|

|

|

|

|||||

|

|

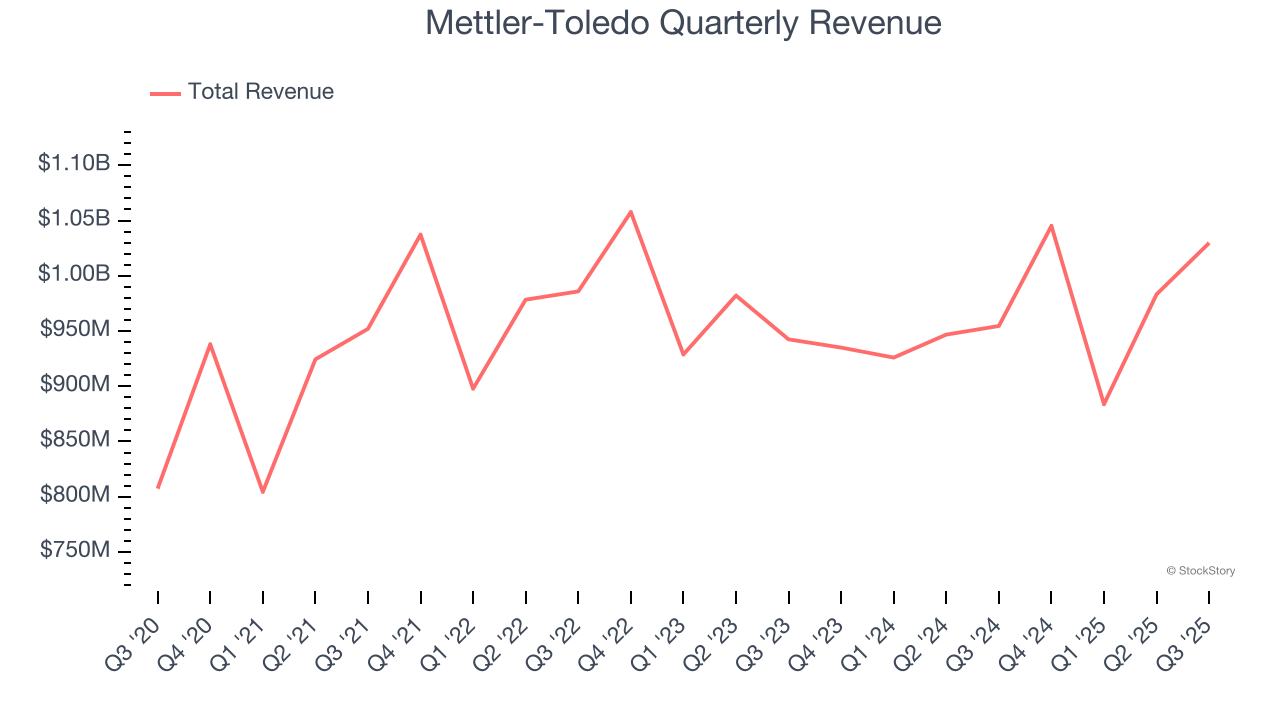

Precision measurement company Mettler-Toledo (NYSE:MTD) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 7.9% year on year to $1.03 billion. On the other hand, next quarter’s revenue guidance of $1.08 billion was less impressive, coming in 2.4% below analysts’ estimates. Its non-GAAP profit of $11.15 per share was 4.5% above analysts’ consensus estimates.

Is now the time to buy Mettler-Toledo? Find out by accessing our full research report, it’s free for active Edge members.

Patrick Kaltenbach, President and Chief Executive Officer, stated, “Our third quarter results were strong and reflected very good growth, especially in Industrial. I am very pleased with our team’s strong execution as we leverage our Spinnaker sales and marketing program and innovative product portfolio to drive growth while delivering solid EPS.”

With roots dating back to the precision balance innovations of Swiss engineer Erhard Mettler, Mettler-Toledo (NYSE:MTD) manufactures precision weighing instruments, analytical equipment, and product inspection systems used in laboratories, industrial settings, and food retail.

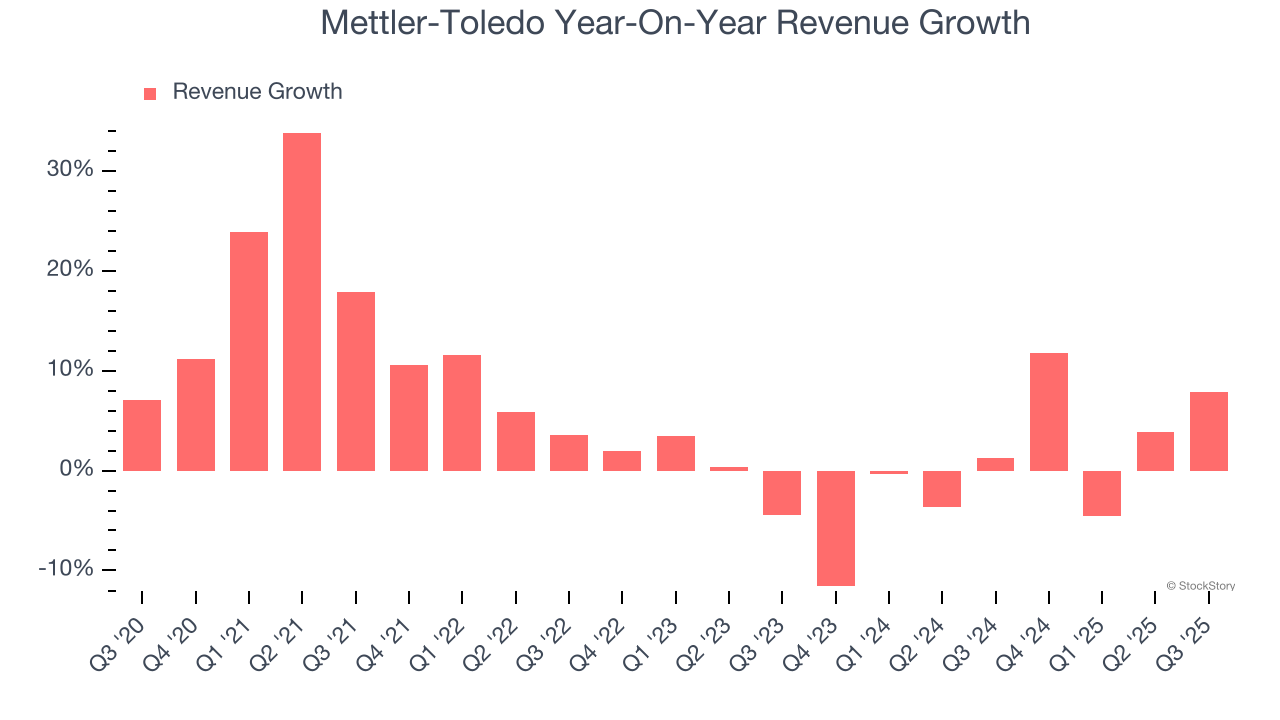

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Mettler-Toledo’s 5.7% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the healthcare sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Mettler-Toledo’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

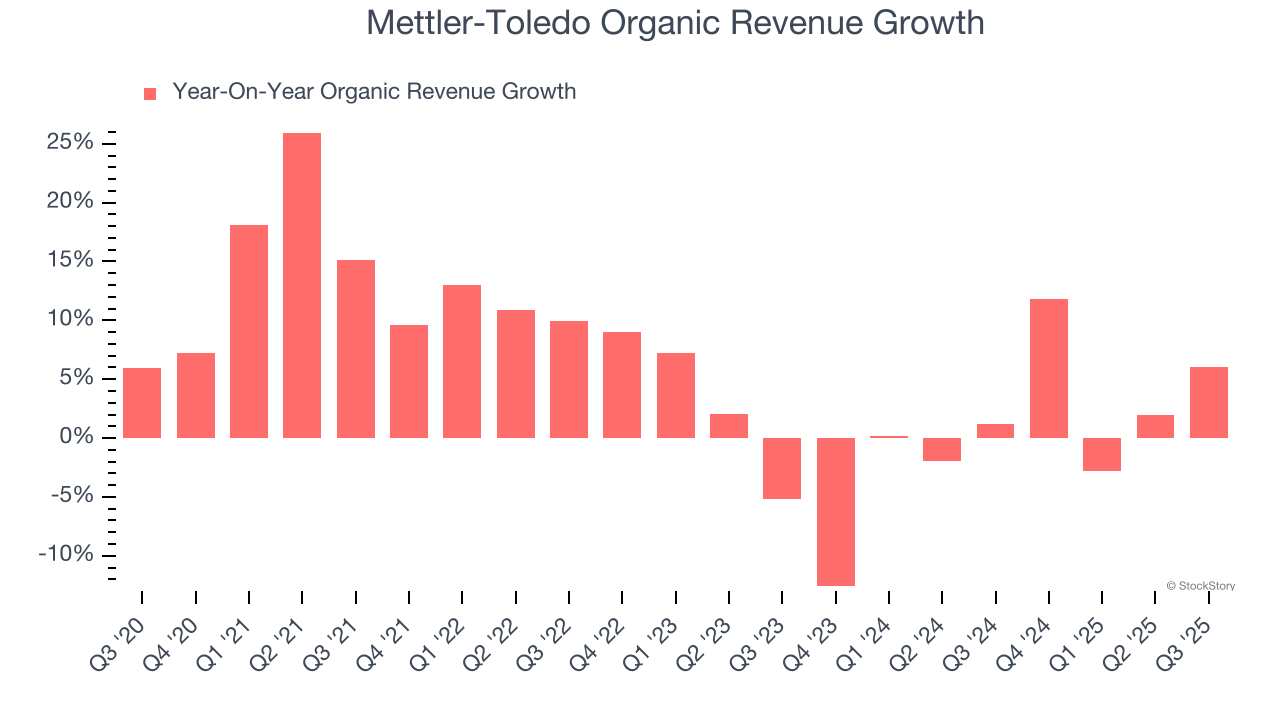

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Mettler-Toledo’s organic revenue was flat. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Mettler-Toledo reported year-on-year revenue growth of 7.9%, and its $1.03 billion of revenue exceeded Wall Street’s estimates by 3.2%. Company management is currently guiding for a 3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

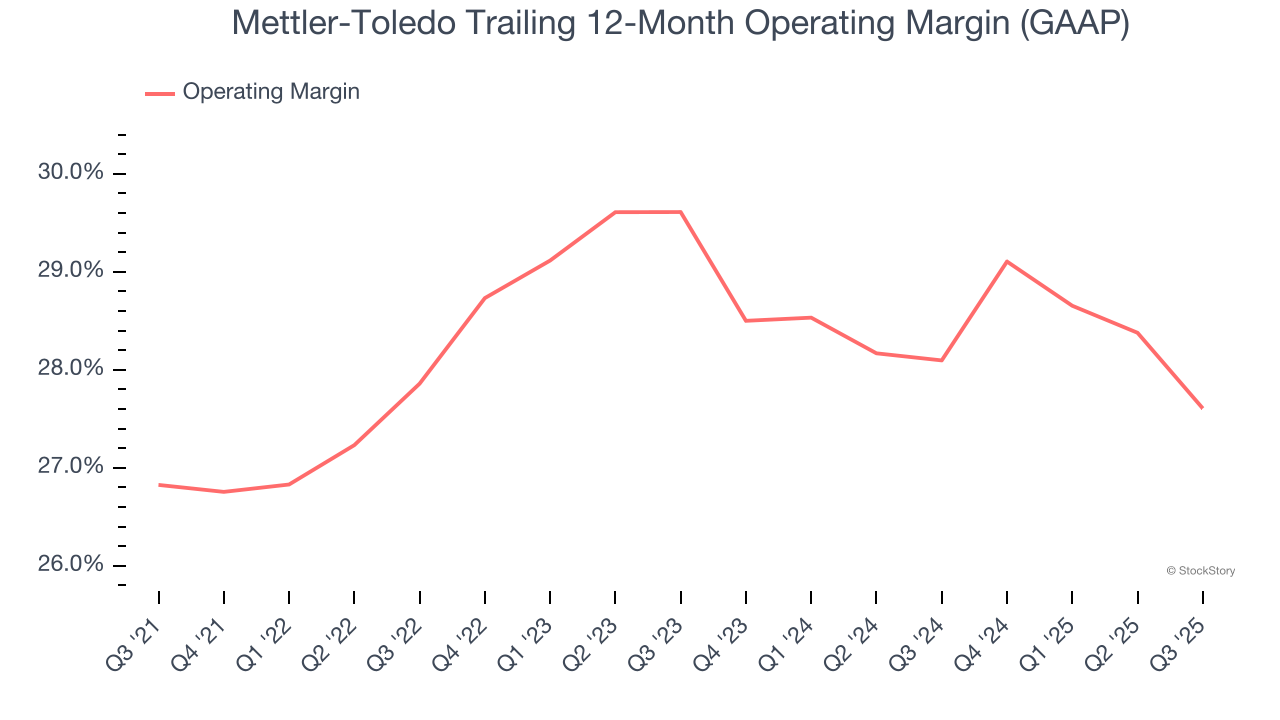

Mettler-Toledo’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 28% over the last five years. This profitability was top-notch for a healthcare business, showing it’s an well-run company with an efficient cost structure.

Analyzing the trend in its profitability, Mettler-Toledo’s operating margin of 27.6% for the trailing 12 months may be around the same as five years ago, but it has decreased by 2 percentage points over the last two years. This dynamic unfolded because it struggled to adjust its fixed costs while its demand plateaued.

This quarter, Mettler-Toledo generated an operating margin profit margin of 26.1%, down 3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

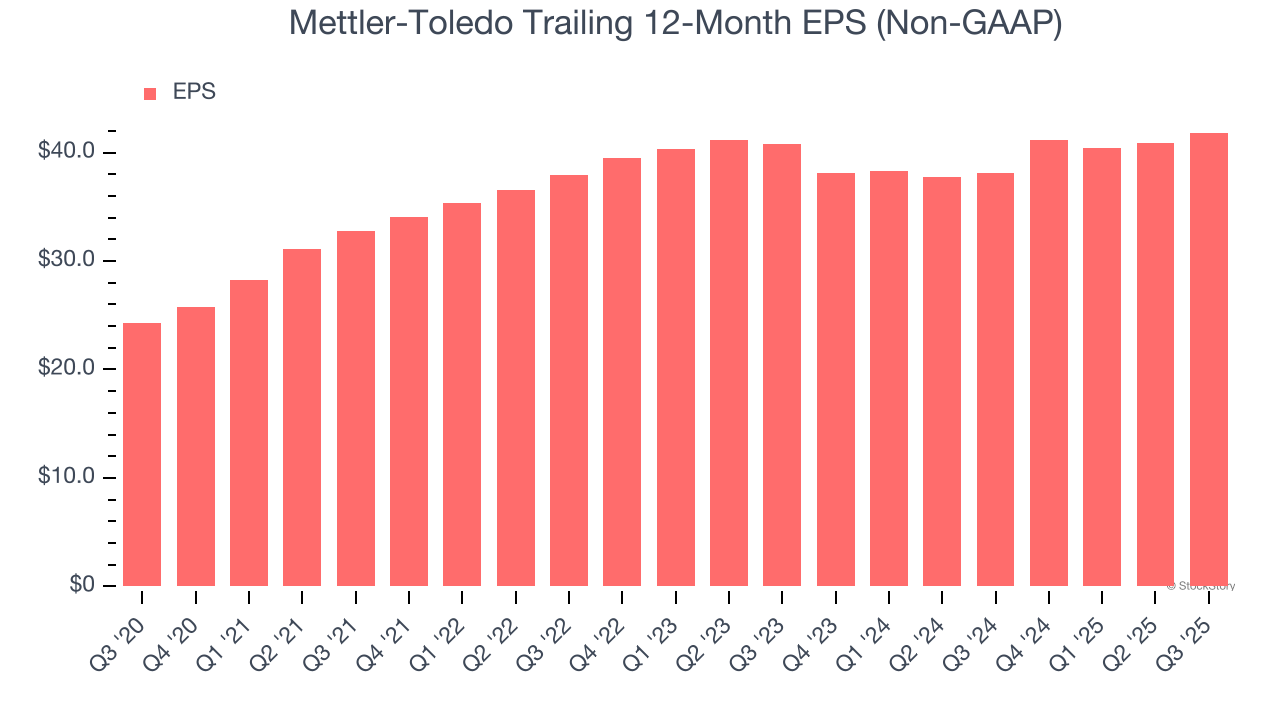

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

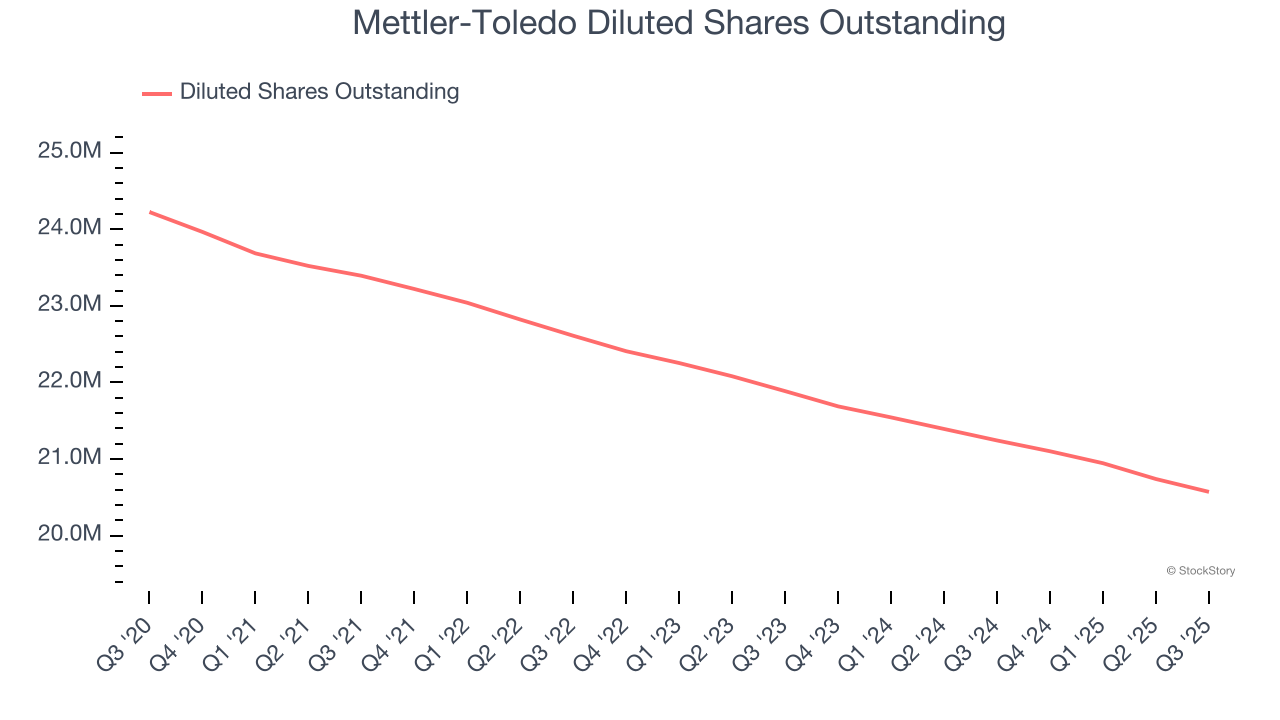

Mettler-Toledo’s EPS grew at a remarkable 11.5% compounded annual growth rate over the last five years, higher than its 5.7% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Diving into Mettler-Toledo’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Mettler-Toledo has repurchased its stock, shrinking its share count by 15.1%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Mettler-Toledo reported adjusted EPS of $11.15, up from $10.21 in the same quarter last year. This print beat analysts’ estimates by 4.5%. Over the next 12 months, Wall Street expects Mettler-Toledo’s full-year EPS of $41.84 to grow 7.8%.

We enjoyed seeing Mettler-Toledo beat analysts’ organic revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed and its EPS guidance for next quarter fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $1,440 immediately following the results.

Is Mettler-Toledo an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

| Feb-12 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-04 | |

| Feb-03 | |

| Feb-02 | |

| Jan-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite