|

|

|

|

|||||

|

|

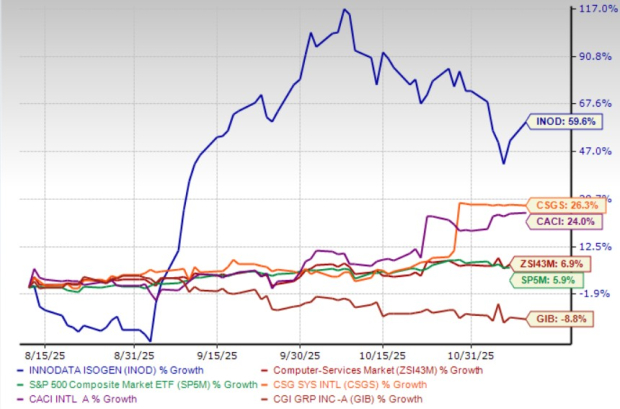

Innodata Inc. INOD has seen its stock surge 59.6% over the past three months, driven by sustained momentum in demand for generative AI, strengthened customer relationships and expanding contract wins.

In the same time frame, the industry and the S&P 500 have gained 6.9% and 5.9%, respectively. INOD has outpaced other industry players like CSG Systems International, Inc. CSGS, CACI International Inc. CACI and CGI Inc. GIB in the past year.

Investor enthusiasm has been fueled particularly by the company’s solid third-quarter performance, where revenues reached a record $62.6 million, up 20% year over year, accompanied by adjusted EBITDA margin improvement and strong cash generation. Management highlighted robust deal momentum with major cloud and model-building companies, lending credibility to the growth trajectory.

Another factor supporting the share rally is management’s reaffirmation of at least 45% year-over-year revenue growth in 2025, alongside expectations for “potentially transformative” growth in 2026, reflecting confidence in the pipeline. The company is not just landing incremental deals but moving into larger and more strategic programs, including newly expanded relationships with some of the biggest names in global technology. It has also secured several new high-value federal, enterprise and sovereign AI opportunities that could meaningfully scale over time.

A central strength in Innodata’s current story is its growing trust and embeddedness with major AI model builders. On the third-quarter 2025 call, management noted that six of eight large tech customers are expected to increase spending in 2026, some “quite substantially.” This includes verbal confirmation for new expansions with its largest customer, which is expected to ramp in the coming quarters. The company also expects meaningful contributions from five newly added big tech clients, three of which could have annual AI budgets in the hundreds of millions, presenting significant revenue capture opportunities.

Historically focused on post-training data (reinforcement learning, evaluation and alignment), Innodata anticipated a growing need for high-quality pretraining corpora. In response, the company invested $1.3 million to build pretraining capabilities — an investment that has already paid off. Management disclosed $42 million in signed pretraining contracts, with an additional $26 million expected to be signed soon, totaling $68 million in potential revenues largely flowing into 2026. This early move not only validates Innodata’s strategic agility but positions it ahead of slower-moving peers.

The launch of Innodata Federal, a dedicated government-facing business unit, represents another meaningful growth vector. The unit has already secured an initial project expected to yield approximately $25 million in revenues, primarily in 2026, with additional large-scale opportunities under discussion. The increasingly streamlined federal procurement environment for AI solutions further enhances long-term scalability.

As nations strive to build independent AI infrastructure and data sovereignty, Innodata is engaging with multiple sovereign entities across the Middle East and Asia. These opportunities are backed by state-level funding and urgency, suggesting durable multi-year revenue potential.

While hyperscaler and foundation model customers remain the primary engine, the enterprise AI practice has begun to scale, too. The company is actively deploying generative AI into enterprise workflows, enabling both cost optimization and productivity gains. These engagements often begin in the $1-$2 million range but carry strong repeatability upside.

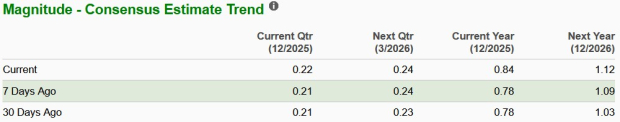

The 2025 EPS estimates have ticked up to 84 cents from 78 cents over the past seven days. However, the figure still represents a 5.6% year-over-year decline. Yet, earnings are expected to grow 33.3% in 2026.

By contrast, revenues are projected to rise nearly 45.2% in 2025 and 24.6% in 2026. This divergence signals a heavy investment in expansion. Meanwhile, sales for other industry players like CSG Systems International, CACI International and CGI for the current year are likely to witness year-over-year increases of 1.7%, 8.5% and 5.8%, respectively.

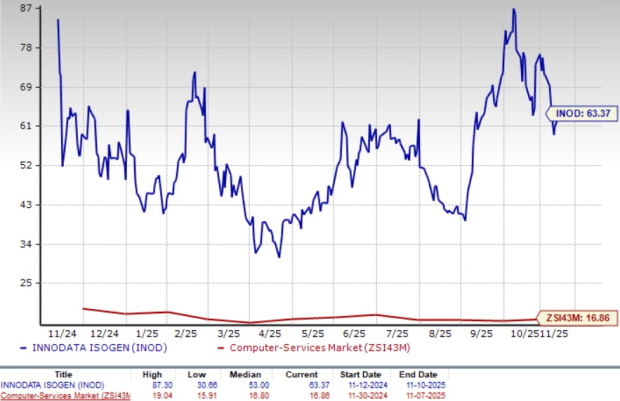

Innodata trades at a forward 12-month P/E ratio of 63.37x compared with just 16.86x for the industry average.

Investors may consider buying Innodata because it is increasingly positioned at the center of the generative AI ecosystem with deepening relationships across major tech platforms, expanding contracts in high-value data services, and entry into fast-growing markets like federal and sovereign AI.

Innodata’s early investment in building capabilities for pretraining data is already proving to be a strategic advantage, enabling it to secure larger, longer-duration projects. Meanwhile, momentum remains strong across both existing and newly onboarded customers, with visible catalysts that could support further revenue scale. Though valuation is elevated, the business is moving from incremental project wins toward broader, more embedded partnerships, suggesting that growth visibility, pipeline strength and structural demand for high-quality training data may justify a longer-term bullish stance.

INOD currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-14 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite