|

|

|

|

|||||

|

|

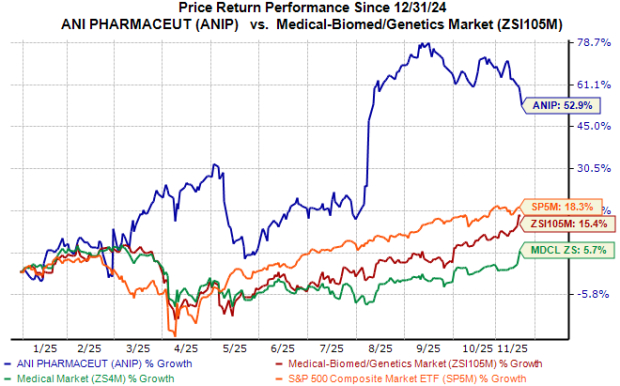

Shares of ANI Pharmaceuticals ANIP have surged 53% so far this year compared with the industry’s 15% growth. The stock has also outperformed the sector and the S&P 500 during the same period, as shown in the chart below.

This upside is attributable to the encouraging financial performance of the company since the start of this year. ANI Pharmaceuticals recently reported third-quarter 2025 results, with both top and bottom lines beating our estimates. Based on this momentum, the company raised its financial guidance for full-year 2025. ANIP now expects sales between $854 million and $873 million (previously: $818-$843 million) and EPS in the range of $7.37-$7.64 (up from $6.98-$7.35). The revised outlook implies annual growth of 39-42% in sales and 42-47% in earnings.

Let’s explore the company’s fundamentals to better understand how to play the stock amid the recent share price increase.

ANI Pharmaceuticals’ rare disease segment sales have surged more than 100% year over year to $291 million in the first nine months of 2025, driven by increased demand for the lead product, Cortrophin Gel. The company expects to generate nearly half of its 2025 top line from the rare disease franchise.

Sales of the ACTH-based injection Cortrophin Gel climbed 70% year over year to $236 million during the first nine months, highlighting its role as ANIP’s key revenue driver. This uptick was driven by increased demand across all specialties — neurology, rheumatology, nephrology and ophthalmology — aided by an expanded sales force and broader prescriber adoption. The momentum is likely to continue in the future, further supported by new clinical studies (including a phase IV study in acute gouty arthritis) and ongoing efforts to deepen specialty penetration. For the full year, ANI Pharmaceuticals expects Cortrophin Gel sales between $347 million and $352 million, reflecting a 75-78% increase over the prior year.

This strong performance is expected to more than offset the softer contribution from recently acquired ophthalmology assets, Iluvien and Yutiq, added through the September 2024 acquisition of Alimera Sciences. ANI Pharmaceuticals recently lowered its full-year guidance for these products to $73-$77 million (previously: $87-$93 million), citing ongoing reimbursement challenges, particularly reduced Medicare access and continued utilization of remaining inventory at physician offices. However, ANIP expects a rebound in Iluvien and Yutiq sales growth in 2026, supported by an expanded ophthalmology sales effort, improved patient access and a significantly larger addressable patient population, nearly 10 times the size of current usage.

Sales from ANI Pharmaceuticals’ generics business rose 27% year over year to more than $283 million in the first nine months of 2025, fueled by increased base-business volumes, contributions from new product launches and temporary exclusivity from a partnered generic introduced in the second half of Q3. This partnered product benefited from a brief period of sole-generic status, lifting Q3 results above earlier expectations of a sequential decline. However, with competing versions entering the market in Q4, generics sales are expected to fall from Q3 levels, though ANIP still projects full-year generics growth in the low-20% range.

The generic market remains highly competitive, with large pharma and specialized developers vying for share. As more biosimilars enter the market, payers and healthcare providers are gaining greater pricing leverage, often driving deeper discounts to secure preferred access. This dynamic could constrain ANIP’s pricing flexibility and pressure margins, particularly in price-sensitive therapeutic areas. Moreover, intensified competition from established generic players, such as Teva Pharmaceutical TEVA, Viatris VTRS and Amneal Pharmaceuticals AMRX, may require increased spending on marketing and support services, adding to near-term cost pressures.

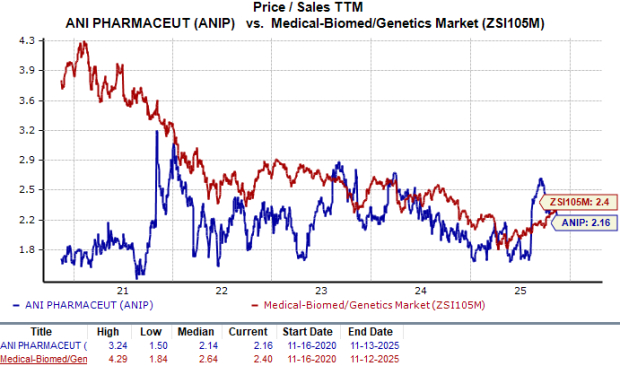

The company is trading at a discount to the industry. Going by the price/sales (P/S) ratio, the stock currently trades at 2.16 times trailing 12-month sales value, lower than 2.40 times for the industry.

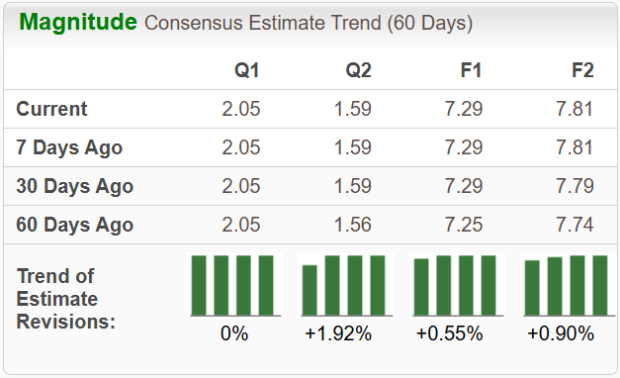

Over the past 30 days, estimates for ANI Pharmaceuticals’ 2025 EPS have remained consistent while those for 2026 have slightly increased.

ANI Pharmaceuticals has been executing well across its rare diseases segment with strong operational momentum reflected in recent quarters. While the generic business faces stiff competition in the near future, we expect sales to remain a steady contributor to top-line growth, supported by selective product launches and a resilient U.S. manufacturing base.

We are also encouraged by the company’s upbeat financial guidance, which ANIP has raised for the fourth time this year, a sign of management’s confidence and consistent execution. The future outlook for ANIP appears equally promising, backed by sustained growth in Cortrophin Gel and improving traction in ophthalmology products.

Overall, ANI Pharmaceuticals appears well-positioned to sustain profitability, expand its rare disease footprint and deliver steady shareholder value in the coming quarters, a view which is also reinforced by the stock’s current Zacks Rank #2 (Buy). Despite strong year-to-date gains, IT continues to trade at a discount to the broader industry, suggesting room for further upside. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 56 min | |

| 1 hour | |

| 1 hour | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite