|

|

|

|

|||||

|

|

Peloton Interactive, Inc. PTON and Planet Fitness, Inc. PLNT represent two very different approaches to the modern fitness market, one built on connected at-home equipment and digital subscriptions, the other on an expansive network of affordable gyms.

Both companies are working to regain momentum after industry disruptions, but their recovery paths and investor expectations vary widely. As fitness spending normalizes and competition intensifies, the big question for shareholders becomes: Which stock offers the stronger upside from here?

Peloton’s improving profitability is a key pillar of the bullish argument. The company delivered $118 million in adjusted EBITDA in first-quarter fiscal 2026, beating expectations by $18 million, and generated $67 million in free cash flow, a significant improvement from last year. Management raised full-year EBITDA guidance to $425-$475 million, supported by faster-than-expected cost savings and tariff benefits.

The company is also gaining traction with its largest product refresh to date, including the new Cross Training Series equipment lineup and Peloton IQ AI coaching, which management says is driving a shift toward premium hardware and higher engagement levels. Strong product innovation helps reinforce Peloton’s positioning beyond connected biking and into a broader wellness ecosystem.

Growth in distribution channels further strengthens Peloton’s outlook. The brand expanded to 10 micro stores in the United States and formed a new retail partnership with Johnson Fitness & Wellness, broadening its reach across 46 states. Its commercial segment, supported by Precor, is also gaining momentum in hospitality and residential markets, creating new revenue opportunities.

Despite operational progress, Peloton faces continued top-line pressure. Paid Connected Fitness subscriptions fell 6% year over year, contributing to a 6% revenue decline in the fiscal first quarter. Management expects churn to rise in second-quarter fiscal 2026 following subscription price increases before stabilizing later in the year. The company also notes ongoing softness in the connected fitness equipment category, which remains in decline post-pandemic.

Peloton is also managing the impact of another product recall involving the Original Series Bike+, which resulted in a $16.5 million inventory accrual and could temporarily affect member sentiment and usage. While management expects minimal revenue disruption, recall-related headlines risk slowing subscriber momentum at a critical stage of recovery.

Planet Fitness continues to benefit from strong demand trends and an expanding member base. The company ended third-quarter 2025 with approximately 20.7 million members and delivered 6.9% system-wide same-club sales growth, supported by both pricing and membership increases. Revenues rose 13% year over year, and management raised its full-year outlook for revenues, EBITDA and net income growth on the back of this strong momentum.

The brand’s value proposition is resonating especially with younger consumers. Participation in the High School Summer Pass program surged 30% year over year, bringing in 3.7 million teens, many of whom later converted to paying memberships. That success is helping Planet Fitness strengthen long-term loyalty and brand relevance with Gen Z, a key demographic for sustained growth.

Expansion remains a powerful driver. The company opened 35 new clubs in third-quarter 2025, bringing the global count to 2,795 and continues rolling out optimized club formats and upgraded strength equipment that attracted enthusiastic franchisee investment. Planet Fitness also sees growing real estate availability as a tailwind for accelerated club development, with franchisees actively seeking new territories and conversion opportunities.

While join trends are strong, attrition remains elevated on a year-over-year basis due to the rollout of click-to-cancel and management expects higher churn to continue through fourth-quarter 2025. Although cancellation behaviors are moderating, the membership count dipped slightly versus the second quarter, typical seasonality, but still a reminder that net adds are not yet on a steady upward trajectory.

Another risk is reliance on pricing to sustain same-club sales growth. Roughly 80% of third-quarter 2025 comp growth came from higher rates versus volume. With another Black Card price increase planned for 2026, there is potential for consumer resistance, temporary mix pressure or slower conversion to the premium tier, especially as gym-goers become more value-conscious in a competitive fitness landscape.

The Zacks Consensus Estimate for Peloton's fiscal 2026 sales and EPS implies almost flat and growth of 140%, respectively, year over year. Earnings estimate revisions for fiscal 2026 have witnessed upward revisions in the past 30 days.

The Zacks Consensus Estimate for PLNT’s 2025 sales and EPS implies year-over-year increases of 10.8% and 15.4%, respectively. Earnings estimates for 2025 have witnessed upward revisions in the past 30 days.

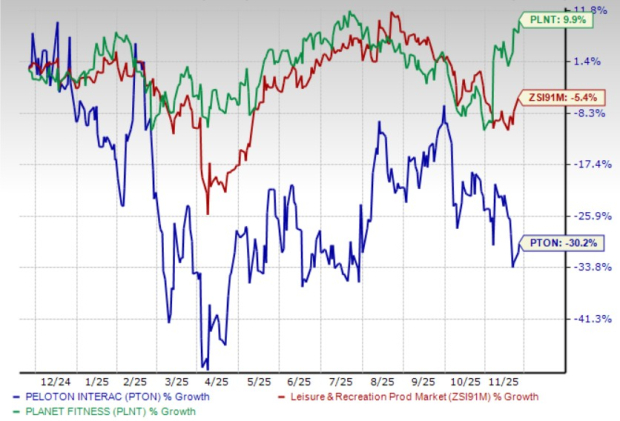

PTON stock has tanked 30.2% in the past year. However, PLNT’s shares have gained 9.9% in the same time frame.

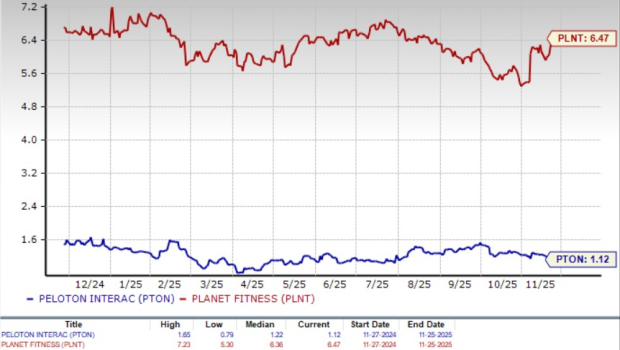

PTON is trading at a forward 12-month price-to-sales ratio of 1.12X, below its median of 1.22X over the last year. PLNT’s forward sales multiple sits at 6.47X, above its median of 5.30X over the same time frame.

Both Peloton and Planet Fitness are making meaningful progress in their recovery journeys, supported by improving profitability and renewed strategic focus, making them reasonable hold candidates for investors. Peloton is showing encouraging signs of stabilization through innovation, cost discipline and expanding distribution, but it still needs to prove that subscriber trends can return to sustainable growth.

Planet Fitness, on the other hand, benefits from steady demand for in-person fitness, strong brand momentum and growing franchise investment, putting it slightly ahead at this stage in terms of consistency and visibility. While each company offers a unique path to long-term upside, Planet Fitness currently appears to have the clearer runway, but Peloton’s turnaround efforts keep it firmly in the game for patient investors.

Both PTON and PLNT carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite