|

|

|

|

|||||

|

|

Gitlab GTLB shares have surged 17.8% in the past three months, outperforming the broader Zacks Computer & Technology sector’s rise of 8.5% and the Zacks Internet - Software industry’s decline of 12.9%. Among major tech peers, Amazon AMZN and Alphabet GOOGL have climbed 12.2% and 44.4%, respectively, while Microsoft MSFT has slipped 3% during the same period.

The rally reflects growing investor confidence in GitLab's differentiated AI-native DevSecOps platform, accelerating customer adoption and expanding addressable market opportunity driven by enterprise AI transformation.

GitLab's long-term growth story is increasingly anchored in its position as an AI-native DevSecOps leader. As enterprises accelerate their shift toward integrated, intelligent software development platforms, GitLab's Duo Agent Platform is emerging as a core enabler of that transformation. Its AI-orchestrated architecture unifies planning, coding, security and deployment, allowing human-AI collaboration across the entire software lifecycle while remaining fully cloud- and model-agnostic.

The Zacks Consensus Estimate for GitLab’s fiscal 2026 revenues is pegged at $940.15 million, indicating 32.12% year-over-year growth. GitLab's hybrid monetisation strategy is transitioning from a seat-based model to one that also charges for AI-agent usage, further enhancing revenue scalability as automation and AI-driven workflows proliferate.

Unlike Microsoft's GitHub Copilot, Amazon's Q Developer or Alphabet's Gemini, which are tied to their respective ecosystems, GitLab's open architecture integrates with Anthropic Claude Code, Amazon Q, Google Gemini CLI and OpenAI, giving enterprises freedom of choice and avoiding vendor lock-in. This independence strengthens its competitive moat as entities demand flexibility across clouds and AI models. With a unified data platform and rising customer retention, GitLab stands poised to become the backbone of enterprise software innovation.

GitLab's strategic transition toward SaaS and GitLab Dedicated offerings remains a major growth catalyst, enhancing both customer value and business efficiency. GitLab Dedicated has emerged as a standout performer, addressing the stringent security, compliance and isolation needs of financial institutions, healthcare providers and public-sector agencies. Its single-tenant, enterprise-grade architecture positions GitLab as a trusted partner for enterprises modernising development workflows in regulated environments.

The Zacks Consensus Estimate for the fiscal third-quarter Remaining Performance Obligation is pegged at $1.07 billion, up 31.5% year over year, indicating expanding multi-year contracts and deepening enterprise engagement. GitLab's cloud-neutral strategy enables seamless deployment across AWS, Azure and Google Cloud, unlike Microsoft's Azure-centric or Alphabet's Google Cloud-focused models. This independence broadens GitLab's distribution reach and strengthens its competitive position as enterprises increasingly adopt hybrid and multi-cloud architectures.

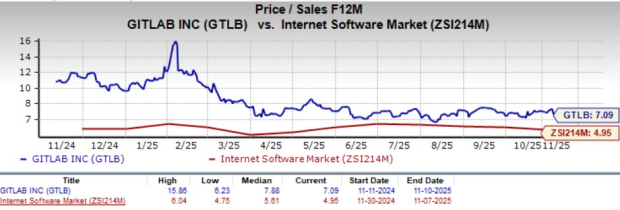

GitLab's current valuation remains well supported by its strong fundamentals and consistent execution. The stock trades at a forward 12-month price-to-sales multiple of 7.09X compared with the sub-industry average of 4.95X and the sector average of 6.75X. In contrast, Amazon trades at 3.4X, Microsoft at 11.01X and Alphabet at 9.21X. This positioning reflects GitLab's robust growth prospects and differentiated AI-native DevSecOps platform while still leaving room for multiple expansions.

The Zacks Consensus Estimate for fiscal 2026 earnings is pegged at 83 cents per share, indicating 12.16% year-over-year growth. The company's expanding SaaS and Dedicated mix continues to improve revenue quality and cash generation, while rising enterprise adoption suggests durable demand. With healthy earnings visibility and a platform well aligned to the shift toward AI-driven, multi-cloud development, GitLab's valuation appears both justified and positioned for further upside.

GitLab Inc. price-consensus-chart | GitLab Inc. Quote

GitLab's recent rally reflects growing conviction in its ability to sustain high-quality growth through consistent execution and strategic innovation. The company's AI-native Duo Agent Platform sets it apart from peers by enabling end-to-end software development automation across any cloud environment, while its SaaS and Dedicated offerings continue to strengthen recurring revenue visibility.

Backed by expanding multi-year contracts, rising adoption in regulated industries and disciplined cost management, GitLab is demonstrating both scalability and resilience. Its cloud-neutral strategy provides a unique edge over ecosystem-tied competitors, positioning it as a trusted, flexible partner for enterprises transitioning to AI-driven, multi-cloud infrastructure.

With strong revenue visibility, improving profitability and a valuation that remains attractive relative to its growth potential, GitLab's fundamentals appear well aligned for continued momentum. GitLab currently carries a Zacks Rank #2 (Buy), suggesting investors may consider accumulating the stock at current levels. The company's expanding enterprise footprint, strategic product innovation and disciplined execution support confidence in its ability to deliver sustained long-term value. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 39 min | |

| 1 hour | |

| 3 hours |

Tech Firms Arent Just Encouraging Their Workers to Use AI. Theyre Enforcing It.

AMZN GOOGL

The Wall Street Journal

|

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite