|

|

|

|

|||||

|

|

As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the financial exchanges & data industry, including Intercontinental Exchange (NYSE:ICE) and its peers.

Financial exchanges and data providers operate trading platforms and sell market information. They enjoy relatively stable revenue from trading fees and subscriptions, increasing demand for data analytics, and expansion opportunities in emerging markets. Challenges include regulatory oversight of market structure, competition from alternative trading venues, and substantial technology investments needed to maintain low-latency trading infrastructure and data security.

The 10 financial exchanges & data stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 0.9%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

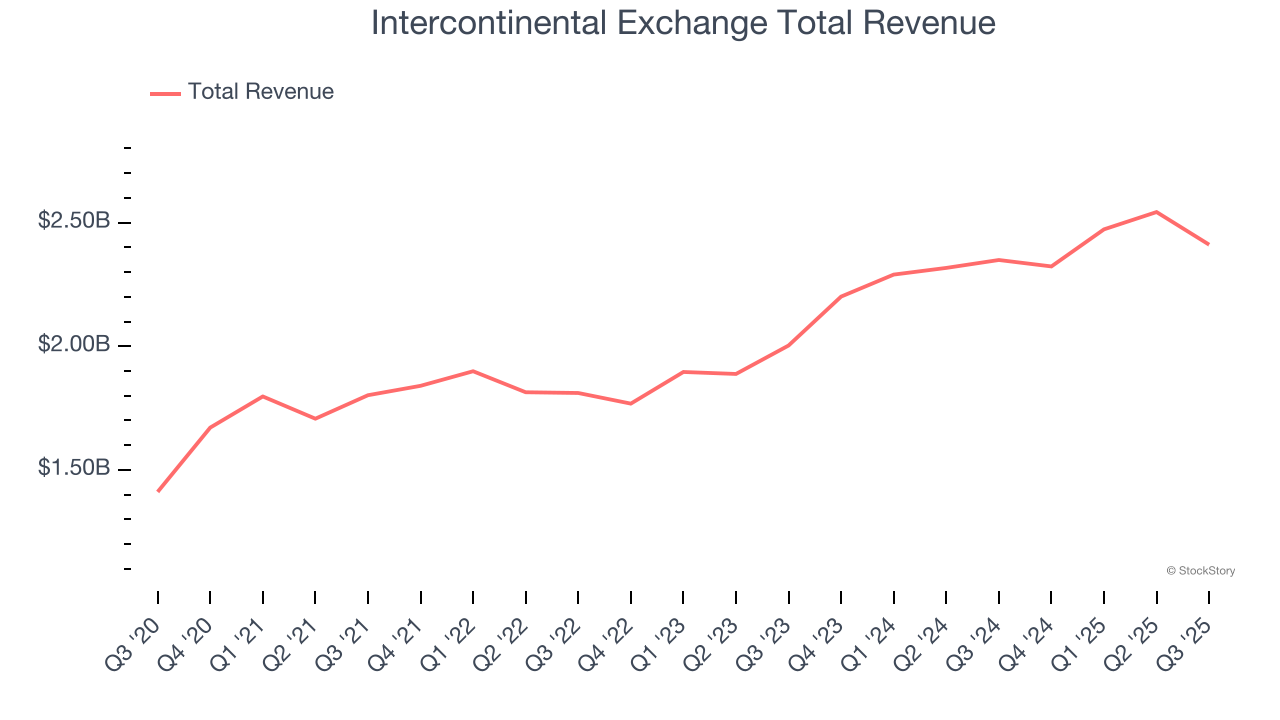

Starting as an energy trading platform in 2000 before acquiring the iconic New York Stock Exchange in 2013, Intercontinental Exchange (NYSE:ICE) operates global financial exchanges, clearing houses, and provides data services and mortgage technology solutions to financial institutions and corporations.

Intercontinental Exchange reported revenues of $2.41 billion, up 2.6% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a solid beat of analysts’ Exchanges segment estimates but revenue in line with analysts’ estimates.

Interestingly, the stock is up 1.5% since reporting and currently trades at $152.94.

Is now the time to buy Intercontinental Exchange? Access our full analysis of the earnings results here, it’s free for active Edge members.

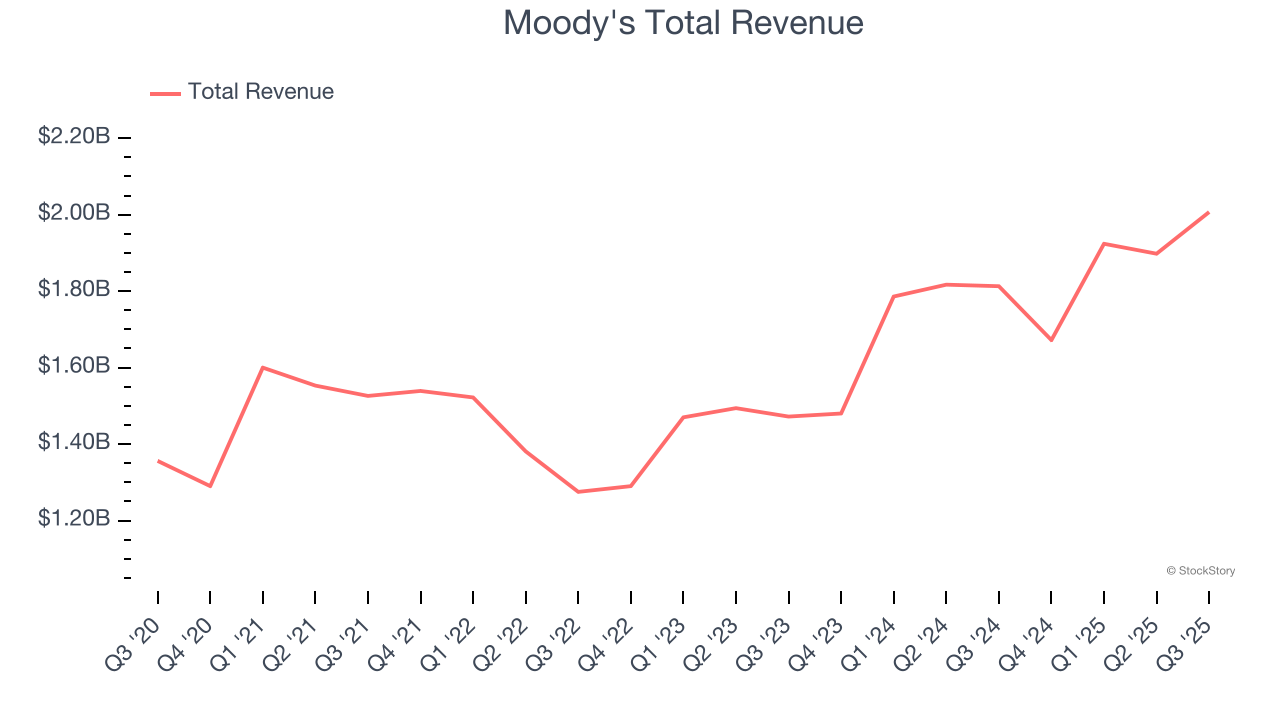

Founded in 1900 during America's railroad boom when investors needed reliable information on bond risks, Moody's (NYSE:MCO) provides credit ratings, risk assessment tools, and analytical solutions that help organizations evaluate financial risks and make informed investment decisions.

Moody's reported revenues of $2.01 billion, up 10.7% year on year, outperforming analysts’ expectations by 2.4%. The business had a very strong quarter with a solid beat of analysts’ Investor Services segment estimates and an impressive beat of analysts’ EBITDA estimates.

Moody's achieved the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 1.9% since reporting. It currently trades at $494.

Is now the time to buy Moody's? Access our full analysis of the earnings results here, it’s free for active Edge members.

Founded in 1978 when financial data was still primarily delivered through paper reports, FactSet (NYSE:FDS) provides financial data, analytics, and technology solutions that investment professionals use to research, analyze, and manage their portfolios.

FactSet reported revenues of $596.9 million, up 6.2% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a slower quarter as it posted full-year EPS guidance meeting analysts’ expectations and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 19.1% since the results and currently trades at $271.56.

Read our full analysis of FactSet’s results here.

Founded in 1996 as one of the pioneers in electronic bond trading, Tradeweb Markets (NASDAQ:TW) builds and operates electronic marketplaces that connect financial institutions for trading across rates, credit, equities, and money markets.

Tradeweb Markets reported revenues of $508.6 million, up 13.3% year on year. This number beat analysts’ expectations by 1%. Aside from that, it was a slower quarter as it produced a significant miss of analysts’ EPS estimates and transaction volumes in line with analysts’ estimates.

Tradeweb Markets pulled off the fastest revenue growth among its peers. The stock is up 3.9% since reporting and currently trades at $109.50.

Read our full, actionable report on Tradeweb Markets here, it’s free for active Edge members.

Originally founded in 1971 as the world's first electronic stock market, Nasdaq (NASDAQ:NDAQ) operates global exchanges and provides technology, data, and corporate services that help companies, investors, and financial institutions navigate capital markets.

Nasdaq reported revenues of $1.32 billion, up 11.4% year on year. This result surpassed analysts’ expectations by 0.8%. Overall, it was a satisfactory quarter as it also logged an impressive beat of analysts’ Trading Services segment estimates.

The stock is down 1.4% since reporting and currently trades at $87.65.

Read our full, actionable report on Nasdaq here, it’s free for active Edge members.

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

| Feb-17 | |

| Feb-17 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite