|

|

|

|

|||||

|

|

Warren Buffett's approach to investing can be simplified into three steps.

If you are new to investing, Buffett's approach is worth learning even if you don't follow it to the letter.

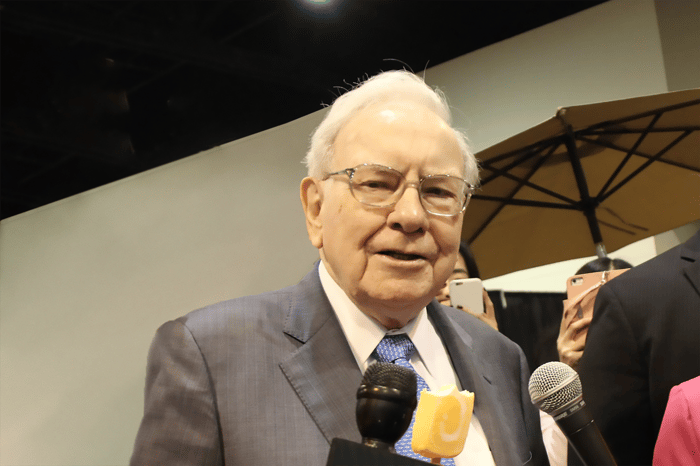

Investing can be a daunting task for those new to finance. But it doesn't have to be complicated. Although you should start slowly, perhaps only buying one or two stocks, world-famous investor Warren Buffett's approach is a great one to emulate. Luckily, the simplified rules are fairly easy to follow.

Here's what new investors need to know to get started.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: The Motley Fool.

Warren Buffett is the CEO of conglomerate Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). In simple terms, the company is really just Buffett's investment vehicle. It owns hundreds of companies. Some are owned fully by Berkshire, while others are owned partially, via share purchases in publicly traded companies. In some ways, Berkshire Hathaway is like a mutual fund, with the stock's incredible performance over time a testament to Buffett's investment success.

Data by YCharts.

There are two ways to follow Warren Buffett's investment advice. The first is simple: He thinks most investors would be wise to just buy an S&P 500 (SNPINDEX: ^GSPC) index fund and then focus all of their effort on saving money (to keep putting in the index fund). If you don't want to be an active investor, that's not a bad plan, so long as you keep adding money regularly through good markets and bad, which is the equivalent of dollar-cost averaging.

The second way is to follow Buffett's lead and invest in stocks like he invests in stocks. To be fair, you aren't Buffett, so you'll never actually do that. You can only invest the way you are comfortable investing. But Buffett can help guide your decisions using three deceptively simple steps: Buy good companies when they are attractively priced and hold them long term.

So what, exactly, is a good company? To some extent, that's in the eye of the beholder. But you can swing back to a tip from Buffett's mentor, Benjamin Graham, for a little extra help. Graham suggested looking at companies that pay dividends, preferably ones that have grown regularly, for a long time, when considering an investment. You should do that, too, to whittle down your list of investment options to a manageable number.

It is probably best to start with at least 10 consecutive years of growing dividends, though you could go even more stringent than that. If you are just getting started, you might even want to go with the cream of the crop on the dividend front and select only from the Dividend Kings list. Dividend Kings have increased their dividends annually for at least 50 consecutive years. A company doesn't build a streak like that by accident.

After that point, you can be a bit more subjective. Basically, look for companies that you can understand and that have businesses you believe offer long-term growth potential. Read through at least a year's worth of quarterly earnings updates, listen to the quarterly earnings calls, and examine the last annual report. All of these activities will give you a deeper understanding of the company you are looking at.

Valuing a company can be a very complex effort. If you are sticking to long-term dividend payers, you are probably better off using a shortcut or two. The quick and dirty one is to only focus on stocks that have historically high dividend yields. Generally speaking, dividend stocks tend to trade within yield ranges, so when a yield is historically high it is likely to be priced attractively based on the math of dividend yields (dividend divided by price).

You can confirm that valuation by also looking at more traditional valuation metrics like price-to-sales, price-to-earnings, and price-to-book value. Of the three, the P/S and P/B ratios tend to be more stable over time (earnings can vary greatly from year to year) and should probably be your core focus. The idea isn't to see all of them aligning with the yield, but most should be heading in the same direction.

To give you an example at this point, PepsiCo (NASDAQ: PEP) and Walmart (NYSE: WMT) are both Dividend Kings. They are both fairly easy-to-understand businesses, one being a beverage and food producer and the other a retailer. But PepsiCo's 3.8% dividend yield is on the high side for the company, while Walmart's tiny 0.9% yield is on the low side. PepsiCo looks cheap, which is confirmed when you look at its P/S and P/B ratios, which are below their five-year averages. Walmart looks expensive, which is also confirmed when you look at its P/S and P/B ratios, which are above their five-year averages.

The last step is probably the most important. Buffett's goal is to benefit from the long-term growth of the businesses he owns. He can only do that if he sticks around for the long term as an investor. For you, when you buy a stock, like PepsiCo, you need to think in decades, not days or even years. History suggests that a company like PepsiCo will continue to reward you with a growing dividend as its business grows. And history suggests that the stock price will rise over time, as well. This is what will build generational wealth for you and your family.

There's another Buffett idea that you should keep in mind at this point. The so-called Oracle of Omaha has suggested that investors should only be allowed to buy a small number of stocks in their lifetimes. The idea is to make you focus on only buying companies you really believe in and to stop you from overtrading, which can lead to less-than-optimal decision-making. Assuming you take Buffett's advice with regard to how you invest, you should probably take his advice on how many stocks to own.

Keeping the number at 20 or less will likely be a good move. Building up to a full portfolio, meanwhile, should probably be something you do over years, not days. Take your time, keep it simple, and soon enough you'll start to feel a lot more confident as an investor.

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $603,392!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,241,236!*

Now, it’s worth noting Stock Advisor’s total average return is 1,072% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of October 27, 2025

Reuben Gregg Brewer has positions in PepsiCo. The Motley Fool has positions in and recommends Berkshire Hathaway and Walmart. The Motley Fool has a disclosure policy.

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite