|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Pan American Silver Corp. PAAS has gained 4% since reporting solid third-quarter 2025 results on Wednesday, delivering year-over-year increases in its top and bottom lines. However, PAAS missed the Zacks Consensus Estimate on both metrics.

Year to date, PAAS shares have surged 95.5%. In comparison, the industry has skyrocketed 121.4%, the Basic Materials sector has risen 27.2% and the S&P 500 has rallied 19.5%.

Let us take a closer look at PAAS’s third-quarter results and understand if this is the right time to invest in Pan American Silver’s shares.

The company reported revenues of $855 million, reflecting 19% year-over-year growth, attributed to higher gold and silver prices. It was partially offset by an $80.5-million decrease in the quantities of metal sold, reflecting the disposition of La Arena, and lower production at Dolores and Timmins. The top-line missed the Zacks Consensus Estimate of $868 million.

PAAS’s third-quarter silver production reached 5.5 million ounces, flat compared with the output from the same period last year. Gold production for the third quarter was 183.5 thousand ounces. It was lower than the 225 thousand ounces produced in the year-ago quarter.

Mine operating earnings surged 78.1% to $313 million. Adjusted earnings per share were 48 cents, marking a 50% jump from the year-ago quarter. However, the figure missed the Zacks Consensus Estimate of 49 cents.

The company reported a record cash flow from operations of $324 million. The free cash flow was also a record $252 million.

In early September, PAAS completed its previously stated acquisition of MAG Silver Corp. This move boosts Pan American Silver’s position as one of the leading silver producers globally and significantly strengthens the company’s industry-leading silver reserve base.

Pan American Silver gained a 44% stake in the Juanicipio project, which is a large-scale, high-grade silver mine in Zacatecas operated by Fresnillo plc. The Juanicipio mine is expected to produce 14.7-16.7 million ounces of silver in 2025. With just a month of contribution from its stake in the Juanicipio mine, Pan American Silver saw a strong impact on its silver segment performance and cash flow in the third quarter of 2025.

The transaction also adds the full ownership of the Larder exploration project and a full earn-in interest in the Deer Trail exploration project to PAAS’s portfolio. The addition of these assets will contribute significantly to Pan American Silver’s production, reserves and cash flow.

Considering a month of strong performance from its stake in the Juanicipio mine, Pan American Silver has increased its silver production outlook for 2025 to 22-25 million ounces, up from the prior stated 20-21 million ounces. The company produced 21.1 million ounces of silver in 2024.

PAAS is maintaining its gold production for 2025 at 735-800 thousand ounces, indicating a decline from the 895.5 thousand ounces registered in 2024. The downside mainly reflects the loss of contribution of the La Arena mine and Dolores. Production at Dolores was down following the cessation of mining operations in July 2024 and the site transitioning into its residual leaching phase.

Endeavour Silver Corporation EXK reported an adjusted loss of 1 cent per share for the third quarter of 2025 against earnings of 1 cent in the prior-year quarter. Endeavour Silver’s revenues skyrocketed 109% to $111 million from $53 million in the third quarter of 2024. However, both top and bottom lines missed the Zacks Consensus Estimate.

Hecla Mining Company HL registered third-quarter 2025 adjusted earnings per share of 12 cents. HL posted earnings of 3 cents per share in the year-ago quarter. Hecla Mining’s revenues surged 67.3% year over year to $410 million in the quarter under review. Both top and bottom lines beat the Zacks Consensus Estimate.

In the July-September 2025 period, gold prices averaged $3,500 per ounce, up 41% year over year. Silver prices averaged $39.80 per ounce in the quarter, up 34% year over year. This aided PAAS and its peers in the third quarter of 2025.

Backed by a strong cash flow generation, the company recently increased its quarterly dividend 17% to 14 cents from the prior payment of 12 cents. This increase takes the company’s annualized dividend to 0.56 cents from the prior 48 cents. Pan American Silver will pay the new quarterly dividend of 14 cents on Dec. 5, 2025, to shareholders of record as of Nov. 24, 2025.

In comparison, Hecla Mining maintains an annual dividend of 0.02 cents and Endeavour Silver does not pay any regular dividend as of now.

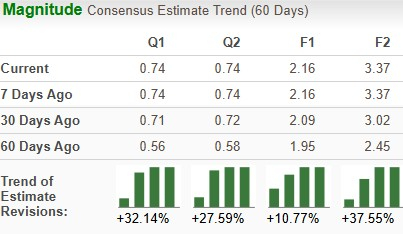

The Zacks Consensus Estimate for Pan American Silver’s earnings for 2025 and 2026 has moved up 10.8% and 37.6%, respectively, over the past 60 days.

The consensus mark for 2025 earnings is pegged at $2.16 per share, indicating a year-over-year upsurge of 173.4%. The estimate for 2026 of $3.37 suggests an increase of 56%.

PAAS has solidified its position as a leading precious metal producer in the Americas with a diversified asset base. The company has been rationalizing its portfolio following the Yamana acquisition (in 2023), investing in its producing mines while advancing organic opportunities.

Per PAAS’s report as of June 30, 2025, its proven and probable mineral reserves are estimated to total 452.3 million ounces of silver and 6.3 million ounces of gold. Pan American Silver’s measured and indicated mineral resources are estimated to contain 1,130.6 million ounces of silver and 9.9 million ounces of gold. The estimated inferred mineral resources contain 405.6 million ounces of silver and 8.6 million ounces of gold. These estimates, however, do not factor in PAAS’s acquisition of MAG Silver. We expect the company to report the updated figures soon, including the acquisition.

The company has also been successfully extending the lifespan of many of its operations, driven by ongoing exploration efforts across its portfolio.

At the La Colorada Skarn mine, Pan American Silver has recently discovered several high-grade silver zones and increased mineral resources. This has created an opportunity to integrate the existing vein mine with the Skarn project.

Pan American Silver remains focused on progressing initiatives to further increase shareholder value.

Pan American Silver is currently trading at a forward 12-month price-to-earnings multiple of 12.16X, at a discount to the industry average of 15.43X.

In comparison, Endeavour Silver and Hecla Mining are trading higher at 12.77X and 36.58, respectively.

Pan American Silver is well-positioned to capitalize on the ongoing rally in gold and silver prices, and the recent MAG Silver buyout. Continued investments in growth initiatives strengthen its long-term prospects. However, a lower gold production outlook suggests caution for new investors.

Existing shareholders should stay invested in Pan American Silver’s stock to benefit from its solid long-term growth prospects. The company currently has a Zacks Rank #3 (Hold), which supports our thesis.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite