|

|

|

|

|||||

|

|

JPMorgan JPM is the largest U.S. bank, while Truist Financial TFC is a prominent regional bank. JPM leverages its massive global presence, branch expansion strategy and diversified financial services, while TFC is blending its targeted regional branch expansion with cutting-edge digital banking.

As the Federal Reserve has started an interest rate cut cycle, it is important to understand how these two large banks navigate the evolving operating environment. Let’s analyze JPMorgan and Truist Financial’s business models to determine which one presents a solid investment opportunity.

JPMorgan’s balance sheet is highly asset-sensitive. Therefore, rate cuts are likely to adversely impact the company’s net interest income (NII). Lower rates will lead to reduced asset yields on variable-rate loans and securities, compressing margins unless deposits or funding costs are repriced more quickly.

JPMorgan expects the near-term impact of rate cuts to be manageable, driven by robust loan demand and deposit growth. Following the strong performance so far, management raised its 2025 NII forecast to $95.8 billion from the prior $95.5 billion target. This implies almost 3% year-over-year growth. Further, the company projects 2026 NII (excluding Markets) to be nearly $95 billion, driven by balance sheet growth and mix, partially offset by the impact of lower rates.

The shift toward easier monetary policy is expected to support client activity, deal flow and asset values. Thus, JPMorgan’s non-interest income streams will likely see robust improvement.

Additionally, JPM continues to invest in brick-and-mortar to strengthen its competitive edge in relationship banking, having a presence in all 48 contiguous states. In 2024, JPMorgan opened nearly 150 branches and plans to add 500 more by 2027 to deepen relationships and boost cross-selling across mortgages, loans, investments and credit cards. The company has also expanded through strategic acquisitions, including a larger stake in Brazil’s C6 Bank, partnerships with Cleareye.ai and Aumni, and the 2023 purchase of First Republic Bank.

Lower rates will likely support JPMorgan's asset quality, as declining rates will ease debt-service burdens and improve borrower solvency. The company lowered its 2025 card charge-off rate to approximately 3.3% from the previously expected 3.6% “on favorable delinquency trends.”

Unlike JPM, Truist Financial is less sensitive to interest rate cycles. Since the divestiture of its insurance subsidiary in 2024, the company has been trying to strengthen its balance sheet through repositioning and making efforts to enhance its non-interest revenue sources.

In August, TFC announced a growth plan – opening 100 new branches and renovating more than 300 existing locations in high-growth opportunity cities in the next five years and investing in its business banking ecosystem -- to capitalize on growth opportunities in dynamic U.S. markets while strengthening its digital capabilities.

Also, the company is focusing on wealth management and expects a broad-based recovery in trading and investment banking businesses to drive non-interest income higher. This will also help alleviate Truist’s dependence on spread income to sustain top-line growth as rates come down.

For the fourth quarter of 2025, TFC anticipates NII to be up almost 2% sequentially, primarily driven by continued loan growth, higher client deposits and lower deposit costs amid rate cut expectations. Management expects to reprice nearly $14 billion of fixed-rate loans and securities in the fourth quarter.

Like JPM, the company’s asset quality is expected to benefit as interest rates decline. As Truist gets on with its branch expansion plan, upgrade technology and hire personnel to drive commercial banking business, operating expenses will likely remain high. The company expects adjusted non-interest expenses to rise approximately 1% this year.

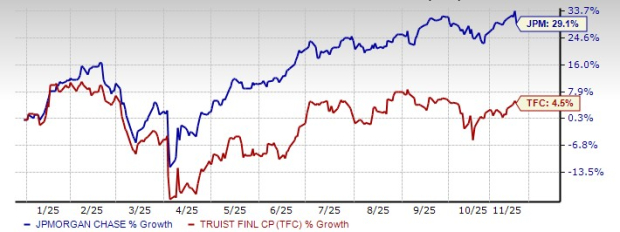

So far this year, shares of JPMorgan have gained 29.1%, while Truist Financial rallied 4.5%.

JPM & TFC YTD Price Performance

In terms of investor sentiments, JPM clearly has the edge.

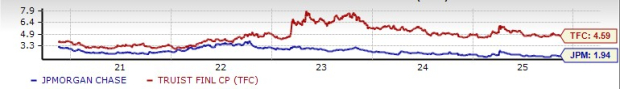

In terms of valuation, JPM is currently trading at a 12-month forward price-to-earnings (P/E) of 14.89X, while the TFC stock is currently trading at a 12-month forward P/E of 10.33X.

P/E F12M

Further, both are trading at a discount compared with the industry average of 15.07X. So, JPMorgan is expensive compared to TFC.

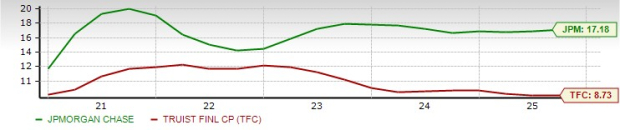

After clearing the 2025 stress test, JPM announced a hike in its quarterly dividends, while Truist maintained it at the same level. JPMorgan increased its dividend by 7% to $1.50 per share, while Truist will continue to pay 52 cents per share as a dividend. At present, JPM's dividend yield is 1.94%, which is less than Truist’s 4.59%.

Dividend Yield

JPMorgan’s return on equity (ROE) of 17.18% is above TFC’s 8.73%. This reflects that JPM is more efficiently using shareholder funds to generate profits.

ROE

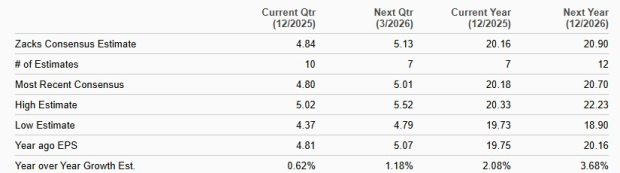

The Zacks Consensus Estimate for JPM’s 2025 and 2026 revenue implies year-over-year growth of 2.5% and 3.5%, respectively. The consensus estimate for earnings indicates a 2.1% and 3.7% rise for 2025 and 2026, respectively.

JPM Earnings Estimate

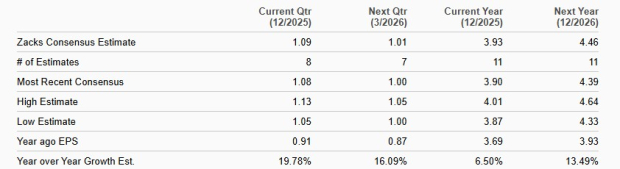

Meanwhile, the Zacks Consensus Estimate for TFC’s 2025 and 2026 revenue suggests year-over-year growth of 2.2% and 5%, respectively. The consensus estimate for earnings indicates a 6.5% and 13.5% rise for 2025 and 2026, respectively.

TFC Earnings Estimate

While Truist is making meaningful strides in branch expansion, digital investments and non-interest income diversification, its progress comes with higher operating expenses and a still-recovering earnings profile. JPM, by contrast, enters the rate-cut cycle from a position of exceptional financial strength, supported by resilient loan demand, expanding non-interest revenue streams and disciplined balance-sheet management. Its nationwide branch network, strategic acquisitions and ability to raise guidance even in a lower-rate environment underscore a durable competitive edge that Truist has yet to match.

JPMorgan’s superior returns, stronger investor sentiment and consistent shareholder rewards reinforce its status as a best-in-class banking franchise. While TFC offers a higher dividend yield and appears cheaper on a valuation basis, JPM’s higher ROE, stronger growth visibility and proven outperformance make it the more compelling long-term holding. For investors seeking stability, scale advantages and reliable execution in an evolving interest-rate landscape, JPMorgan stands out as the better stock to own.

Currently, JPM carries a Zacks Rank #2 (Buy) and TFC has a Zacks Rank of 3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

NVDA Stock Rebounds In Premarket After Worst Drop In 10 Months; Analysts, Retail Investors Remain Optimistic

TFC

New feeds test provider finance

|

| Feb-26 |

How JPMorgan's Bankers Stayed Close to Epstein After Bank Fired Him as a Client

JPM

The Wall Street Journal

|

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite