|

|

|

|

|||||

|

|

Figma FIG and Atlassian TEAM are major players in the collaboration software for digital product development. While Figma operates in the design collaboration space, supporting UI/UX design, prototyping, and real-time creative workflows, Atlassian focuses on project management, software development coordination, and team productivity through its collaboration tools, such as Jira and Confluence.

Per the Grand View Research report, the global enterprise collaboration market size was valued at $54.67 billion in 2024. It is expected to reach $107.03 billion by 2030, expanding at a CAGR of 12.1% from 2025 to 2030. Both Figma and Atlassian are expected to benefit from this rapid growth pace.

FIG or TEAM, which of these collaboration stocks has the greater upside potential? Let’s find out.

Figma is integrating AI into its workflows to enhance collaboration. The launch of Figma Make, an AI-powered tool that allows users to create prototypes and web apps using text prompts, has been noteworthy. Approximately 30% of customers spending $100,000 or more in annual recurring revenues (ARR) were using Figma Make weekly by the end of September.

Figma’s robust portfolio and an expanding clientele have been noteworthy. As of Sept. 30, 2025, the company had 12,910 paid customers with more than $10,000 in annual recurring revenues and 1,262 paid customers with more than $100,000 in ARR.

In the third quarter of 2025, Figma’s net dollar retention for paid customers with more than $10,000 in ARR increased to 131%, up 2 percentage points sequentially. This growth was driven by faster customer adoption of new products and platform features.

Expanding portfolio has been noteworthy. In the third quarter of 2025, Figma announced its partnership with OpenAI to launch the Figma App for ChatGPT. This app allows users to convert conversations into FigJam diagrams, flow charts, and Gantt charts. These can be shared and edited directly in Figma.

Atlassian’s focus on adding generative AI features to some of its collaboration software is likely to drive the top line. Atlassian has collaborated with OpenAI to enhance the capabilities of its Confluence, Jira Service Management, and other programs with generative AI features.

Atlassian is making significant strides in the enterprise segment by signing more than $1 million deals. At the end of the first quarter of fiscal 2026, the company had more than 500 customers spending more than $1 million annually, indicating strong enterprise penetration. Fortune 500 companies, leading banks and global technology firms are increasingly adopting Atlassian’s cloud platform and collaboration tools.

In August 2025, Atlassian announced a multi-year partnership with Google Cloud. The company’s collaboration with Google Cloud aims to bring its AI-powered teamwork platform, including Jira, Confluence, and Loom, onto Google’s AI-optimized infrastructure. This will allow for deeper Gemini integrations and smoother collaboration across platforms.

In the first quarter of fiscal 2026, Atlassian has integrated AI deeply into its platform, enabling more than 3.5 million monthly active users to leverage AI-powered tools for collaboration. This usage has grown by more than 50% since the last quarter, demonstrating strong adoption.

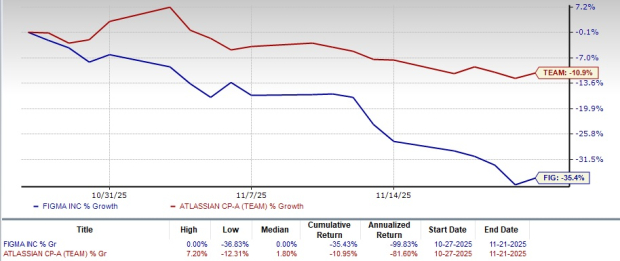

In the past month, FIG shares have plunged 35.4%, underperforming TEAM shares, which have lost 10.9%. The outperformance of Atlassian can be attributed to the rising demand for remote working tools amid the hybrid work trend and accelerated digital transformation.

The underperformance of Figma can be attributed to the company’s investments in AI-powered products like Figma Make, which led to higher costs to serve these products, which impacted gross margin.

FIG and TEAM shares are currently overvalued, as suggested by a Value Score of F.

In terms of forward 12-month Price/Sales, FIG shares are trading at 11.33X, higher than TEAM’s 5.71X.

The Zacks Consensus Estimate for FIG’s 2025 earnings is pegged at 41 cents per share, which has increased 26.8% over the past 30 days. This indicates a 110.96% increase year over year.

Figma, Inc. price-consensus-chart | Figma, Inc. Quote

The Zacks Consensus Estimate for TEAM’s fiscal 2026 earnings is pegged at $4.70 per share, which has increased 12.9% over the past 30 days. This indicates a 27.72% increase year over year.

Atlassian Corporation PLC price-consensus-chart | Atlassian Corporation PLC Quote

While both Figma and Atlassian stand to benefit from rising demand in the collaboration market, Atlassian appears to have the greater upside potential at present with deeper enterprise penetration and stronger AI adoption.

Despite an innovative portfolio and increased customer engagement, Figma’s modest growth prospects make the stock risky for investors. The company’s investments in AI-powered products are also expected to hurt margin expansion in the near term.

Currently, Atlassian has a Zacks Rank #2 (Buy), making the stock a stronger pick than Figma, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 13 hours | |

| 15 hours | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite