|

|

|

|

|||||

|

|

Dutch Bros Inc. BROS reported record-setting third-quarter 2025 results, highlighted by all-time-high average unit volumes (AUVs) and continued strength in customer traffic. The results underscored solid consumer demand for the company’s beverage offerings and reaffirmed the scalability of its distinctive drive-thru model across both new and established markets.

During the quarter, the company reported revenues of $423.6 million, increasing 25.2% year over year, topping estimates, while adjusted earnings per share came in at 19 cents. BROS also recorded system same-shop sales growth of 5.7%, marking its fifth consecutive quarter of transaction gains. For more details, read: Dutch Bros Q3 Earnings & Revenues Beat, Both Rise Y/Y, Stock Up.

Management highlighted that improved labor deployment, advanced shop analytics and enhanced leadership training are translating into faster service, stronger throughput and greater operational consistency across markets. With more than 475 operators in the pipeline and a growing focus on self-funded expansion, Dutch Bros is building a foundation for sustainable, long-term growth.

As of Friday, Dutch Bros stock is trading 38.5% below its 52-week high of $86.88 (attained on Feb. 18, 2025). So, should investors pour more capital into BROS now? Let us take a closer look.

Dutch Bros is setting the stage for continued growth, driven by several strategic initiatives that unlock long-term value. A key growth driver is its record-high AUVs, a clear indicator of strong shop productivity and customer engagement. The company’s focus on transaction-driving initiatives, including the Order Ahead and Dutch Rewards program, has allowed it to maintain robust same-shop sales and transaction growth. Dutch Rewards, which now accounts for 72% of transactions, is a significant driver of repeat business and higher customer retention.

Additionally, the company’s innovative food program has become an important growth catalyst. Now in 160 shops, the program has generated a 4% same-shop sales lift, with about a quarter of that growth stemming from increased transactions. The food initiative is strategically expanding to capture a larger share of the morning daypart, complementing Dutch Bros' beverage-first model and driving AUV growth.

Dutch Bros' digital strategy is another critical growth factor. Order Ahead continues to grow in prominence, making up 13% of transactions, particularly in new markets where the program’s adoption is faster. Integrated with Dutch Rewards, this digital push allows the company to serve customers more efficiently and increase sales, all while enhancing the overall customer experience.

New shop expansion remains a cornerstone of Dutch Bros' growth. The company opened 38 new shops in the third quarter of 2025 and plans to add 175 in 2026. This expansion, combined with the company’s strong AUV performance, highlights the scalability of the Dutch Bros brand and its growing appeal across diverse geographies. With a solid pipeline of new locations and a focus on capital-efficient leases, Dutch Bros is well-positioned to continue its sustainable growth.

Encouraged by record shop performance, Dutch Bros raised its full-year 2025 revenue outlook to $1.61-$1.615 billion compared with the prior expectation of $1.59-$1.6 billion. Same-shop sales growth is now expected to be approximately 5%, up from the previously projected 4.5%. The company expects adjusted EBITDA to be within $285-$290 million.

Management expects to open approximately 175 systemwide shops in 2026, extending its footprint into new regions while maintaining its focus on four-wall economics. The company’s digital and menu innovations — along with expansion into food and CPG categories — are expected to support sustained growth momentum into 2026 and beyond.

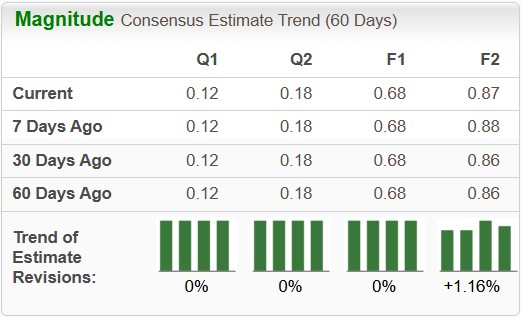

Following the strong third-quarter results, analysts have maintained a positive outlook for Dutch Bros’ earnings trajectory. Over the past 60 days, the Zacks Consensus Estimate for Dutch Bros’ 2026 EPS has been revised upward, increasing from 86 cents to 87 cents. The company’s ability to deliver record shop-level volumes, rising loyalty penetration and expanding digital adoption continues to bolster sentiment toward the stock.

The 60-day earnings estimate growth trend for industry players, including Starbucks Corporation SBUX, Sweetgreen, Inc. SG and Chipotle Mexican Grill, Inc. CMG, stands at negative 7.8%, 1.6% and 12%, respectively.

Dutch Bros stock has steadily gained momentum alongside improving fundamentals. Shares of Dutch Bros have risen 10.3% in the past year against the industry’s fall of 14.8%. Meanwhile, industry peers, such as Starbucks, Sweetgreen and Chipotle, have declined 14.7%, 85.3% and 48.4%, respectively, over the same time frame.

From a valuation standpoint, BROS trades at a forward price-to-sales (P/S) multiple of 4.57, above the industry’s average of 3.36. Conversely, industry players, such as Starbucks, Sweetgreen and Chipotle, have P/S multiples of 2.5, 0.83 and 3.11, respectively.

While Dutch Bros’ impressive third-quarter performance underscores the strength of its business model, its fundamentals suggest the company still has significant growth potential. Record-high average unit volumes, a growing digital presence, and successful food program expansion are all driving consistent traffic and same-store sales growth. With rising loyalty program engagement, improved operational efficiency and an expanding footprint, the company is poised for continued momentum well into 2026 and beyond.

BROS stock continues to trade at a premium, but with upward earnings revisions, increasing transaction growth and management’s ability to exceed expectations, the company’s growth trajectory remains solid. As the brand strengthens its digital ecosystem and extends its reach across new regions, investors may want to consider buying BROS stock now. The combination of robust fundamentals, strategic execution and a positive outlook makes this Zacks Rank #2 (Buy) stock a compelling opportunity for those seeking to tap into its growth momentum. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 |

Cava Fourth-Quarter Sales Rise on Higher Prices, New Restaurant Openings

CMG

The Wall Street Journal

|

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite