|

|

|

|

|||||

|

|

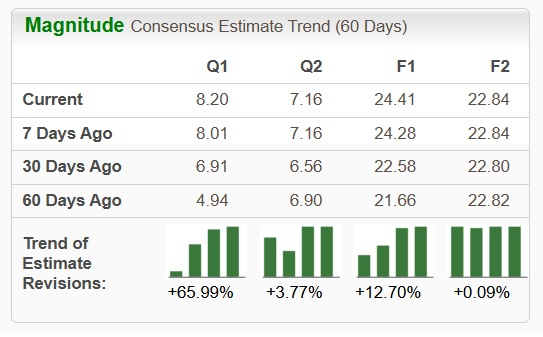

The Allstate Corporation ALL is scheduled to release third-quarter 2025 results on Nov. 5, after the closing bell. The Zacks Consensus Estimate for earnings is pegged at $8.20 per share, which has more than doubled from the prior-year quarter’s reported figure.

The third-quarter earnings estimate has witnessed four upward revisions against no downward movement over the past 30 days. Meanwhile, the consensus mark for revenues is pegged at $17.4 billion, implying 5.9% growth from the year-ago quarter’s figure.

Allstate’s bottom line beat estimates in each of the trailing four quarters, the average surprise being 57.67%. This is depicted in the chart below:

The Allstate Corporation price-eps-surprise | The Allstate Corporation Quote

Our proven model does not conclusively predict an earnings beat for Allstate this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here, as you see below.

Earnings ESP: Allstate has an Earnings ESP of 0.00%. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: ALL currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allstate’s revenues are expected to have gained on the back of improved net premiums earned as a result of higher policies in force. Policies in force are likely to have received an impetus from the acquisition of National General and improved direct sales. We estimate net earned premiums to grow 8.3% year over year to $15.5 billion in the third quarter.

Net investment income is likely to have been driven by higher fixed income yields. The Zacks Consensus Estimate for net investment income is pegged at $832 million, which indicates a 6.3% improvement from the prior-year quarter’s reported figure.

The Property-Liability segment is likely to have been aided by higher earned premiums, which, in turn, are expected to have stemmed from higher policies in force and new business growth. The consensus mark for the unit’s net premiums earned stands at $14.8 billion, suggesting 7.8% growth from the year-ago quarter’s reported number.

However, continued incidence of catastrophe losses is expected to have hurt the overall underwriting results of Allstate in the third quarter. Management forecasts pre-tax catastrophe losses to be $558 million in the third quarter.

The Protection Services segment is expected to have been aided by the strength in Allstate Protection Plans. The Zacks Consensus Estimate for the unit’s revenues is pegged at $899 million, which indicates an 8.1% improvement from the prior-year quarter’s reported figure. We expect the unit’s revenues to rise 7.6% year over year to $895.5 million.

In the third quarter, underwriting results in the auto insurance and homeowners insurance businesses are expected to improve.

Additionally, Allstate’s margins are likely to have suffered a blow due to elevated property and casualty insurance claims and claims expenses. We expect the abovementioned cost to increase 2.7% year over year to $10.7 billion.

Here are some companies from the insurance space, which according to our model, have the right combination of elements to beat on earnings this time around:

HCI Group, Inc. HCI has an Earnings ESP of +87.40% and a Zacks Rank of 2 at present. The Zacks Consensus Estimate for HCI’s third-quarter earnings is pegged at $2.35 per share, indicating a fivefold increase from the year-ago quarter’s figure.

HCI Group’s earnings beat estimates in each of the trailing four quarters, the average surprise being 41.70%.

Primerica, Inc. PRI has an Earnings ESP of +2.27% and a Zacks Rank of 2 currently. The Zacks Consensus Estimate for PRI’s third-quarter earnings is pegged at $5.51 per share, indicating 3% decline from the year-ago quarter’s number.

Primerica’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.72%.

Essent Group Ltd. ESNT has an Earnings ESP of +4.20% and a Zacks Rank of 3 currently. The Zacks Consensus Estimate for ESNT’s third-quarter earnings is pegged at $1.75 per share, indicating a 6.1% improvement from the year-ago quarter’s figure.

Essent Group’s earnings beat estimates in two of the trailing four quarters and missed the mark twice, the average surprise being 2.09%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite