|

|

|

|

|||||

|

|

Continued revenue growth and ongoing progress on the bottom line are likely.

Investors shouldn't put too much faith in analysts' estimates.

Post-earnings volatility may drag shares lower, but this stock's still an attractive long-term purchase.

It's been a tough stretch for DraftKings (NASDAQ: DKNG) shareholders. The stock is down nearly 50% from the 52-week high it reached in February, largely on worries that event-betting platforms like Kalshi and Polymarket are encroaching on DraftKings' sports-wagering turf.

Can the company halt this sell-off and rekindle its previous bullishness? It will get a chance to do so after Thursday's market close when it's slated to release its third-quarter results. Whether or not the market is ready to see things in a bullish light, however, depends on a few key matters.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

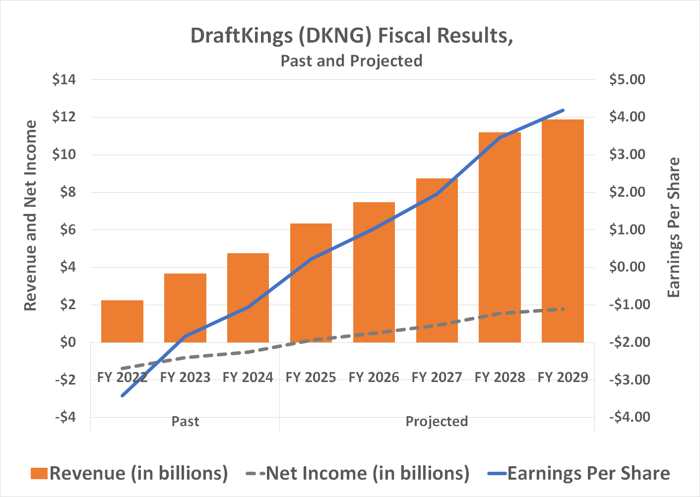

DraftKings' roots are in the fantasy sports business. Since the federal ban on sports wagering was lifted back in 2018, kicking the decision back to individual states, sports betting has become the company's biggest business. It's also building a respectable digital casino operation. All told, DraftKings reported nearly $4.8 billion worth of revenue in 2024, up 30% from the previous year, to extend a long-lived growth trend. Although still suffering net losses then, the company is expected to report a full-year profit for 2025.

Meanwhile, there are a few things from the prior quarter's report that I'd like to see DraftKings address in its third-quarter investor call.

Image source: Getty Images.

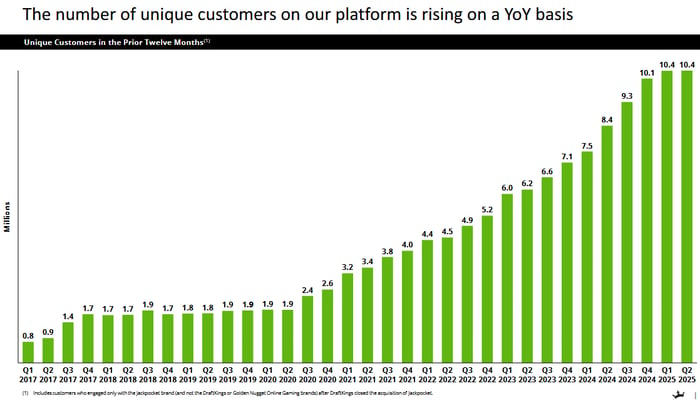

Revenue may have continued growing during the second quarter of this year but not exactly in the way shareholders were hoping. Namely, the number of unique users of DraftKings' online wagering platform were flat going from Q1 to Q2. Sequential user growth also increased only modestly in Q1.

Image source: DraftKings' Q2-2025 earnings call presentation.

One of the second quarter's key topics was the amount of money the company spent, particularly on marketing and promotion. Yet despite the narrative, DraftKings' marketing spending was far from unbridled. The company's quarterly outlay of $233 million on sales and marketing was only up 8% year over year, versus top-line growth of 37%. Management needs to remind investors these investments are well worth it.

In its first-quarter letter to shareholders, the company said, "We've built strong momentum around our companywide focus on leveraging artificial intelligence, embracing an 'AI-first' mindset to unlock greater speed, efficiency, and scale across the business."

DraftKings did not take the opportunity to expand much on these efforts during the Q2 earnings call. Management only mentioned artificial intelligence briefly with no indication of how the technology will drive growth for the company.

While I hope to see management shed more light on the above topics, here's what I expect to see looking ahead at the company's Q3 results and beyond:

Despite the stock's hot-and-cold performance since early 2024, double-digit revenue growth remains the norm for DraftKings with steady progress on the bottom line as well. In fact, analysts expect earnings per share to take off through the rest of this decade.

Data source: Morningstar. Chart by author.

That being said, while impressive top- and bottom-line growth is in the cards for Q3, that doesn't necessarily mean DraftKings is going to beat analysts' estimates for revenue and earnings. Its second-quarter adjusted profit of $0.38 per share, after all, fell short of analysts' expectations for $0.41, marking yet another miss of several seen since late 2023. The company has fallen short of some revenue estimates as well.

I blame the analysts, mostly; they've just misjudged the business. In their defense, however, this fast-growing business is difficult to handicap, and the company is admittedly spending heavily to keep its strong growth going. For what it's worth though, the most recent analyst consensus suggests DraftKings is on pace to turn Q3 revenue of between $1.24 billion and $1.40 billion (up about 11% year over year) into a per-share loss of about $0.27 per share. Don't panic! That's just a seasonal slowdown the business usually sees this time of year.

Finally, although it was announced a couple of weeks ago, DraftKings hasn't said too much about its recent acquisition of event-based betting platform Railbird.

This is an important acquisition. One of the recent drags on the stock is the entry of rivals like Kalshi and Polymarket into the sports-wagering space. Although these platforms have historically focused on matters like election outcomes, entertainment, and pop culture, their foray into the sports-wagering arena poses an obvious threat. With Railbird, DraftKings can push back against this competition, leveraging its know-how and customer base to firm up its position in the industry.

Stepping into any stock right before an earnings report is always risky, especially with a volatile stock like DraftKings. That volatility could work in your favor, but it could also work against you. If you're interested, it may be wise to wait until after its Q3 earnings are released before diving in ... even if that means missing out on a post-earnings bounce.

Either way, I believe DraftKings is a great long-term bet regardless of what Thursday has in store. New entrants like Polymarket and Kalshi are potential threats, neither of them has the sports-oriented brand recognition that DraftKings does. Media companies, professional sports teams, and leagues already have a deep relationship with DraftKings too.

I believe the bearish sentiment surrounding DraftKings this year has nearly run its course. The stock just needs the right catalyst to recover, and this next earnings report could be it.

Before you buy stock in DraftKings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and DraftKings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $589,424!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,217,942!*

Now, it’s worth noting Stock Advisor’s total average return is 1,054% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 3, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

| 38 min | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 |

Stocks to Watch Friday Recap: Applied Materials, Coinbase, DraftKings

DKNG -13.51%

The Wall Street Journal

|

| Feb-13 | |

| Feb-13 |

DraftKings Tanks On Q4 Results; Cathie Wood Unloads More Shares

DKNG -13.51%

Investor's Business Daily

|

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite