|

|

|

|

|||||

|

|

Astera Labs ALAB, a leading provider of semiconductor-based connectivity solutions powering rack-scale AI infrastructure, reported its third-quarter 2025 results on Nov. 4.

The company’s quarterly results surpassed the Zacks Consensus Estimate for both the top and bottom lines. Strong demand across its signal conditioning, smart cable module and switch fabric portfolios, driven by the production ramp of new AI platforms, contributed significantly to the solid quarterly performance.

Let’s look at how Astera Labs performed in the latest quarter, and does its strong momentum make the stock a buy right now?

Astera Labs delivered strong financial results in the third quarter of 2025, underscoring its accelerating growth trajectory and strong execution across key product lines. Revenues surged 104% year over year and 20% sequentially to reach a record $230.6 million, led by new AI platform ramps featuring multiple product families. Non-GAAP earnings per share climbed 113% year over year to 49 cents, reflecting strong operational efficiency and scaling profitability.

Astera Labs also posted impressive margin performance, benefiting from operating leverage and an improved product mix. The non-GAAP operating margin expanded to 41.7%, up from 32.4% in the prior-year quarter, while the non-GAAP gross margin held strong at 76.4%. These metrics underscore the company’s growing efficiency and the profitability potential of its diversified connectivity platform spanning the Aries, Taurus and Scorpio product families.

Astera Labs anticipates continued momentum into the fourth quarter of 2025, projecting revenues between $245 million and $253 million, representing sequential growth of 6%-10%. Non-GAAP earnings are forecast at approximately 51 cents per share.

The Zacks Consensus Estimate reflects this optimism, projecting fourth-quarter earnings to rise 21.62% year over year to 45 cents per share, and revenues to increase 76.9% to $249.6 million.

Astera Labs is gaining strong momentum, driven by the rapid expansion and diversification of its product portfolio, which aligns with the accelerating global demand for AI and data-center connectivity.

The ramp-up of the Scorpio product line marks a key milestone in Astera’s evolution from component provider to full-scale connectivity platform leader. The Scorpio P Series has entered volume production with a top hyperscaler, while the Scorpio X Series, supporting next-generation UALink standards, is expected to ramp up in 2026. With UALink adoption accelerating, this initiative opens a multibillion-dollar market opportunity for Astera Labs by 2029.

Meanwhile, the Aries family of PCIe 6 smart retimers continues to achieve strong adoption, reinforcing Astera’s leadership in high-speed, low-latency signal conditioning. Alongside, the Taurus Smart Cable Module portfolio is evolving from 400 GB to 800 GB capacity, addressing the surging data throughput requirements of hyperscale data centers.

Adding to this momentum, the company’s planned acquisition of aiXscale Photonics GmbH introduces advanced optical interconnect technology, paving the way for future AI rack-scale designs. Together, these innovations underscore Astera Labs’ strong execution and multi-year growth potential driven by a robust product portfolio.

Astera Labs continues to strengthen its position in the AI infrastructure ecosystem through a rapidly expanding network of strategic partnerships. The company recently announced a broad range of collaborations spanning GPU, CPU, cables, connectors, ODMs, IP design, verification and software management providers — all aimed at accelerating the deployment of AI Infrastructure 2.0 built on open standards. Key partners include industry leaders such as Advanced Micro Devices, Amphenol, Arm, ASPEED, Cadence Design Systems, Eoptolink, Ingrasys, Insyde Software, Molex, Quanta Computer, Synopsys and TE Connectivity — collectively driving innovation in rack-scale connectivity.

These partnerships will expand on existing collaborations with major players such as NVIDIA, Micron Technology and Alchip Technologies. Through these alliances, Astera Labs is solidifying its role as a key enabler of next-generation AI infrastructure. Its growing partner base not only accelerates product adoption but also positions the company for sustained long-term growth.

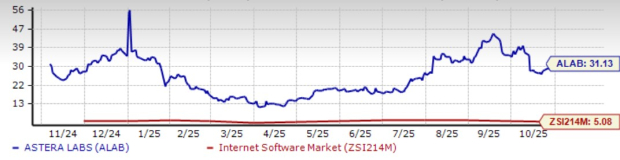

Astera Labs shares have soared 130.7% over the past six months, outperforming the broader Zacks Computer & Technology sector’s rise of 40.2% and the Zacks Internet - Software industry’s return of 12%.

ALAB stock has outperformed its industry peers, including Datadog DDOG, JFrog FROG and Atlassian TEAM. Over the same period, shares of Datadog and JFrog have surged 80% and 71.1%, respectively, whereas Atlassian has declined 24.1%.

Conversely, Astera Labs’ stock is trading at a premium, as suggested by the Value Score of F.

In terms of the forward 12-month Price/Sales, ALAB is trading at 31.13X, higher than the industry’s 5.08X. The stock is also trading at a higher price compared with its industry peers, Datadog, JFrog and Atlassian, which have forward P/S multiples of 17.34X, 9.54X and 6.37X, respectively.

The stock’s premium valuation is justified by Astera Labs’ strong revenue visibility, expanding margins and robust multi-year growth prospects within the rapidly growing AI connectivity space. Investors may consider accumulating ALAB shares despite the elevated valuation, as its consistent execution and expanding market opportunity warrant a higher multiple relative to peers.

Astera Labs’ strong fundamentals, expanding partnerships and rising AI demand reinforce its leadership in connectivity solutions. With solid growth momentum and profitability gains, the company appears well-positioned for long-term accumulation.

Currently, ALAB carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite