|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

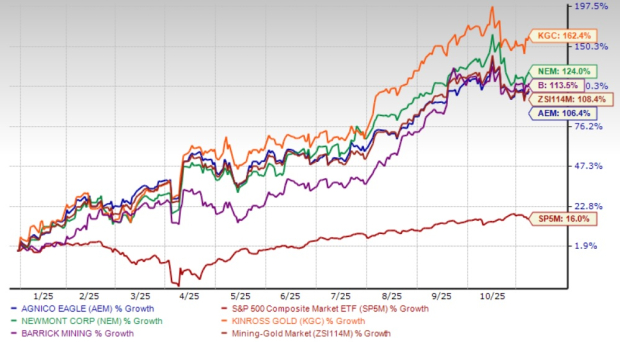

Agnico Eagle Mines Limited AEM shares have surged 106.4% year to date. The upside has been fueled by an upswing in gold prices to historic highs and AEM’s forecast-topping earnings performance, driven by higher realized prices and strong production.

AEM has modestly underperformed the Zacks Mining – Gold industry’s 108.4% rise while outperforming the S&P 500’s increase of 16% so far this year. Its gold mining peers, Barrick Mining Corporation B, Newmont Corporation NEM and Kinross Gold Corporation KGC, have rallied 113.5%, 124% and 162.4%, respectively, over the same period.

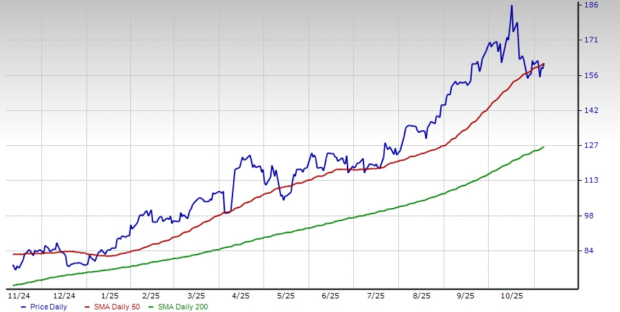

Agnico Eagle has been trading above the 200-day simple moving average (SMA) since March 4, 2024, suggesting a long-term uptrend. The stock broke above the 50-day SMA last Friday after briefly staying below that level. The 50-day SMA continues to read higher than the 200-day SMA, indicating a bullish trend.

Let’s take a look at AEM’s fundamentals to better analyze how to play the stock.

Agnico Eagle is focused on executing projects that are expected to provide additional growth in production and cash flows. It is advancing its key value drivers and pipeline projects, including the Odyssey project in the Canadian Malartic Complex, Detour Lake, Hope Bay, Upper Beaver and San Nicolas.

The Hope Bay Project, with proven and probable mineral reserves of 3.4 million ounces, is expected to play a significant role in generating cash flow in the years to come. The processing plant expansion at Meliadine was completed and commissioned in the second half of 2024, with mill capacity expected to increase to roughly 6,250 tons per day in 2025. At Canadian Malartic, Agnico Eagle is advancing the transition to underground mining with the construction of the Odyssey mine and executing other opportunities to beef up annual production. During the third quarter of 2025, AEM continued exploration drilling to extend the East Gouldie deposit at Canadian Malartic to the east.

At Hope Bay, drilling results at Patch 7 also suggest the potential for mineral resource expansion. Moreover, drilling at the Marban deposit, added through the acquisition of O3 Mining, focuses on mineral reserve and mineral resource expansion. AEM also continued to work on a feasibility study at San Nicolas, with completion expected in late 2025. At Detour Lake, AEM started the development of the exploration ramp during the second quarter and it advanced further in the third quarter.

The merger with Kirkland Lake Gold established Agnico Eagle as the industry's highest-quality senior gold producer. The integrated entity now has an extensive pipeline of development and exploration projects to drive sustainable growth. It also has the financial flexibility to fund a strong pipeline of growth projects.

AEM has a robust liquidity position and generates substantial cash flows, which enable it to maintain a strong exploration budget, finance a strong pipeline of growth projects, pay down debt and drive shareholder value. Its operating cash flow was roughly $1.8 billion in the third quarter, up around 67% from the year-ago quarter.

AEM recorded third-quarter free cash flow of roughly $1.2 billion, nearly doubling the prior-year quarter figure of $620 million. The increase was backed by the strength in gold prices and robust operational results. The company remains focused on paying down debt using excess cash, with total long-term debt reducing by roughly $400 million sequentially to $196 million at the end of the third quarter. It ended the quarter with a significant net cash position of nearly $2.2 billion, driven by the increase in cash position and reduction in debt. AEM also returned around $350 million to its shareholders in the third quarter.

Higher gold prices are expected to boost AEM’s profitability and drive cash flow generation. Gold prices have soared roughly 52% this year, mainly due to aggressive trade policies, including sweeping new import tariffs announced by President Donald Trump, which have intensified global trade tensions and heightened investor anxiety. Additionally, central banks worldwide have been accumulating gold reserves, driven in part by concerns about risks arising from Trump’s policies.

The Federal Reserve’s interest rate reduction, prospects of more rate cuts amid concerns over the labor market, and concerns over a protracted U.S. government shutdown triggered the recent rally, driving bullion prices north of $4,000 per ton for the first time. Increased purchases by central banks and geopolitical and trade tensions are the other factors expected to help the yellow metal sustain the upswing in gold prices.

AEM offers a dividend yield of 1% at the current stock price. It has a five-year annualized dividend growth rate of 3.2%. AEM has a payout ratio of 23% (a ratio below 60% is a good indicator that the dividend will be sustainable).

Agnico Eagle is exposed to higher production costs. In the third quarter, its total cash costs per ounce for gold were $994, up 8% from $921 a year ago and increased from $933 in the prior quarter. All-in-sustaining costs (AISC) — a critical cost metric for miners — were $1,373 per ounce, marking a roughly 6% increase from the prior quarter and a 7% year-over-year rise.

The company forecasts total cash costs per ounce in the range of $915 to $965 and AISC per ounce between $1,250 and $1,300 for 2025, suggesting a year-over-year increase at the midpoint of the respective ranges. While Agnico Eagle is taking actions to control costs, the inflationary pressure is likely to continue over the near term, weighing on its profit margins and overall financial performance.

The Zacks Consensus Estimate for AEM’s 2025 earnings has been going up over the past 60 days. The consensus estimate for 2026 earnings has also been revised upward over the same time frame.

The Zacks Consensus Estimate for 2025 earnings is currently pegged at $7.55, suggesting year-over-year growth of 78.5%. Earnings are expected to grow roughly 20.1% in 2026.

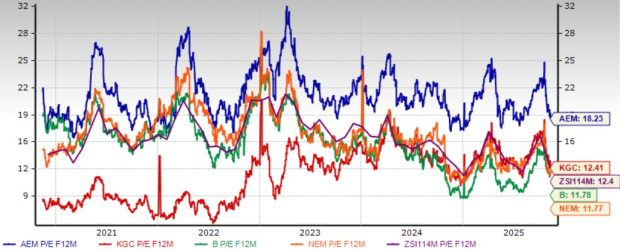

Agnico Eagle is currently trading at a forward price/earnings of 18.23X, a roughly 47% premium to the industry average of 12.4X. AEM is also trading at a premium to its gold mining peers, Barrick Mining, Newmont and Kinross Gold. Agnico Eagle and Newmont have a Value Score of C, while Barrick Mining and Kinross Gold have a Value Score of B, each.

AEM offers an attractive investment opportunity in the gold mining space, backed by a robust pipeline of growth projects, a strong financial footing and supportive technical trends. Surging gold prices are expected to further enhance profitability and strengthen cash flow generation. The company’s positive earnings growth outlook and upward-trending earnings estimates add to its appeal. However, its high production costs warrant caution. The company’s stretched valuation also might not offer an attractive entry point at this time. Holding onto this Zacks Rank #3 (Hold) stock will be prudent for investors who already own it.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 17 min | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 6 hours | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite