|

|

|

|

|||||

|

|

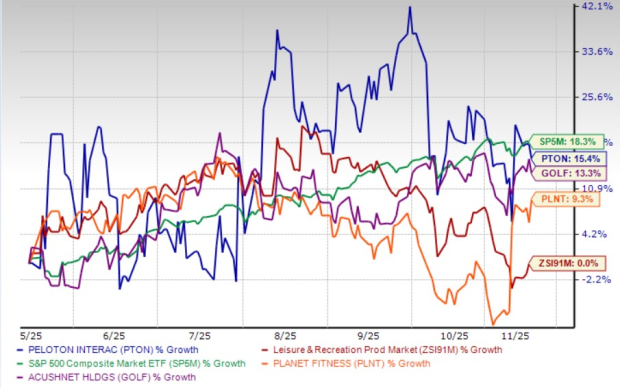

Shares of Peloton Interactive, Inc. PTON are up 15.4% over the past six months, outperforming the industry, which was flat, while trailing the S&P 500’s 18.3% growth. The company sharpening its strategy around profitable growth, product innovation and broader wellness offerings bodes well.

In fiscal first-quarter 2026, the company exceeded its guidance on most key financial metrics, demonstrating improved execution and strengthening fundamentals. Connected Fitness subscription churn improved year over year, while profitability, including adjusted EBITDA and free cash flow, showed meaningful progress. A rising mix toward higher-margin products, cost efficiency, tariff favorability and increased member engagement have helped support recent performance.

As of Thursday, the stock closed at $7.31, below its 52-week high of $10.90 but well above its 52-week low of $4.63. PTON has also outperformed other industry players, such as Planet Fitness, Inc. PLNT and Acushnet Holdings Corp. GOLF, over the past six months.

Peloton’s new leadership has reshaped the business model into a more disciplined, subscription-first ecosystem. During first-quarter fiscal 2026, Peloton achieved $118 million in adjusted EBITDA, surpassing guidance by $18 million and generated $67 million in free cash flow, a major improvement from last year. The company ended the quarter with more than $1.1 billion in cash, significantly improving leverage ratios, a key investor concern.

A crucial driver of optimism is product innovation. On Oct. 1, Peloton launched its most significant hardware refresh ever, introducing the Cross Training Series and Pro series, a lineup designed to support both cardio and strength seamlessly. New features such as computer-vision rep counting, motion guidance, voice control and studio-grade audio aim to increase engagement and justify premium pricing. A shift toward higher-priced equipment, especially the Tread and Plus-line products, is already benefiting gross margins.

The company also rolled out Peloton IQ, an AI-powered personalized coaching system that adapts workout recommendations using a member’s goals, health stats and workout history. Management sees this as a major differentiator that transforms Peloton from a hardware brand into a comprehensive wellness platform. Early indicators show improved time spent working out and increased strength training, a category with strong long-term demand.

Distribution expansion is another growth catalyst. Peloton has expanded to 10 U.S. micro stores, joined forces with Johnson Fitness & Wellness’ more than 100 retail locations, broadened its commercial presence and opened new retail franchise sites in Australia, giving consumers more opportunities to try products before purchasing. The commercial channel, strengthened by integrating Precor’s manufacturing and servicing capabilities, now provides access to more than 60 international markets and enhances brand visibility in hotels, gyms and residential developments.

Additionally, strategic partnerships are opening new monetization pathways. Recent collaborations include Breathwrk for mental fitness, the Hospital for Special Surgery on injury prevention and Respin Health to support menopause-related wellness. Subscriber loyalty initiatives like Club Peloton, already engaged by more than 500,000 members, reinforce stickiness while encouraging long-term subscription value.

Despite progress, Peloton’s top line remains under pressure. First-quarter revenues declined 6% year over year to $551 million, reflecting lower subscription and equipment sales. The company anticipates full-year revenues to fall about 2% at the midpoint, a concerning trend for a business historically valued as a high-growth fitness disruptor. Paid Connected Fitness Subscriptions also fell 6% year over year and management expects further declines in the second quarter due to pricing-related churn.

The recent Bike+ seat post recall, affecting more than 875,000 units in the United States and Canada, imposed a $16.5 million financial impact and is expected to temporarily increase subscription pauses and churn into the second and third quarters. Although management calls the revenue impact immaterial, investors remain wary given Peloton’s history of recalls damaging the brand.

Competition across fitness and wellness remains intense and the broader Connected Fitness category is still declining in low single-digits post-pandemic. While Peloton is repositioning beyond cardio into strength and wellness, execution risk remains high as consumers shift purchases from at-home hardware to gym-based or hybrid models.

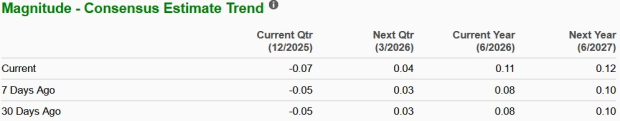

The Zacks Consensus Estimate for fiscal 2026 adjusted earnings per share has increased to 11 cents from 8 cents. The company’s earnings in fiscal 2026 are likely to witness a gain of 136.7% year over year.

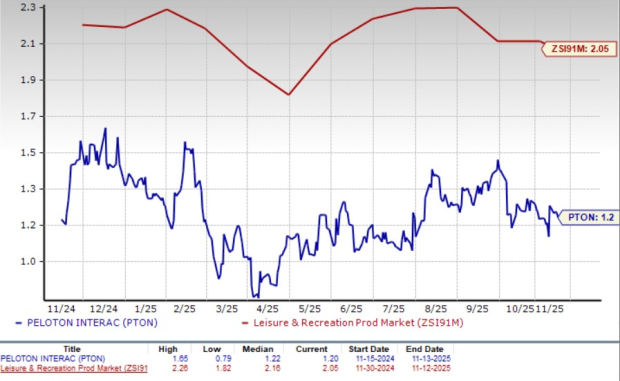

Peloton is currently valued at a discount compared with the industry on a forward 12-month P/S basis. PTON’s forward 12-month price-to-sales ratio stands at 1.2, significantly lower than the industry average.

Peloton has taken meaningful steps to stabilize its business, strengthening profitability, improving churn, expanding retail touchpoints and rolling out high-engagement innovations like the latest hardware lineup and AI-driven coaching, all of which signal that the turnaround strategy is gaining traction. At the same time, revenues are still shrinking, competition remains fierce and execution risks persist as the company transitions from a hardware-centric model to a broader wellness ecosystem.

With the stock already rebounding from its lows but the growth outlook still uncertain, existing investors may benefit from holding shares to see whether operational improvements translate into a sustainable top-line recovery, while new buyers would be better off waiting for clearer signs of consistent demand momentum before stepping in.

PTON currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 hours | |

| 14 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite