of charge. This kind of in-house technology gives BYD a potent edge in cost and reliability.

However, the latest results hint at some growing pains. In the third quarter of 2025, BYD reported revenues of 195 billion yuan, down 3% year over year due to weakness in its automotive business. NEV sales fell 1.8% in the quarter, marking its first decline since early 2021, per CnEVPost. Amid intense competition, rivals like Geely introduced new models at huge discounts. Cut-throat competition and aggressive pricing not just impacted BYD’s sales volumes but also gross margins. Third-quarter gross margin came in at 17.61%, down year over year. Net profit slumped 32.6% to 7.8 billion yuan as aggressive price cuts and fierce domestic competition squeezed margins, marking the second consecutive quarterly decline.

Investors also seem concerned after Warren Buffett’s Berkshire Hathaway offloaded its entire stake in BYD, ending a 17-year investment. The firm began selling shares in 2022, after BYD’s stock had surged more than twentyfold. While this could be seen as a normal portfolio rebalancing move and profit-taking, the recent slowdown in BYD’s sales adds to investor worries. Discouragingly, the company has trimmed its 2025 sales target by 16% to 4.6 million vehicles.

Nonetheless, BYD continues to expand globally. New registrations in Europe jumped nearly fivefold in September, and the company plans to strengthen its presence in Japan. It expects exports to double, supported by solid demand for its EVs and hybrids overseas. In short, BYD may be slowing at home, but its global reach, scale advantage and battery technology remain long-term growth drivers.

NIO is on a different path—smaller in scale but strong in innovation and brand loyalty. The company delivered a record 87,071 vehicles in the third quarter of 2025, up 41% year over year and setting a new quarterly record. A key contributor to this growth is ONVO L90, which was launched on Aug. 1, 2025, and became a hit in just two months.

In addition, NIO launched its flagship All-New ES8, a premium three-row SUV, in September. The ES8 is expected to strengthen NIO’s presence in the core premium SUV segment. Alongside the ES8, NIO’s 2025 lineup—including ET5, ET5T, EC6, and the refreshed ES6—leverages the company’s proprietary smart-driving chip and full-vehicle operating system, reinforcing its technology edge in a competitive market.

A key differentiator for NIO is its vast battery swap network—over 3,500 stations globally, including 1,000 on Chinese highways. These allow a full battery change in three minutes, giving NIO a major advantage in convenience over traditional charging. Combined with more than 27,000 chargers, this ecosystem reinforces its brand appeal and customer stickiness.

NIO is yet to report its third-quarter 2025 results. Financially, NIO’s vehicle margins are holding up well (more than 10% in the second quarter of 2025), with expectations of improving to 16–17% as new models scale up. The ONVO L90 and ES8 could deliver margins of around 20%, thanks to cost optimization and in-house tech. The fourth quarter will be the first full quarter for L90 and ES8 sales, potentially boosting profitability and reinforcing NIO’s competitive position.

However, challenges remain. Operating expenses have been rising, and NIO’s debt levels (0.76 debt-to-capital ratio) and shrinking cash reserves may put pressure on near-term flexibility.

Despite these financial headwinds, NIO’s vehicle positioning, technology, and infrastructure make it a unique player in China’s EV race. If it can control costs and sustain its momentum, NIO could emerge as one of the most resilient and differentiated EV brands in the coming years.

While both BYD and NIO face challenges in China’s crowded EV market, NIO appears better positioned in the near term. BYD’s slowing domestic sales, profit pressure and lower sales highlight a cooling growth phase after years of dominance.

In contrast, NIO’s strong delivery momentum, improving vehicle margin outlook, and promising new models suggest renewed traction. Its proprietary battery swap technology adds a competitive edge.

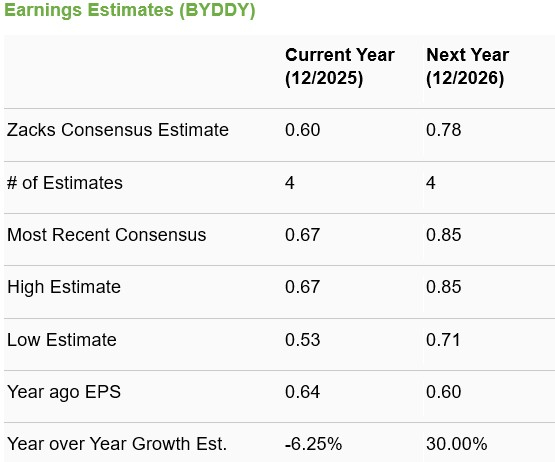

NIO’s bottom-line estimates for the current and next year also point to stronger improvement. With BYD navigating a reset and NIO gaining ground, investors may find NIO the smarter choice for now.

NIO currently carries a Zacks Rank #3 (Hold), while BYD carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-15 | |

| Feb-13 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-07 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite