|

|

|

|

|||||

|

|

Editas Medicine EDIT reported a loss of 28 cents per share in the third quarter of 2025, narrower than the Zacks Consensus Estimate of a loss of 38 cents. The company had incurred a loss of 75 cents per share in the year-ago quarter.

Collaboration and other research and development (R&D) revenues, which comprise Editas’ top line, were $7.5 million in the reported quarter, up significantly from the year-ago quarter’s figure. The reported figure comprehensively beat the Zacks Consensus Estimate of $2 million. The increase is primarily due to the recognition of revenues related to a milestone achievement under a collaboration agreement with Bristol Myers.

In the third quarter of 2025, R&D expenses decreased 58% to $19.8 million compared with $47.6 million reported in the year-ago period. The downtick in R&D expenses is mainly due to lower clinical and manufacturing costs following the abandonment of the reni-cel program in December 2024, partly offset by costs of in vivo research and discovery.

General and administrative expenses were $12.3 million in the reported quarter, down 32% year over year, due to a decrease in employee-related expenses because of reduced workforce following the abandonment of the reni-cel program.

EDIT did not record any restructuring and impairment charges in the reported quarter.

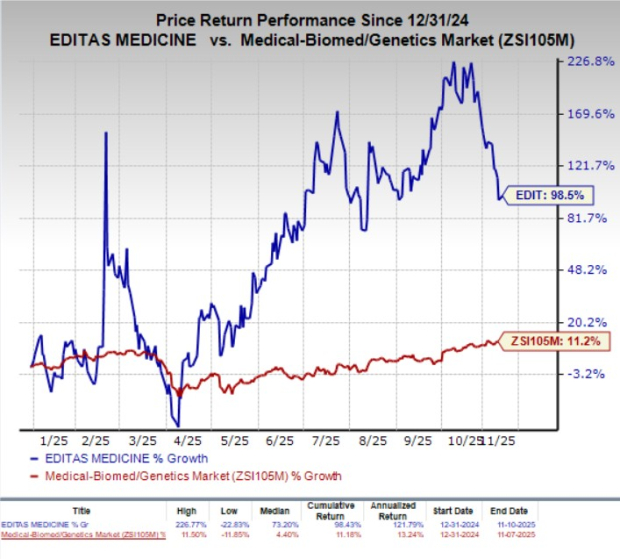

Shares of Editas have rallied 98.5% year to date compared with the industry’s 11.2% growth.

Editas had cash, cash equivalents and investments worth $165.6 million as of Sept. 30, 2025, down from $178.5 million as of June 30, 2025. The company expects that its existing cash position, together with $17.3 million in ATM proceeds raised after Sept. 30, 2025, and retained payments from its Vertex license agreement, will fund operating and capital needs into the third quarter of 2027.

Editas has no approved products in its portfolio at the moment. Therefore, pipeline development remains the key focus of the company.

In December 2024, Editas ended the reni-cel development program following the failure of an extensive search to yield a commercial partner. As a result of this decision, the company implemented cost-saving measures, including a workforce reduction of approximately 65%. The move reverted EDIT to the pre-clinical stage. As part of its strategic reprioritization efforts, Editas has focused its workforce and resources on in vivo (within the living organism) pipeline development.

In September, Editas nominated EDIT-401 as its lead in vivo development candidate. This experimental, potential best-in-class, one-time gene editing therapy is designed to significantly reduce LDL cholesterol (LDL-C) levels, marking a key milestone in the company’s efforts to advance in vivo programmable gene editing.

Editas has already reported compelling preclinical results for EDIT-401, showing rapid and durable ≥90% LDL-C reductions in both non-human primates and mouse models with only moderate LDLR editing. The data showed a six-fold or more increase in hepatic LDLR protein and sustained lipid lowering over three months.

Editas remains on track to file an investigational new drug or clinical trial application by mid-2026 and targets initial in-human proof-of-concept data for EDIT-401 by year-end 2026.

Editas Medicine, Inc. price-consensus-eps-surprise-chart | Editas Medicine, Inc. Quote

Editas currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are ANI Pharmaceuticals ANIP, Arcutis Biotherapeutics ARQT and ADMA Biologics ADMA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for ANI Pharmaceuticals’ earnings per share have increased from $7.25 to $7.29 for 2025. During the same time, earnings per share estimates for 2026 have increased from $7.74 to $7.81. Year to date, shares of ANIP have surged 63.2%.

ANI Pharmaceuticals' earnings beat estimates in each of the trailing four quarters, the average surprise being 21.24%.

In the past 60 days, estimates for Arcutis Biotherapeutics’ loss per share have narrowed from 44 cents to 24 cents for 2025. During the same time, earnings per share estimates for 2026 have increased from 9 cents to 41 cents. Year to date, shares of ARQT have rallied 80.1%.

Arcutis Biotherapeutics’ earnings beat estimates in each of the trailing four quarters, the average surprise being 64.80%.

In the past 60 days, estimates for ADMA Biologics’ earnings per share have increased from 57 cents to 58 cents for 2025. During the same time, earnings per share estimates for 2026 have improved from 88 cents to 90 cents. Year to date, shares of ADMA have gained 11%.

ADMA Biologics’ earnings beat estimates in one of the trailing four quarters, matched once and missed the same on the remaining two occasions, with the average negative surprise being 3.01%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 | |

| Feb-09 | |

| Feb-06 | |

| Feb-05 | |

| Feb-03 | |

| Feb-02 | |

| Feb-02 | |

| Jan-29 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite