|

|

|

|

|||||

|

|

Exercise equipment company Peloton (NASDAQ:PTON) announced better-than-expected revenue in Q3 CY2025, but sales fell by 6% year on year to $550.8 million. Guidance for next quarter’s revenue was optimistic at $675 million at the midpoint, 2.2% above analysts’ estimates. Its GAAP profit of $0.03 per share was $0.03 above analysts’ consensus estimates.

Is now the time to buy Peloton? Find out by accessing our full research report, it’s free for active Edge members.

"In this quarter leading up to the launch of our new equipment lineup and Peloton IQ, our team once again demonstrated the power of disciplined execution and focus," said Peloton CEO Peter Stern.

Started as a Kickstarter campaign, Peloton (NASDAQ: PTON) is a fitness technology company known for its at-home exercise equipment and interactive online workout classes.

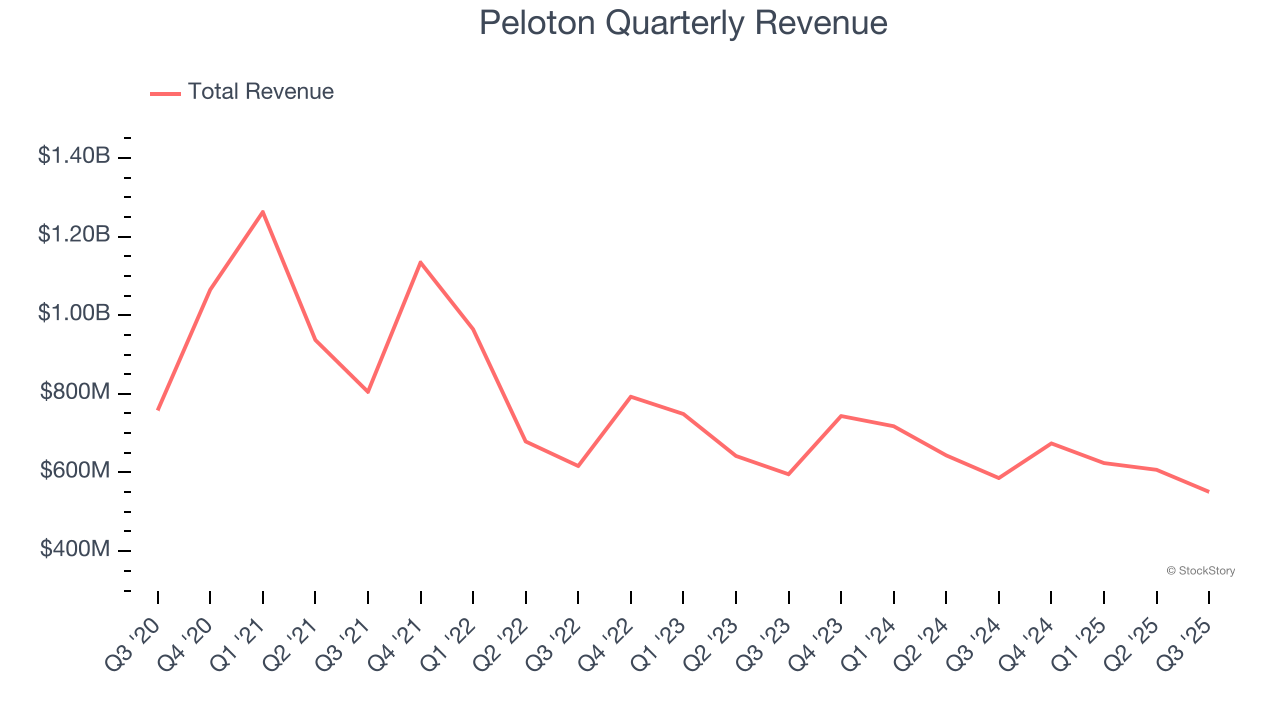

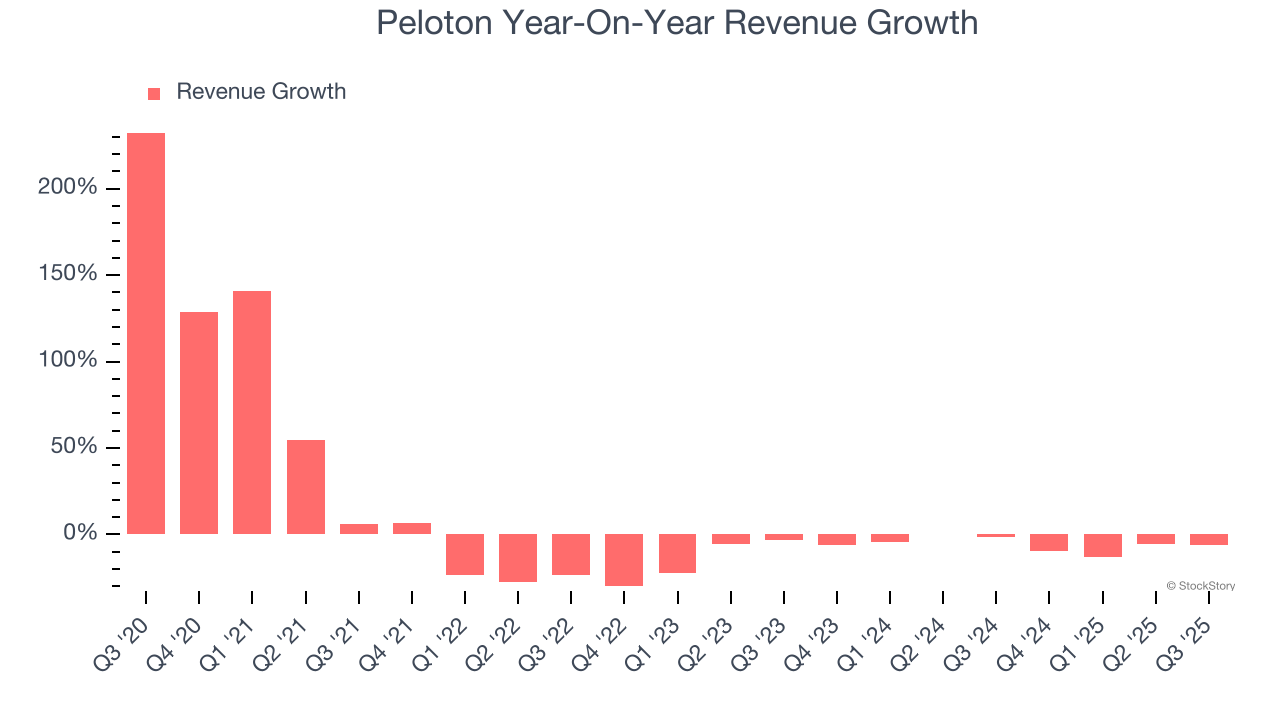

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Peloton struggled to consistently increase demand as its $2.46 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Peloton’s recent performance shows its demand remained suppressed as its revenue has declined by 6% annually over the last two years.

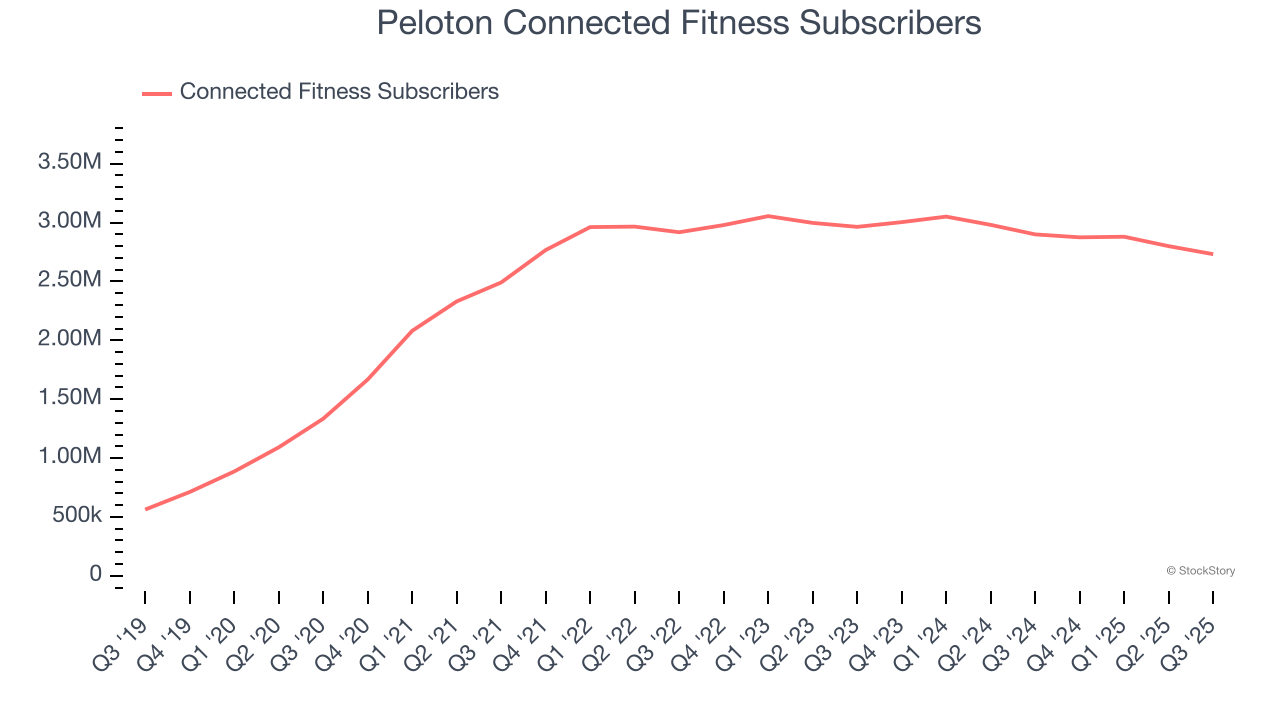

We can better understand the company’s revenue dynamics by analyzing its number of connected fitness subscribers, which reached 2.73 million in the latest quarter. Over the last two years, Peloton’s connected fitness subscribers averaged 3% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Peloton’s revenue fell by 6% year on year to $550.8 million but beat Wall Street’s estimates by 2.1%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Peloton’s operating margin has risen over the last 12 months, but it still averaged negative 7.6% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, Peloton generated an operating margin profit margin of 7.5%, up 5.4 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

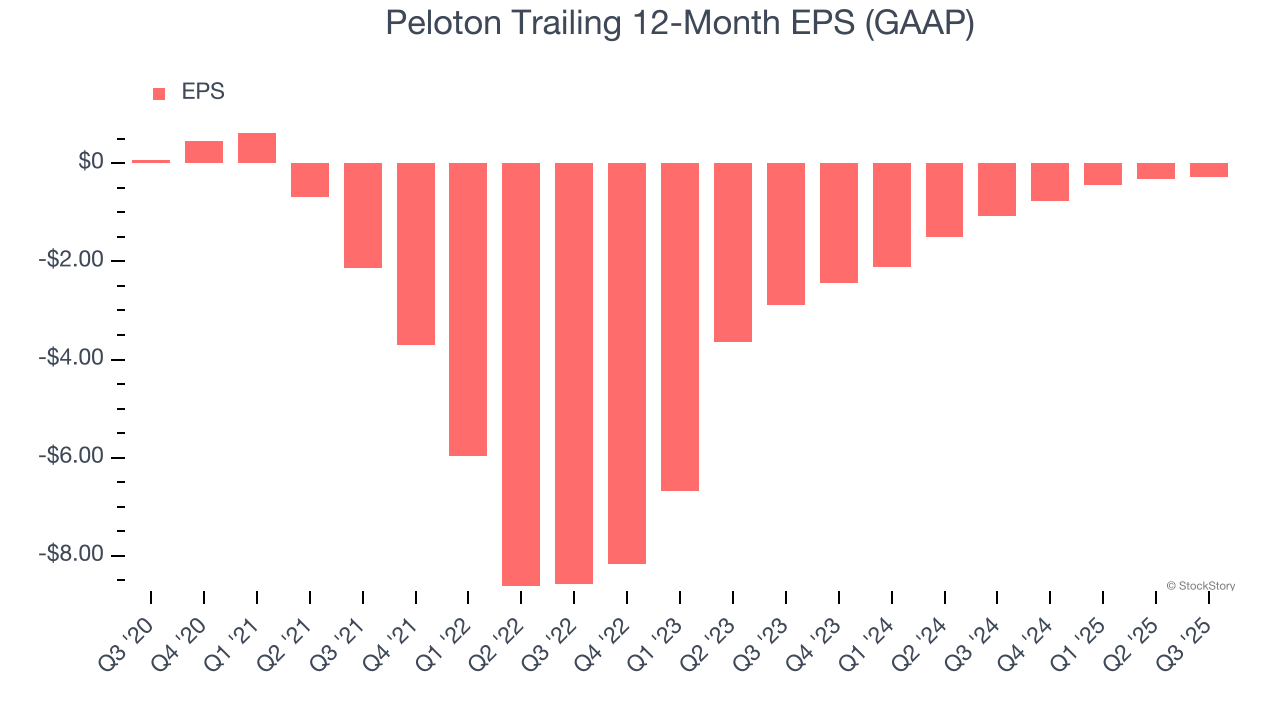

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Peloton, its EPS declined by 42.5% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

In Q3, Peloton reported EPS of $0.03, up from negative $0 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Peloton’s full-year EPS of negative $0.29 will flip to positive $0.17.

It was good to see Peloton beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Overall, this print had some key positives. The stock traded up 5.7% to $7.11 immediately after reporting.

Indeed, Peloton had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| Feb-15 | |

| Feb-12 | |

| Feb-09 | |

| Feb-08 | |

| Feb-08 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 |

Peloton CFO Coddington Leaving for Solar-Energy Company Palmetto

PTON -25.72%

The Wall Street Journal

|

| Feb-05 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite