|

|

|

|

|||||

|

|

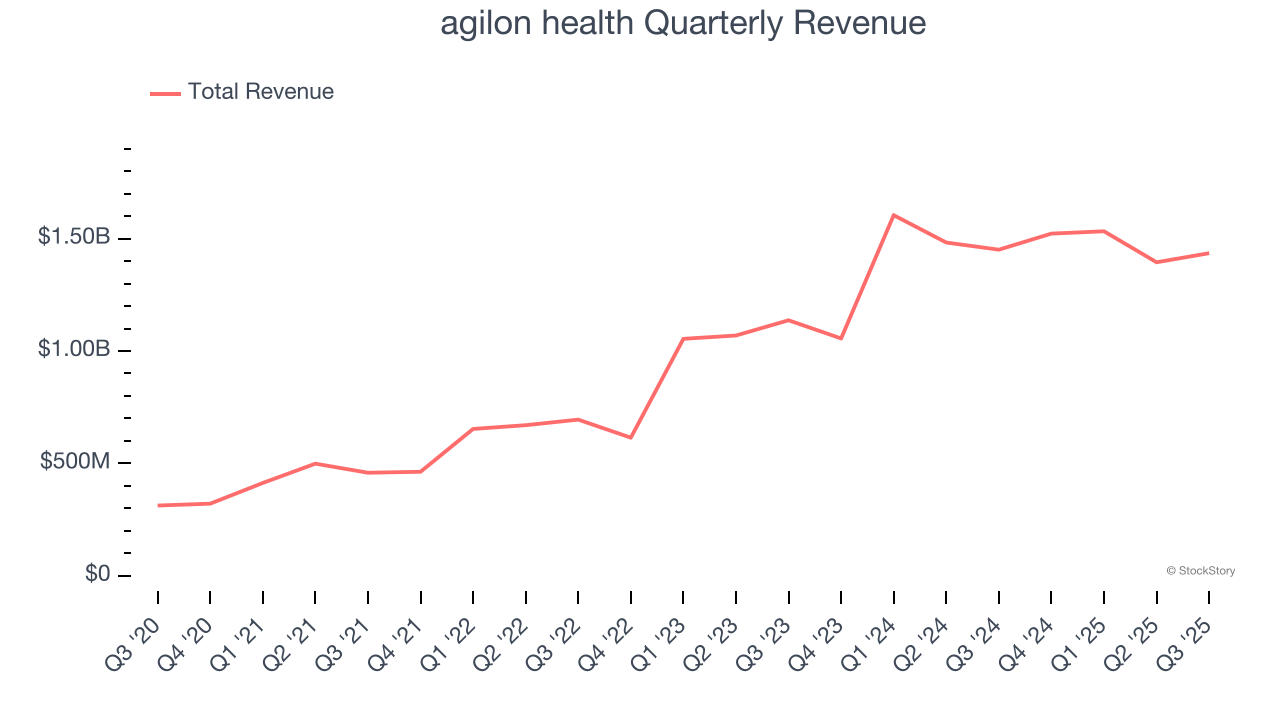

Healthcare services company Agilon Health (NYSE:AGL) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 1.1% year on year to $1.44 billion. The company expects the full year’s revenue to be around $5.82 billion, close to analysts’ estimates. Its GAAP loss of $0.27 per share was 62.4% below analysts’ consensus estimates.

Is now the time to buy agilon health? Find out by accessing our full research report, it’s free for active Edge members.

Transforming how doctors care for seniors by shifting financial incentives from volume to outcomes, agilon health (NYSE:AGL) provides a platform that helps primary care physicians transition to value-based care models for Medicare patients through long-term partnerships and global capitation arrangements.

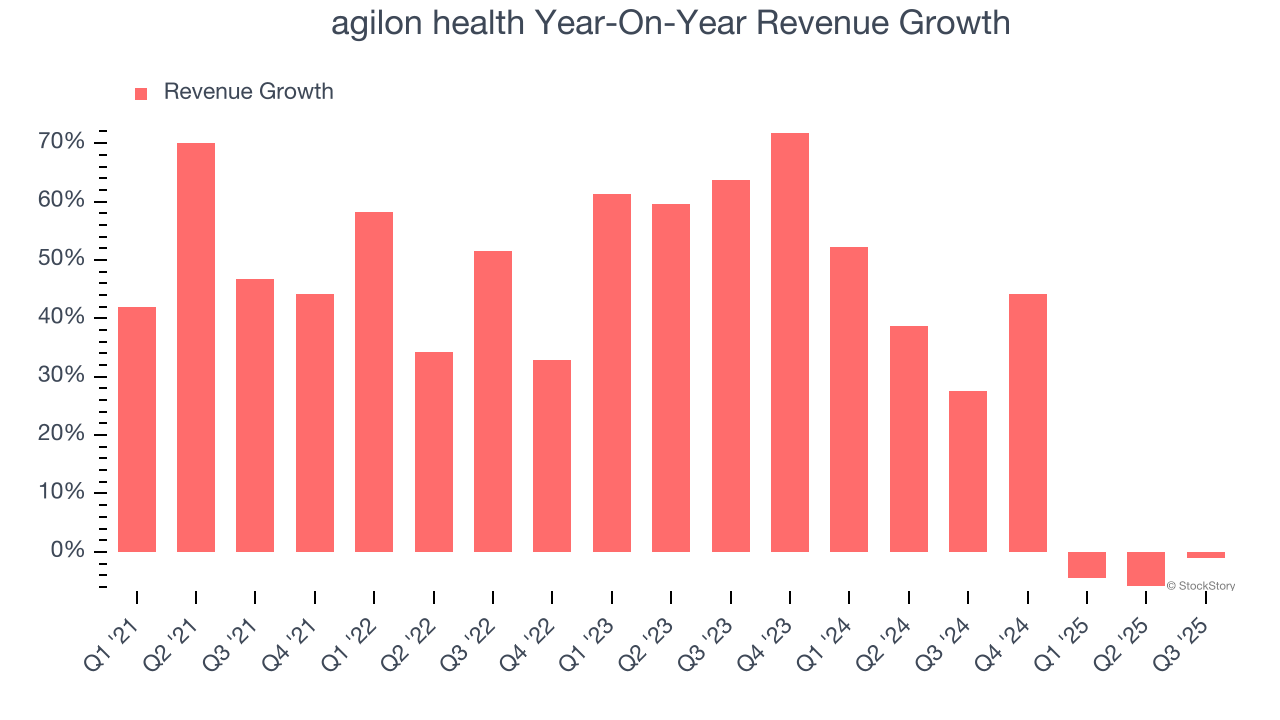

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, agilon health grew its sales at an incredible 37.2% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. agilon health’s annualized revenue growth of 23.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

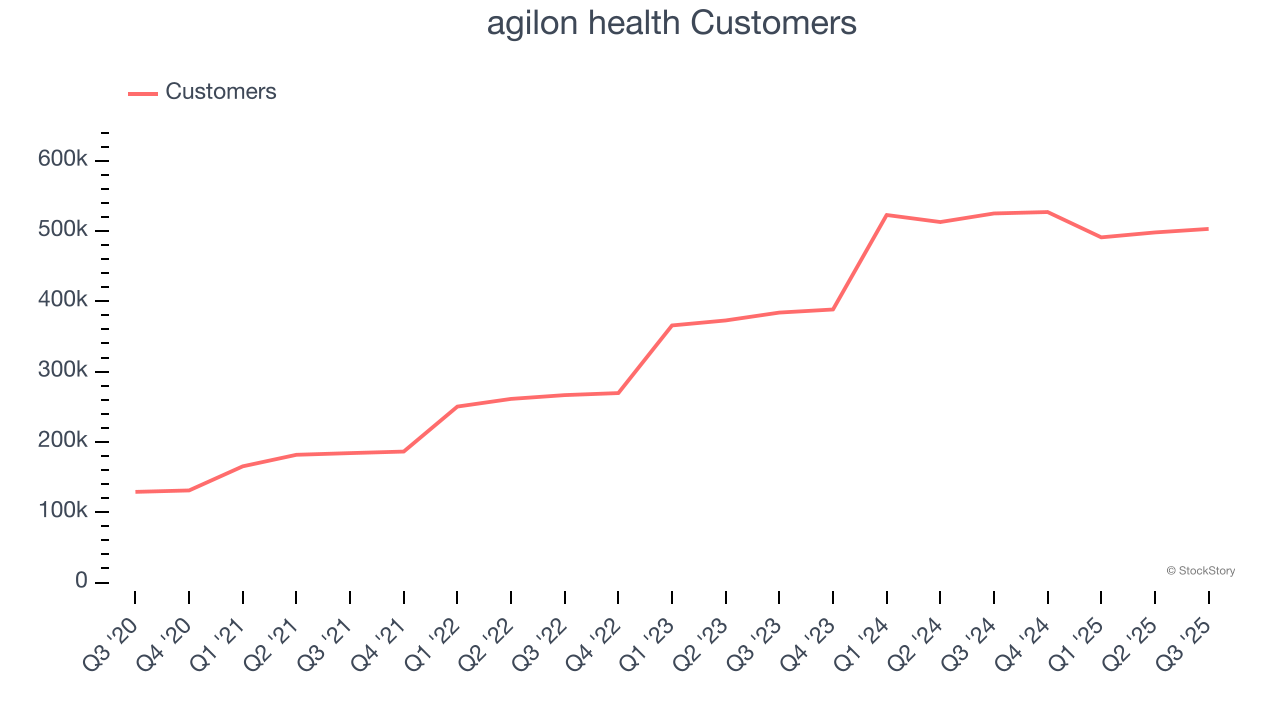

agilon health also reports its number of customers, which reached 503,000 in the latest quarter. Over the last two years, agilon health’s customer base averaged 23% year-on-year growth. Because this number is in line with its revenue growth, we can see the average customer spent roughly the same amount each year on the company’s products and services.

This quarter, agilon health’s revenue fell by 1.1% year on year to $1.44 billion but beat Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

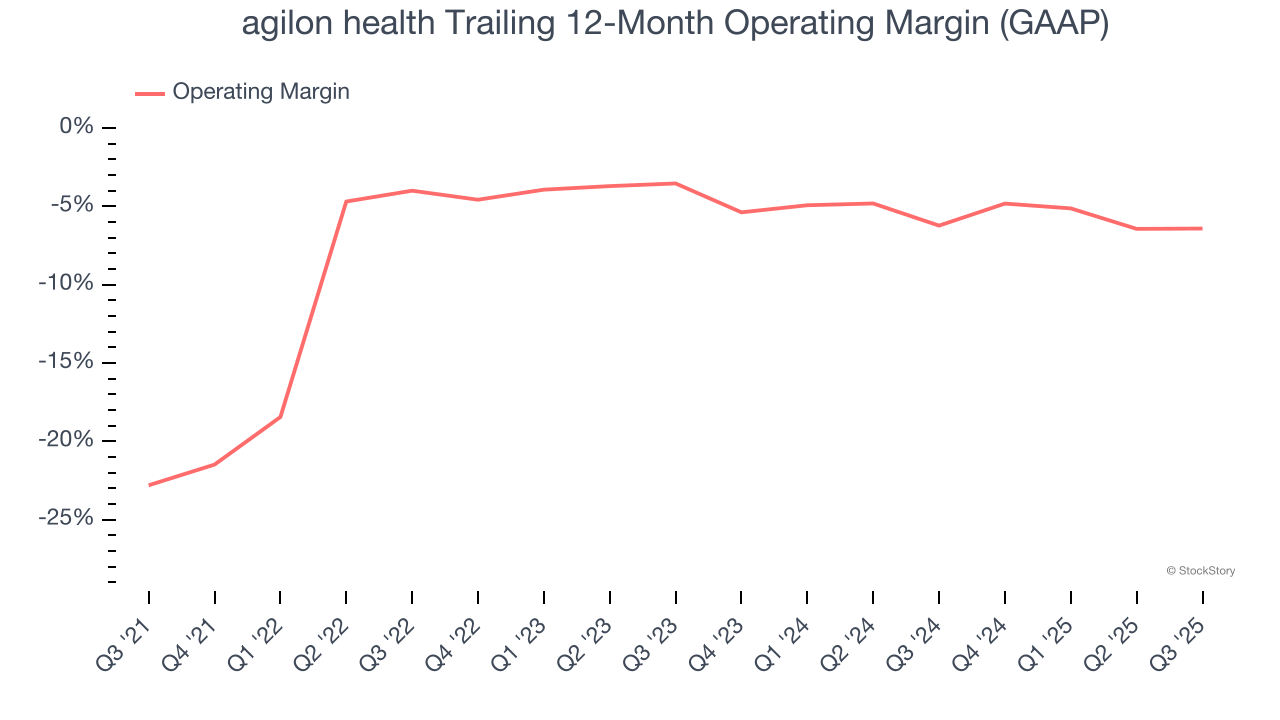

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

agilon health’s high expenses have contributed to an average operating margin of negative 6.9% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, agilon health’s operating margin rose by 16.4 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming into its more recent performance, however, we can see the company’s margin has decreased by 2.9 percentage points on a two-year basis. Given its business quality, we’re optimistic that agilon health can correct course and return to expansion.

In Q3, agilon health generated a negative 9.1% operating margin.

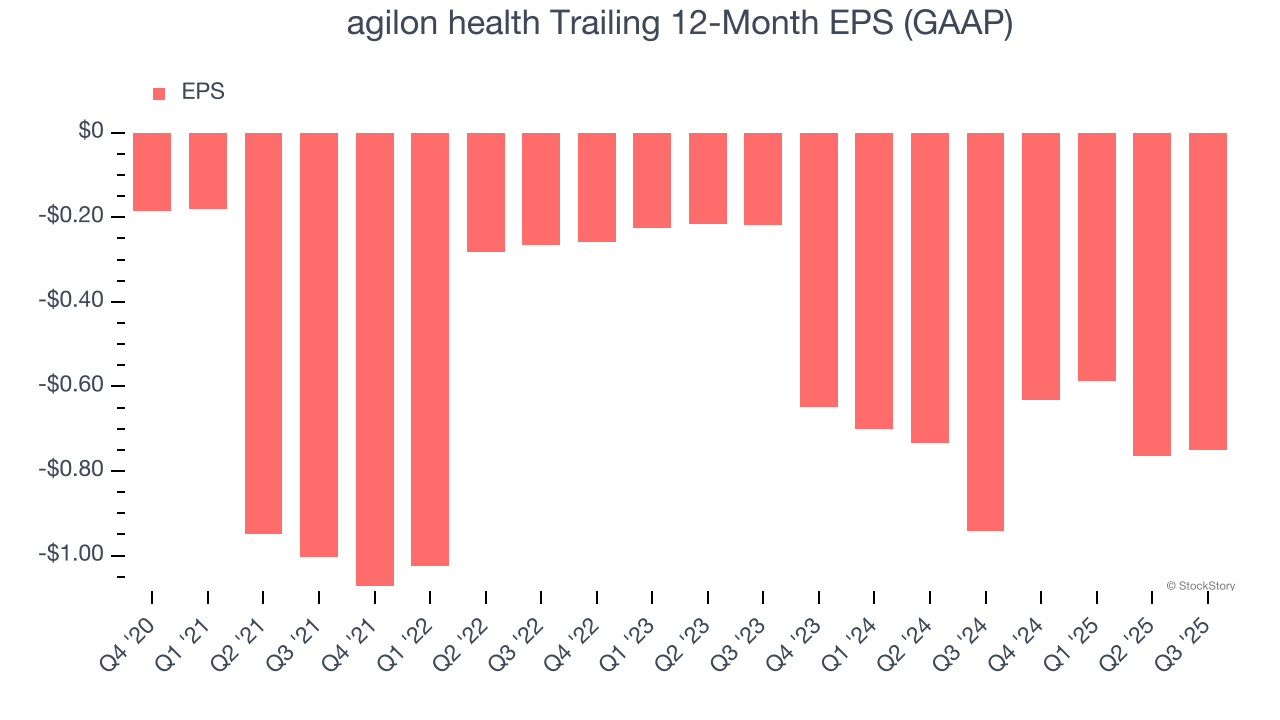

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

agilon health’s earnings losses deepened over the last five years as its EPS dropped 34.7% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

In Q3, agilon health reported EPS of negative $0.27, up from negative $0.29 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects agilon health to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.75 will advance to negative $0.46.

It was good to see agilon health narrowly top analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance was in line with Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock remained flat at $0.72 immediately after reporting.

agilon health may have had a tough quarter, but does that actually create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| 15 hours | |

| Feb-19 | |

| Feb-17 | |

| Feb-10 | |

| Feb-04 | |

| Feb-04 | |

| Jan-28 | |

| Jan-28 | |

| Jan-22 | |

| Jan-22 | |

| Jan-15 | |

| Jan-06 | |

| Jan-05 | |

| Dec-23 | |

| Dec-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite