|

|

|

|

|||||

|

|

Madrigal Pharmaceuticals MDGL reported third-quarter 2025 loss of $5.08 per share, wider than the Zacks Consensus Estimate of a loss of $1.98. In the year-ago quarter, the company had incurred a loss of $4.92 per share.

During the quarter, the company generated total revenues of $287.3 million entirely from product sales of its metabolic dysfunction-associated steatohepatitis (MASH) drug Rezdiffra (resmetirom), which was approved last year. The metric beat the Zacks Consensus Estimate of $249 million. Rezdiffra is the first marketed drug in Madrigal’s portfolio which was launched in April 2024 and posted significant year-over-year growth, driven by increased demand.

MDGL shares gained 7.8% on Tuesday likely because investors were impressed by the strong sales growth.

In March 2024, the FDA granted accelerated approval to Rezdiffra, making it the first and currently the only approved therapy for the MASH indication. The eligible patient population includes adults with noncirrhotic MASH with moderate to advanced liver fibrosis. The drug’s commercial launch is off to a strong start in the country, driven by early patient demand for the drug. Per Madrigal, more than 29,500patients are currently receiving the treatment and more than 10,000 healthcare providers prescribing Rezdiffra, as of Sept. 30, 2025.

During the quarter, research and development expenses more than doubled to $174 million in the third quarter of 2025. The massive increase can be primarily attributed to the upfront expense for CSPC Pharma, partially offset by a reduction in expenses related to clinical studies.

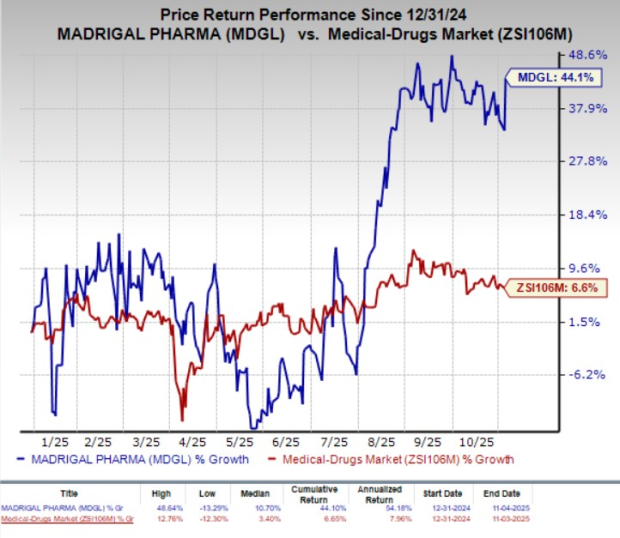

Year to Date, Madrigal shares have gained 44.1% compared with the industry’s 6.6% growth.

Selling, general and administrative expenses also nearly doubled in the reported quarter to $209.1 million. This exponential rise was on account of increased commercial launch activities for Rezdiffra, including significant increases in headcount to support commercialization efforts.

Madrigal had cash, cash equivalents and marketable securities worth $1.1 billion as of Sept. 30, 2025, compared with $802 million as of June 30, 2025. The increase mainly reflects Madrigal’s entry into a new $350 million senior secured term loan with Blue Owl Capital, which partially refinanced its prior loan facility and supported ongoing operational funding.

In August 2025, the European Commission granted a conditional marketing authorization to Rezdiffra for the treatment of adults with noncirrhotic MASH with moderate-to-advanced liver fibrosis. The latest nod made Rezdiffra the first and only therapy to be approved for the treatment of MASH in the EU. Following the approval, Madrigal launched Rezdiffra in Germany in September.

During the third quarter, Madrigal finalized a global licensing deal with CSPC Pharma for MGL-2086, an oral GLP-1 agonist and orforglipron derivative, positioning it to combine the candidate with Rezdiffra in MASH treatment. The move aligns with Madrigal’s strategy to build a differentiated combination therapy pipeline around Rezdiffra, with clinical entry for MGL-2086 expected in the first half of 2026.

As the FDA approved Rezdiffra under the accelerated pathway, the continued approval will be based on promising long-term safety and efficacy data from the pivotal phase III MAESTRO-NASH biopsy study. This late-stage study, which provided the data for the drug's accelerated approval for MASH, is ongoing as an outcomes study. The goal is to generate confirmatory 54-month data that could verify the clinical benefits and support the full approval of the drug for the noncirrhotic MASH indication.

In addition to the study, a second phase III outcomes study (MAESTRO-NASH OUTCOMES) is underway, evaluating the progression to liver decompensation events in patients with compensated MASH cirrhosis treated with Rezdiffra compared with placebo. Top-line data is expected in 2027. A positive outcome from this study is also expected to support the full approval of Rezdiffra for noncirrhotic MASH and expand the eligible patient population for Rezdiffra.

The open-label extension (OLE) arm of the MAESTRO-NAFLD-1 study is also currently evaluating the drug in patients with compensated MASH cirrhosis. In February, Madrigal reported positive two-year data from the OLE arm. The results reinforce Rezdiffra’s potential benefit for patients with compensated MASH cirrhosis and support the potential success of the ongoing MAESTRO-NASH OUTCOMES study. These ongoing studies demonstrate Madrigal's commitment to establishing the drug as the standard-of-care treatment for MASH.

Madrigal Pharmaceuticals, Inc. price-consensus-eps-surprise-chart | Madrigal Pharmaceuticals, Inc. Quote

Madrigal currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are ANI Pharmaceuticals ANIP, Beam Therapeutics BEAM and Amicus Therapeutics FOLD. While FOLD currently sports a Zacks Rank #1 (Strong Buy), ANIP and BEAM carry a Zacks Rank #2 (Buy) each, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Amicus Therapeutics’ earnings per share have remained constant at 31 cents for 2025. During the same time, earnings per share estimates for 2026 have increased from 69 cents to 70 cents. Year to date, shares of FOLD have lost 4.5%.

Amicus Therapeutics’ earnings beat estimates in one of the trailing four quarters, missing the mark thrice, with the average negative surprise being 24.38%.

In the past 60 days, estimates for ANI Pharmaceuticals’ earnings per share have increased from $7.25 to $7.29 for 2025. During the same time, earnings per share estimates for 2026 have increased from $7.74 to $7.81. Year to date, shares of ANIP have surged 71.1%.

ANI Pharmaceuticals' earnings beat estimates in each of the trailing four quarters, the average surprise being 22.66%.

In the past 60 days, estimates for Beam Therapeutics' loss per share have narrowed from $4.36 to $4.23 for 2025. During the same time, loss per share estimates for 2026 have narrowed from $4.41 to $4.21. Year to date, shares of BEAM have lost 8.3%.

Beam Therapeutics’ earnings beat estimates in two of the trailing four quarters while missing the same on the remaining two occasions, the average negative surprise being 2.62%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite