|

|

|

|

|||||

|

|

BigBear.ai Holdings, Inc. BBAI stock has lost 13.2% over the past month, underperforming the Zacks Computers - IT Services industry’s 5.3% dip and the Zacks Computer & Technology sector’s decrease of 4.2%.

This small-cap company has delivered an impressive run over the past year, surging 62.3%, against the industry’s 4.1% decline. BBAI represents a pure-play on AI with its core competency in delivering decision intelligence solutions. However, the stock market's rocky start to 2025 has introduced uncertainty following a stellar 2024, marked by record highs. Moreover, BigBear.ai’s wider-than-expected net loss of $108 million in the fourth quarter of 2024, along with a disappointing 2025 outlook, has weighed on investors’ sentiment.

With BBAI stock down sharply from its recent highs amid the broader stock market sell-off, let's discuss whether investors should buy this AI stock right now.

The company’s bottom line in the fourth quarter was heavily impacted by non-cash charges—specifically, a $93.3 million hit from changes in derivative liabilities tied to the new 2029 convertible notes—resulting in a net loss of $108 million for the quarter. This is despite the company reporting revenues of $43.8 million in the quarter, reflecting an 8% year-over-year increase compared to the same quarter in 2023.

Operating expenses, particularly SG&A (selling, general, and administrative expenses), rose sharply. SG&A increased to $22.2 million in the quarter from $18.2 million the year before, with recurring SG&A seeing a particularly sharp rise—due in part to the inclusion of Pangiam's operations and staff post-acquisition. These growing costs eroded operational efficiency and resulted in a drop in adjusted EBITDA to $2 million in the fourth quarter of 2024 from $3.7 million reported a year ago.

This trend is expected to continue into 2025, with the company forecasting negative single-digit millions in adjusted EBITDA, reflecting the pressures of integrating acquisitions and scaling operations.

BigBear.ai faces significant headwinds, particularly in its core government markets. The company operates in sectors such as border security, defense, intelligence, and critical infrastructure—areas closely tied to federal budgets and procurement cycles. The current environment of fiscal caution, compounded by a continuing resolution in Congress, has resulted in delays and uncertainty around government contract funding. This creates a ripple effect not only for BigBear.ai but across all federal suppliers.

Despite ongoing challenges, the company appears to be laying the foundation for sustainable, long-term growth through focused execution and strategic financial plans. Despite its financial losses, BigBear.ai’s strategic indicators point to a company gaining traction. Its backlog has surged to $418 million as of year-end 2024 from $168 million the prior year—providing a strong base of future contracted revenues. The integration of Pangiam, a key acquisition, is expected to enhance BigBear.ai’s offerings in identity analytics and security, further embedding it within high-priority areas of national interest.

Additionally, the technology portfolio is maturing, and the company has been securing more substantial, long-term contracts. In March, the U.S. Department of Defense awarded BBAI a 3.5-year, $13.2 million sole source contract to support the chairman of the Joint Chiefs of Staff’s Directorate for Force Management. These advancements suggest that BigBear.ai is transitioning from early-stage volatility toward a more stable growth trajectory, particularly as it continues to align its solutions with mission-critical applications in AI-powered decision intelligence.

BigBear.ai is gaining traction through strategic collaborations with top-tier tech companies, underscoring the strength of its AI-driven solutions. Industry giants such as Amazon AMZN, Palantir PLTR, and Autodesk ADSK have integrated BigBear.ai’s technologies into their platforms. Amazon Web Services (AWS) incorporated BBAI’s ProModel solution into AWS ProServe to enhance its AI-powered logistics and warehousing capabilities, streamlining operations with predictive modeling and real-time insights.

Palantir, known for its advanced data analytics platforms, has partnered with BigBear.ai to bolster its AI capabilities in defense and intelligence applications, further validating BBAI’s role in mission-critical environments. Meanwhile, Autodesk has adopted BigBear.ai’s solutions to enhance its design and engineering platforms, demonstrating strong use cases in industrial automation and simulation.

These high-profile partnerships reflect BigBear.ai’s rising influence and the increasing demand for its technology across both government and commercial sectors.

In terms of the forward 12-month price/sales (P/S), BBAI is trading at 4.74X, higher than its median of 2.1X but lower than the Zacks Computer and Technology sector’s 5.45XX. BBAI currently has a Value Score of F.

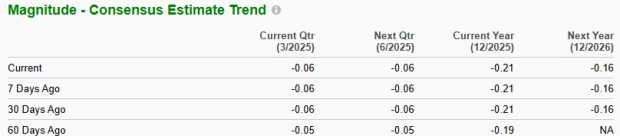

The Zacks Consensus mark for 2025 loss per share is pegged at 21 cents, which has widened by a couple of pennies in the past 60 days.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

While BigBear.ai has made notable strides in expanding its backlog and forming strategic partnerships with industry leaders like Amazon, Palantir, and Autodesk, the near-term outlook presents significant concerns for investors.

The company’s widening losses—driven by substantial non-cash charges and ballooning operating expenses—highlight persistent financial instability. The disappointing 2025 guidance, negative adjusted EBITDA expectations, and increasing reliance on uncertain government contracts amid a tough federal budget environment only add to the risk profile. Furthermore, despite the stock’s steep decline, BBAI’s valuation remains stretched relative to its historical median. In short, BBAI’s potential long-term promise is overshadowed by too many short-term red flags—making it a sell right now. BBAI stock currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 min | |

| 29 min | |

| 43 min | |

| 1 hour | |

| 1 hour |

US filings for jobless aid rise modestly to 212,000 as layoffs remain at historically healthy levels

AMZN

Associated Press Finance

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite