|

|

|

|

|||||

|

|

Medifast, Inc. (MED) delivered third-quarter 2025 results, with the top line surpassing the Zacks Consensus Estimate while the bottom line missing the same. Both the metrics showed a year-over-year decline.

Management is shifting its strategy from being a weight-loss company to becoming a leader in metabolic health. The company believes its coach-guided, clinically proven system can address underlying metabolic issues, positioning it in a larger and more sustainable market.

MED reported a quarterly loss of 21 cents per share, wider than the Zacks Consensus Estimate of a loss of 1 cent. The result also marks a sharp reversal from the prior-year quarter’s earnings of 10 cents per share.

MEDIFAST INC price-consensus-eps-surprise-chart | MEDIFAST INC Quote

Net revenues of $89.4 million declined 36.2% year over year due to a drop in the number of active earning OPTAVIA coaches. However, the metric exceeded the Zacks Consensus Estimate of $86 million. The average revenue per active earning OPTAVIA Coach was $4,585, down from $4,672, mainly caused by pressure in client acquisition associated with the rapid adoption of GLP-1 medications for weight loss.

The number of active earning OPTAVIA Coaches has been going downward year over year since the first quarter of 2023, reflecting continued challenges in client acquisition due to the growing acceptance of GLP-1 medications for weight loss. The total number of active earning OPTAVIA coaches declined 35% to 19,500 from 30,000 seen in the year-earlier quarter.

Gross profit was $62.2 million, down 41.2% year over year on lower revenues, partially offset by reduced cost of sales. The gross margin was 69.5%, down 590 basis points (bps) year over year. The decline reflects 450 bps of loss of leverage on fixed costs and 180 bps related to reserves for the reformulation of the Essential product line. We expected gross profit to be $64.3 million in the third quarter.

Selling, general and administrative expenses (SG&A) fell 36% year over year to $66.2 million. This decrease was primarily caused by a $19.7 million reduction in OPTAVIA coach compensation due to lower volume and fewer active earning coaches. In addition, SG&A for the quarter also included decreases of $5.6 million in company-led marketing, $2.9 million in convention costs and $2 million related to the company’s collaboration with LifeMD, Inc., all of which did not recur in the period.

As a percentage of revenues, SG&A increased 20 bps year over year to 74.1%. The increase was primarily due to 520 bps associated with the loss of leverage on fixed costs and other smaller increases, partially offset by a 360-bps reduction related to company-led marketing and a 210-bps reduction related to convention costs incurred in the prior-year period that did not recur in the third quarter of 2025.

The loss from operations was $4.1 million in contrast to the operating income of $2.1 million in the year-ago quarter. As a percentage of revenues, this represented a loss from operations of 4.6% of revenues versus an operating margin of 1.5% in the prior-year period.

MED concluded the quarter with cash, cash equivalents and investment securities of $173.5 million, no debt (as of Sept. 30, 2025) and total shareholders’ equity of $214.7 million.

The company expects fourth-quarter 2025 revenues between $65 million and $80 million, with loss per share expected to be between 70 cents and $1.25.

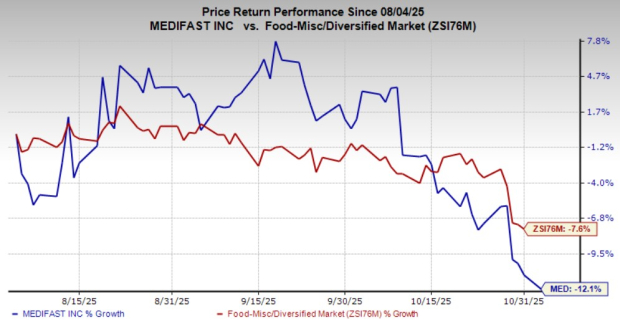

This Zacks Rank #3 (Hold) company’s shares have lost 12.1% in the past three months compared with the industry’s 7.6% decline.

United Natural Foods, Inc. (UNFI) distributes natural, organic, specialty, produce and conventional grocery and non-food products in the United States and Canada. At present, United Natural sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for United Natural’s current fiscal-year sales and earnings implies growth of 2.5% and 167.6%, respectively, from the year-ago figures. UNFI delivered a trailing four-quarter earnings surprise of 416.2%, on average.

Lamb Weston Holdings, Inc. (LW) engages in the production, distribution and marketing of frozen potato products in the United States, Canada, Mexico and internationally. It sports a Zacks Rank #1 at present. Lamb Weston delivered a trailing four-quarter earnings surprise of 16%, on average.

The Zacks Consensus Estimate for Lamb Weston's current fiscal-year sales indicates growth of 1.3% from the prior-year levels.

Vital Farms (VITL) packages, markets and distributes shell eggs, butter and other products in the United States. It carries a Zacks Rank #2 (Buy) at present. Vital Farms delivered a trailing four-quarter earnings surprise of 35.8%, on average.

The Zacks Consensus Estimate for Vital Farms’ current fiscal-year sales and earnings implies an increase of 27.2% and 16.1%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite