|

|

|

|

|||||

|

|

Healthcare services company The Ensign Group (NASDAQ:ENSG). beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 19.8% year on year to $1.30 billion. The company’s full-year revenue guidance of $5.06 billion at the midpoint came in 1% above analysts’ estimates. Its GAAP profit of $1.42 per share was 4.9% below analysts’ consensus estimates.

Is now the time to buy The Ensign Group? Find out by accessing our full research report, it’s free for active Edge members.

“We are pleased to report another record quarter. The primary driver of these results is the extraordinary healthcare outcomes achieved by our dedicated and talented clinical teams. Simply put, our consistent financial results would not be possible without a relentless patient-focused culture that strives to deliver the highest quality clinical outcomes,” said Barry Port, Ensign’s Chief Executive Officer.

Founded in 1999 and named after a naval term for a flag-bearing ship, The Ensign Group (NASDAQ:ENSG) operates skilled nursing facilities, senior living communities, and rehabilitation services across 15 states, primarily serving high-acuity patients recovering from various medical conditions.

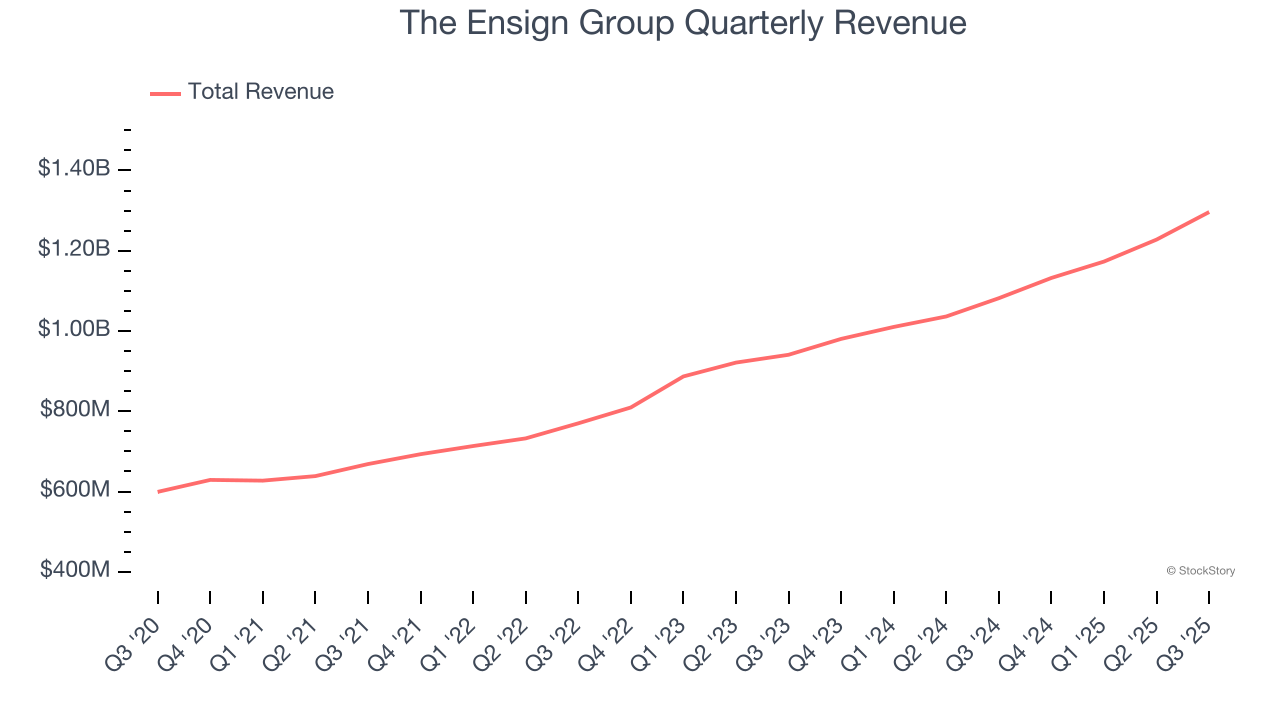

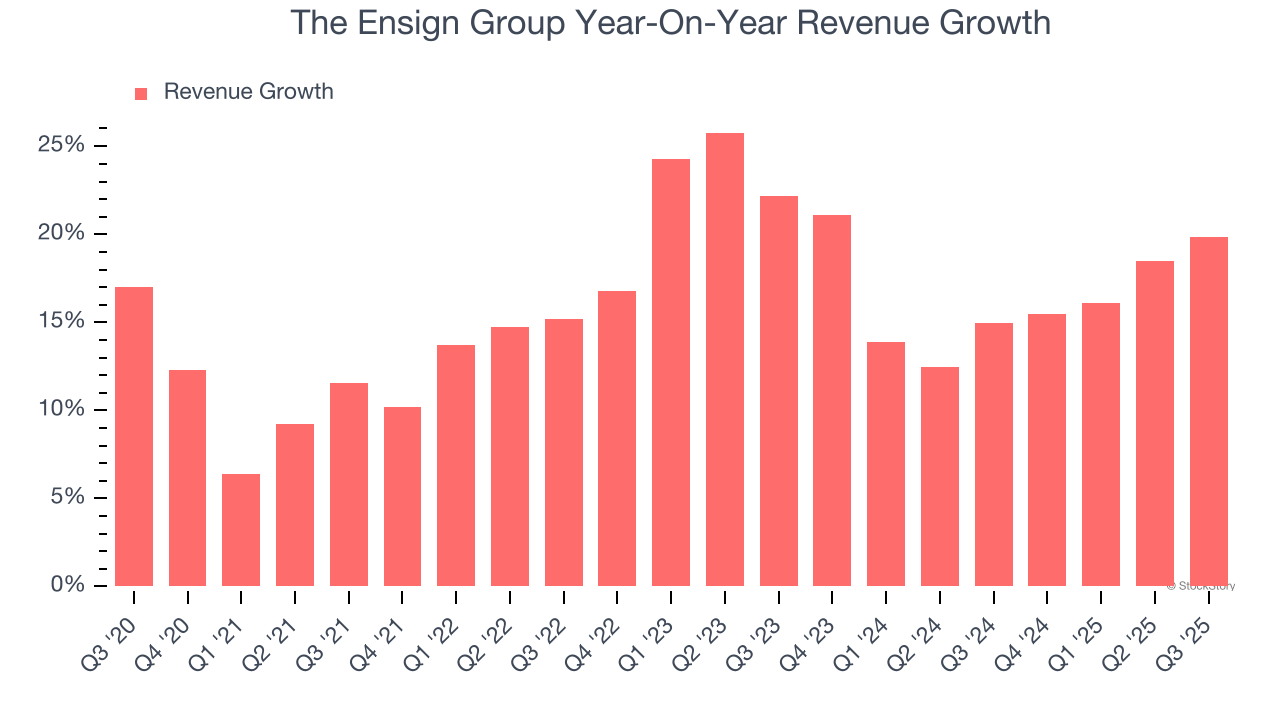

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, The Ensign Group’s 15.7% annualized revenue growth over the last five years was solid. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. The Ensign Group’s annualized revenue growth of 16.5% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

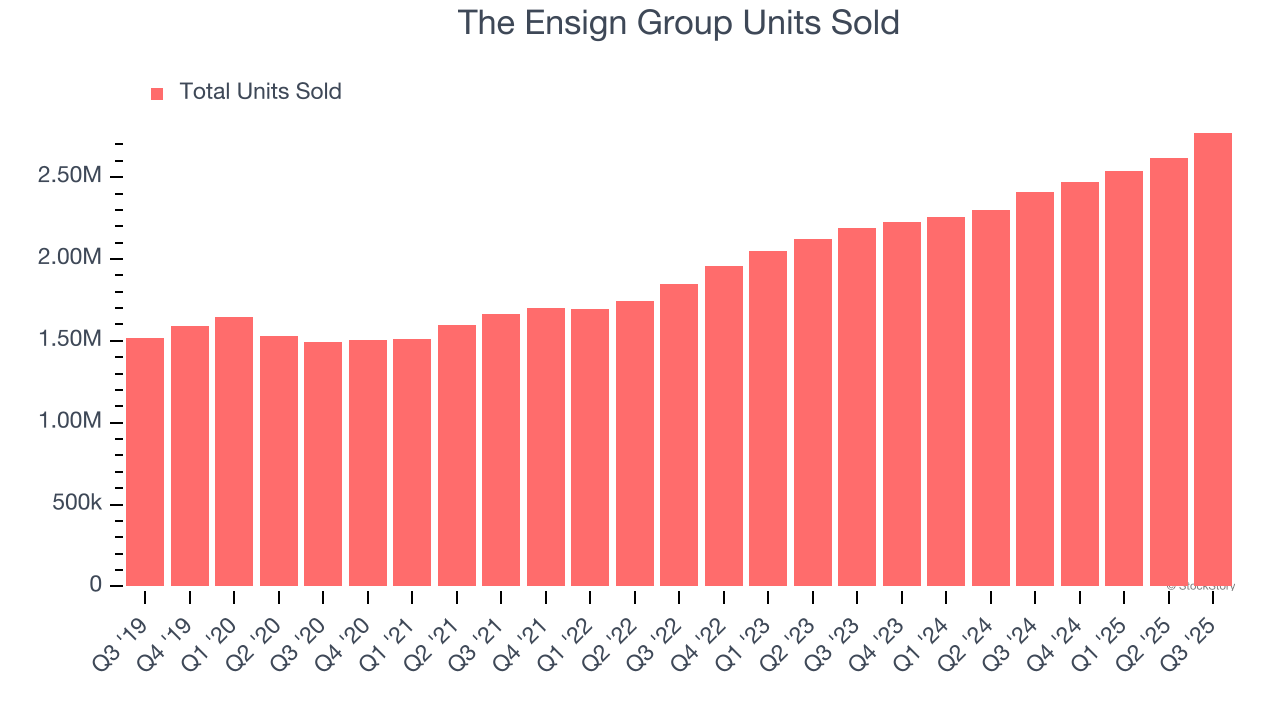

The Ensign Group also reports its number of units sold, which reached 2.77 million in the latest quarter. Over the last two years, The Ensign Group’s units sold averaged 11.8% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, The Ensign Group reported year-on-year revenue growth of 19.8%, and its $1.30 billion of revenue exceeded Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 12.5% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and implies the market is forecasting success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

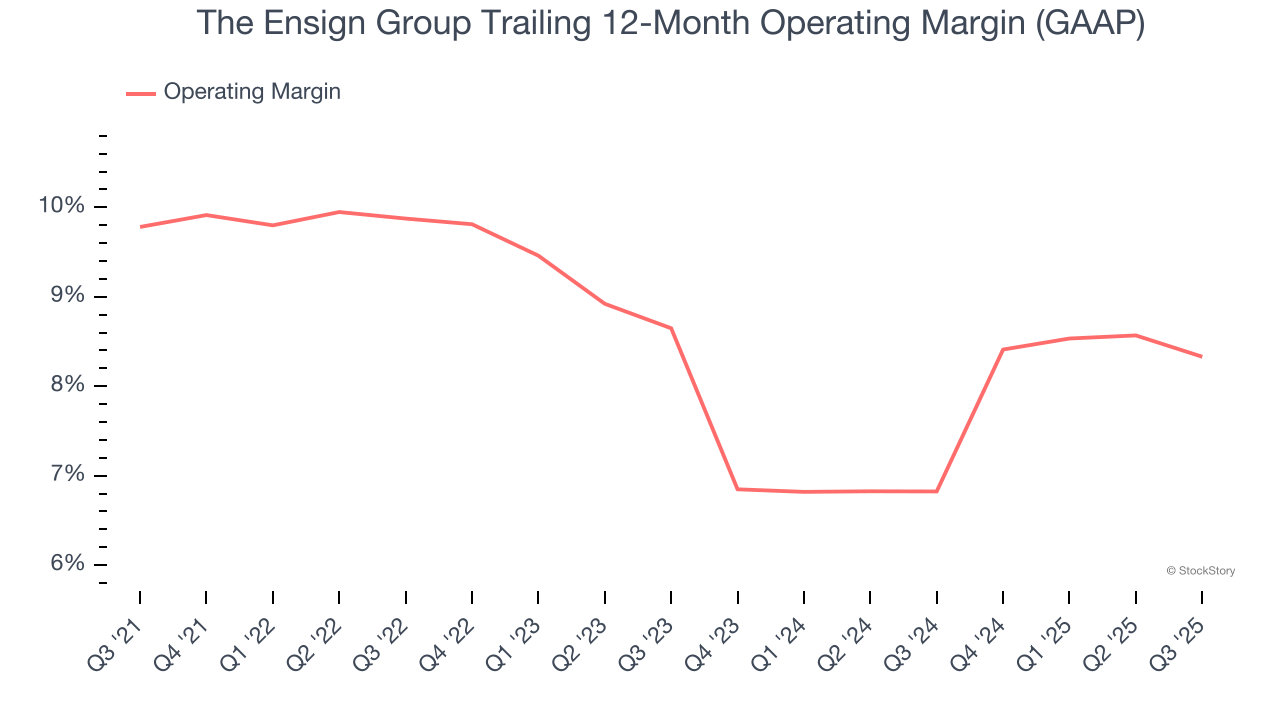

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

The Ensign Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.5% was weak for a healthcare business.

Looking at the trend in its profitability, The Ensign Group’s operating margin decreased by 1.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. The Ensign Group’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, The Ensign Group generated an operating margin profit margin of 7.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

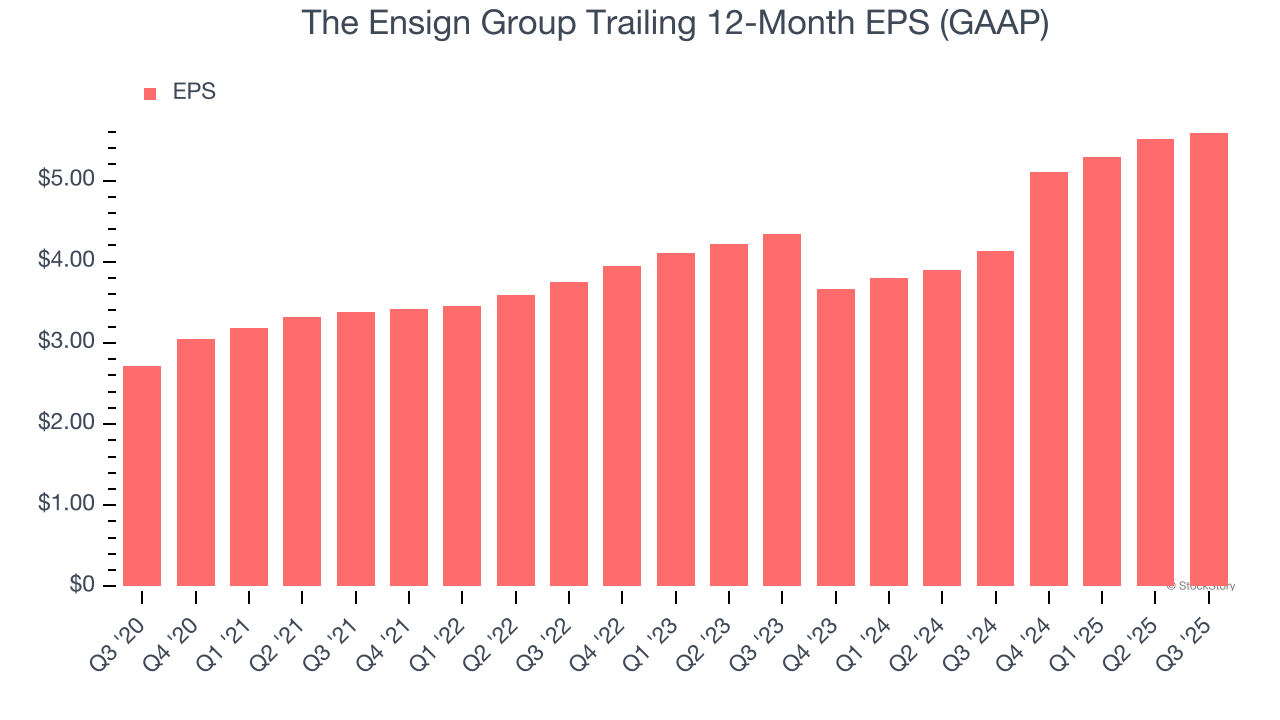

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

The Ensign Group’s astounding 15.5% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q3, The Ensign Group reported EPS of $1.42, up from $1.34 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects The Ensign Group’s full-year EPS of $5.59 to grow 17.2%.

Revenue beat. Looking ahead, we were impressed by how significantly The Ensign Group blew past analysts’ full-year EPS guidance expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its EPS missed. Overall, this print had some key positives. The stock remained flat at $183.88 immediately after reporting.

So should you invest in The Ensign Group right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| Feb-16 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 |

Stock Market Today: Small Caps Sink But Vertiv Booms; Rocket Stock Karman Hits Sell Rule (Live Coverage)

ENSG

Investor's Business Daily

|

| Feb-11 | |

| Feb-10 | |

| Feb-09 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite