|

|

|

|

|||||

|

|

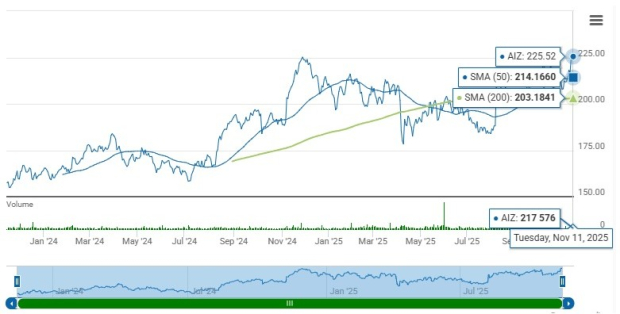

Shares of Assurant, Inc. AIZ closed at $225.52 on Tuesday, near its 52-week high of $230.55. This proximity underscores investor confidence. It has the ingredients for further price appreciation.

The stock is trading above the 50-day and 200-day simple moving averages (SMA) of $213.95 and $204.07, respectively, indicating solid upward momentum. SMA is a widely used technical analysis tool to predict future price trends by analyzing historical price data.

Earnings of Assurant grew 16.6% in the last five years, better than the industry average of 9.8%. Assurant has a solid surprise history. The insurer has a solid track record of beating earnings estimates in each of the last four quarters, the average being 22.74%.

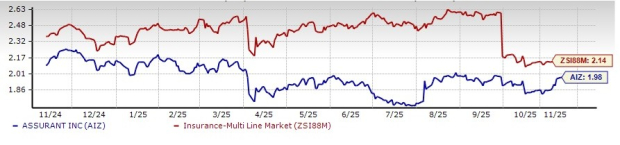

Assurant shares are trading at a discount compared with the Zacks Multi-line Insurance industry. Its forward price-to-earnings multiple of 1.98X is lower than the industry average of 2.14X, the Finance sector’s 4.27X and the Zacks S&P 500 Composite’s 8.37X. The insurer has a Value Score of A.

Shares of The Travelers Companies, Inc. TRV and Cincinnati Financial Corporation CINF are trading at a multiple higher than the industry average, while NMI Holdings Inc NMIH shares are trading at a discount.

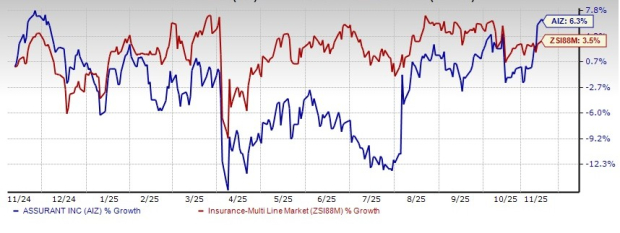

Shares of Assurant have gained 6.3% in the past year, outperforming the industry’s growth of 3.5%.

The Zacks Consensus Estimate for Assurant’s 2025 earnings per share indicates a year-over-year increase of 14.7%. The consensus estimate for revenues is pegged at $12.75 billion, implying a year-over-year improvement of 6.6%.

The consensus estimate for 2026 earnings per share and revenues indicates an increase of 9.3% and 5.1%, respectively, from the corresponding 2025 estimates.

Three of the four analysts covering the stock have raised estimates for both 2025, and four of the five analysts have raised the same for 2026 over the past 30 days. Thus, the Zacks Consensus Estimate for 2025 and 2026 earnings has moved north 7.8% and 2.4%, respectively, over the past 30 days.

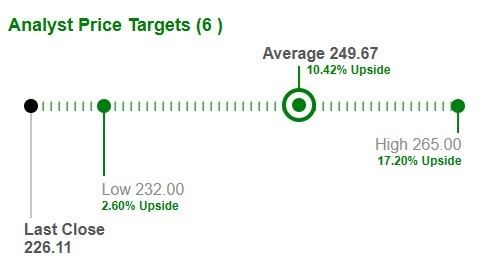

Based on short-term price targets offered by six analysts, the Zacks average price target is $249.67 per share. The average suggests a potential 10.4% upside from the last closing price.

Return on equity in the trailing 12 months was 18.6%, better than the industry average of 15.3%. This highlights the company’s efficiency in utilizing shareholders’ funds.

Also, the return on invested capital (ROIC) has been increasing over the last few quarters as the company raised its capital investment over the same time frame, reflecting AIZ’s efficiency in utilizing funds to generate income. ROIC in the trailing 12 months was 12.2%, better than the industry average of 2.1%.

Assurant’s focus on growing fee-based capital-light businesses, which account for 52% of segmental revenues, bodes well for growth. Management estimates that the contribution from the same will continue to grow in double digits over the long term.

Within Connected Living, AIZ continues to support long-term growth through the development of innovative offerings for partners. U.S. Connected Living is poised for solid growth, particularly within the mobile protection business, riding on innovative offerings, customer experience expertise and improved relationships with mobile carriers and cable operators.

Homeowners’ top-line growth, more favorable loss experience from prior-period development on claims, growth in policies in-force and higher average premiums within lender-placed, as well as growth across various specialty products, should drive better results at Global Housing. For 2025, AIZ expects Global Housing adjusted EBITDA, excluding reportable catastrophes, to deliver strong growth.

Global Lifestyle growth is expected to be driven by Connected Living from growth in global mobile device protection and a new financial services program, inorganic and organic growth strategies. For 2025, Global Lifestyle adjusted EBITDA is projected to increase from growth in Connected Living and Global Automotive.

The insurer remains focused on ramping up the Connected Living platform, deploying innovative products and services, and adding new partnerships. These initiatives are expected to double the margins of Connected Living to 8% over the long term.

Assurant has a solid capital management policy. It expects to deploy capital to fund investments, mergers and acquisitions. In November 2024, the board approved a dividend hike of 11%, which is the 20th consecutive year of increase. As of Sept. 30, 2025, $168.3 million aggregate cost at purchase remained unused under the repurchase authorization. For 2025, AIZ expects to return $300 million to shareholders through share repurchases, at the top end of $200 million to $300 million anticipated range from the beginning of the year. For the fourth quarter of 2025, AIZ expects a higher level of segment dividends given the business' ability to generate meaningful cash flows.

Focus on capital-light businesses, Homeowners growth, and Connected Living growth within the mobile protection business should favor Assurant’s results. Higher return on capital, as well as favorable growth estimates and attractive valuations, should continue to benefit the insurer over the long term.

Assurant also has a VGM Score of A. Stocks with a favorable VGM Score are those with the most attractive value, best growth and most promising momentum compared with peers. Its impressive dividend history as well as attractive valuations are other positives.

Its impressive dividend history, solid growth projections, and optimistic analyst sentiment, are other positives. The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 11 hours | |

| Feb-27 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite