|

|

|

|

|||||

|

|

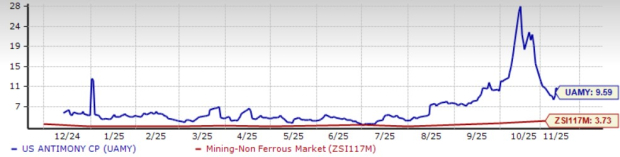

Shares of United States Antimony Corporation UAMY have surged 68.4% over the past three months as the company undergoes one of the most ambitious operational transformations in its history. Management has outlined a rapidly expanding global procurement network for antimony, a meaningful ramp-up in domestic mining activity, and early groundwork to build a strategic position in tungsten — a metal with no active mines currently operating in the United States or Canada.

At the same time, the company continues to navigate challenges ranging from Chinese market dominance to permitting delays in Alaska and setbacks in Australia.

Over the past three months, UAMY has delivered better performance relative to industry as well as its peers such as Coeur Mining CDE and Lundin Mining LUNMF. While shares of CDE have gained 29.3%, those of LUNMF have risen 58.1% over the past three months.

3-Month Performance

Antimony remains the centerpiece of UAMY’s growth strategy, and 2025 has been a defining year. In the second quarter, management reported a 203% year-over-year increase in antimony revenues followed by a strong third quarter, driven largely by higher pricing and expanded ore deliveries to the company’s facilities in Montana and Mexico. Ore shipments to the Thompson Falls smelter were robust, prompting UAMY to increase staffing and processing capacity to convert record inventories into finished product.

The company has simultaneously broadened its global procurement footprint. By the third quarter, UAMY executed more than 15 supply agreements across 10 countries, with additional negotiations ongoing with more than 30 other parties. Material sourced from Bolivia, Chad, Peru, Mexico, and multiple regions in Asia and Africa is either already arriving or en route to UAMY’s smelters. Approximately 330 tons of antimony feedstock were received in Mexico in 2025, with another 295 tons on the water or clearing ports as of the third quarter.

These procurements are essential for meeting recently secured long-term contracts—most notably a $245 million Defense Logistics Agency (DLA) award and a five-year commercial contract worth $107 million for antimony trioxide. Together, these two agreements represent nearly $352 million in committed demand compared with only $15 million in company-wide revenues last year.

On the mining side, UAMY has revived domestic production for the first time in decades. In Montana, bulk sampling at the ELISA claim has already yielded 560 tons of stibnite ore in the first 40 days of extraction. Grades are expected to exceed 10% antimony, a material that significantly improves margin potential compared with third-party concentrates.

One of the most strategically significant developments in 2025 has been UAMY’s move into tungsten. In the second quarter, the company purchased the Fostung tungsten property in Ontario, describing it as a transformative asset that aligns closely with U.S. government critical-minerals objectives. The company emphasizes that there are currently no active tungsten mines in the United States or Canada, positioning UAMY to become the first domestic supplier if development progresses.

By the third quarter, UAMY initiated environmental surveys, stripping programs, metallurgical testing, and commissioned SRK Consulting for a new resource estimate under SEC SK-1300 standards — steps that move the project closer to potential federal funding. Management repeatedly highlighted intentions to replicate the antimony model — acquire upstream resources, develop cost-effective mining plans, and vertically integrate into downstream processing.

Despite the positive sentiment around UAMY, the Zacks Consensus Estimate for earnings per share has seen negative revisions. In the past 60 days, analysts have lowered their EPS estimates for the current and next fiscal year by 20% to 4 cents and 12.5% to 21 cents, respectively, indicating year-over-year growth of 206.6% and 162.3%.

China’s Dominance and U.S. Strategic Vulnerability

Despite these advancements, UAMY’s leadership remains candid about the global antimony landscape. The company noted that China not only dominates mining, producing capacity equivalent to 60 times other countries combined, but also controls 85-90% of global smelting and refining capacity. Even ore mined outside China often must be shipped there for processing, creating near-total dependency.

The United States, by contrast, holds only around 1,100 tons of strategic reserves — enough to meet just a few weeks of demand. UAMY’s domestic expansion is positioned as both a commercial and national-security imperative. But building alternative supply chains is no small task.

Delayed Progress in Alaska

Alaska, one of UAMY’s most promising antimony regions, has been slow to advance. After filing permits in April 2025, regulatory approvals did not arrive until mid-September, leaving little time to begin trenching before winter conditions set in. Environmental objections from local groups, such as “Save Our Domes,” have further slowed progress. UAMY responded by acquiring private land to bypass state and federal permits for certain exploration activities, but the schedule was pushed into 2026.

Australian Setback: Larvotto Proposal Rejected

UAMY also attempted to expand its international mining footprint by submitting an indicative proposal to acquire Larvotto Resources in Australia. The bid was rejected within a week by Larvotto’s board, though UAMY remains the company’s largest shareholder with a 10% stake valued at roughly $40 million. Management has not yet decided whether to pursue renewed engagement or divest.

Shares of United States Antimony have been on a run since the beginning of 2025 amid rising demand for U.S.-based mining companies. This surge has bolstered its valuation, and the company now trades at a premium to both the broader industry and its peers.

UAMY’s shares currently trade at a forward 12-months price-to-sales (P/S F12M) of 9.59X, significantly higher than the industry average of 3.73X. Currently, Coeur Mining and Lundin Mining trade at 5.63X and 4.18X, respectively.

UAMY’s 2025 narrative is one of aggressive expansion — expanding ore procurement, restarting U.S. antimony mining, securing multi-year sales contracts, and planting early seeds in tungsten. Yet, the company’s path is complicated by Chinese market dominance, regulatory bottlenecks in Alaska, and unsuccessful acquisition attempts abroad. Even so, management remains confident that the combination of domestic mining, global procurement, and strategic engagement with U.S. national-security agencies positions UAMY at the center of a rapidly changing critical-minerals landscape.

The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Although the company can become a strategic antimony supplier for the United States over the long term, the near-term challenges, coupled with premium valuation, make it risky for new investors. Moreover, the declining estimate revision trend is not favorable. We advise existing investors to continue to hold their position, while new investors can wait for an entry point with attractive valuation.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite