|

|

|

|

|||||

|

|

The global race for critical minerals is accelerating, and two companies — United States Antimony Corporation UAMY and The Metals Company TMC — have positioned themselves at pivotal but very different strategic fronts. While UAMY is executing a rapid revival of domestic antimony mining and processing, supported by operational expansion and government initiatives, TMC is advancing an ambitious deep-sea nodules strategy aimed at providing the United States with long-term independence in nickel, cobalt, manganese and copper.

Both firms stand at inflection points — UAMY with near-term revenue momentum and growing domestic capacity, and TMC with long-dated, capital-intensive projects targeting large future payoffs.

This article examines their financial performance, operational progress, and strategic milestones to assess how each company is positioned in the evolving critical minerals ecosystem.

Stock Price Performance of UAMY and TMC

Year to date, shares of United States Antimony Corporation and The Metals Company have gained 425% and 227.1%, respectively.

UAMY’s performance through 2025 reflects a company in the midst of a material turnaround, driven primarily by surging antimony demand and strengthened operations. Financially, UAMY delivered 160% year-over-year revenue growth in the first half of 2025, reaching $17.5 million, with gross profit rising 183% during the same period. By the third quarter, revenues for nine months reached $26.2 million, up 182%, while gross margins expanded from 24% to 28% despite pricing pressure in antimony markets. Strong warrant exercises and stock sales boosted cash and investments to $38.5 million with minimal long-term debt, giving UAMY flexibility to scale its mining and processing footprint.

Non-financially, UAMY’s most notable achievement in 2025 is the restoration of domestic antimony mining — an industry that has been dormant for decades. At Stibnite Hill in Montana, the company has begun extracting bulk samples with ore grades expected to exceed 10% antimony, representing the first U.S. antimony mining in roughly 40 years.

UAMY also advanced multiple exploration programs across Alaska and Ontario, including trenching, gravity surveys, property acquisition, and assay programs targeting antimony, cobalt and tungsten. Although regulatory delays in Alaska slowed progress, the company mitigated this by acquiring private land, allowing exploration to continue without state or federal permitting bottlenecks.

UAMY’s processing advancements are equally significant. The company expanded capacity at its Thompson Falls facility, refurbished furnaces and increased staff to address rising ore inflows and record inventory levels. Management emphasized that UAMY remains the only domestic processor and producer of antimony products, including military-spec antimony trisulfide, which strengthens its alignment with U.S. defense supply-chain priorities.

Strategically, UAMY is extending its vision beyond antimony. The acquisition and evaluation of the Fostung tungsten deposit and the Iron Mask cobalt property position the company to replicate its antimony model across additional critical minerals where no domestic production currently exists.

Discussions with federal agencies, such as the Defense Logistics Agency (“DLA”) and the Defense Industrial Base Consortium (“DIBC”), highlight UAMY’s emerging governmental relevance, particularly as the United States seeks resilient non-Chinese sources for strategic materials.

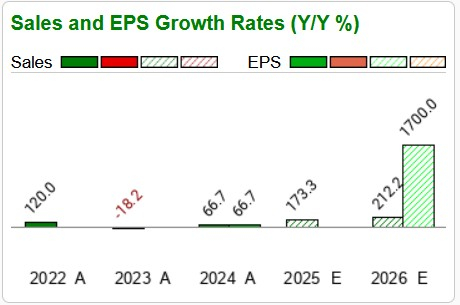

UAMY’s Earnings Growth Estimate

In contrast to UAMY’s near-term production model, TMC is executing a long-cycle strategy centered on harvesting polymetallic nodules from the deep seabed. While TMC reported no revenues in the last two quarters, its progress has been heavily concentrated on regulatory advancement, project financing and technological validation. The company published two major studies — a Prefeasibility Study for the NORI-D project and an Initial Assessment (IA) for broader resources — indicating a combined net present value of more than $23 billion.

TMC’s operational milestones highlight significant progress in both extraction and processing. The company detailed engineering innovations in its nodule collector system, including Coanda nozzles, reduced sediment intake, advanced buoyancy systems, and controlled plume management — reflecting decades of technological advancements since the 1970s.

TMC has also advanced onshore processing pathways, successfully converting nodule-derived manganese silicate into battery-grade manganese sulfate, complementing its previous production of nickel and cobalt sulfates — an important step in demonstrating full precursor cathode active material (pCAM) compatibility.

Regulatory momentum under the U.S. Deep Seabed Hard Mineral Resources Act is central to TMC’s business model. Throughout 2025, the company secured full compliance for exploration applications, progressed toward permit certification and aligned its timeline with anticipated commercial recovery in fourth-quarter 2027. The company also strengthened partnerships with Nauru, Tonga, Allseas, and Korea Zinc — supporting offshore operations, refining capacit, and U.S. supply chain integration.

Financially, TMC reported a strong liquidity position with $165 million in cash and over $400 million potential from warrants, signaling that near-term balance sheet pressures remain manageable despite zero revenues in the development phase. The company's long-term production model envisions EBITDA margins approaching 50% by 2040 as refining operations scale.

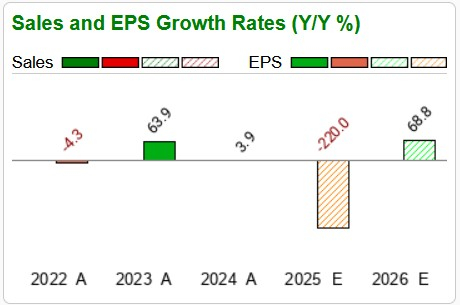

TMC’s Earnings Growth Estimate

UAMY and TMC represent two ends of the critical minerals development spectrum. UAMY is executing rapid near-term growth driven by rising antimony production and expanding domestic mining capabilities. TMC, meanwhile, is building a far-reaching seabed-to-battery mineral ecosystem capable of reshaping U.S. nickel, cobalt, manganese and copper supply chains. Both companies advance strategic U.S. interests, but their risk-reward profiles differ — UAMY offers immediate operational traction, while TMC promises massive long-term scale once regulatory and technical milestones are reached.

However, UAMY currently holds Zacks Rank #4 (Sell) and TMC carries a Zacks Rank #3 (Hold). Although the fundamentals of both companies look promising, the Zacks Rank suggests that investors should maintain their existing position in The Metals Company. However, the correction in UAMY shares may continue following a strong rally.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-05 | |

| Feb-03 | |

| Feb-03 | |

| Feb-03 | |

| Feb-02 | |

| Feb-02 | |

| Feb-02 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite