|

|

|

|

|||||

|

|

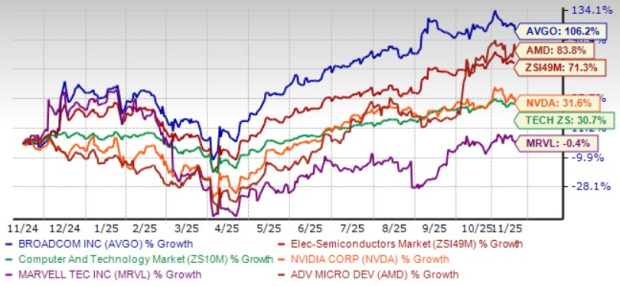

Broadcom AVGO shares have surged 106.3% in the trailing 12-month period, outperforming the Zacks Electronics – Semiconductors industry’s return of 71.4% and the broader Zacks Computer and Technology sector’s appreciation of 30.7%. AVGO is benefiting from strong demand for XPUs, which are a type of application-specific integrated circuits (ASICs) necessary to train Generative AI models. They require complex integration of compute, memory, and I/O capabilities to achieve the necessary performance at lower power consumption and cost. Alphabet and Meta Platforms are notable users of Broadcom’s ASICs.

Strong demand for XPUs, an innovative product portfolio, and an expanding partner base have helped Broadcom outperform peers, including NVIDIA NVDA, Marvell Technology MRVL and Advanced Micro Devices AMD. While shares of NVIDIA and AMD have returned 31.6% and 83.8%, respectively, Marvell Technology fell 0.4% in the past year. Will Broadcom continue to sustain its momentum? Let’s find out.

Broadcom’s XPUs are gaining traction. In the third quarter of fiscal 2025, AI revenues surged 63% year over year to $5.2 billion. XPUs accounted for 65% of AI revenues in the reported quarter. Consolidated backlog hit $110 billion, and the company has secured more than $10 billion of orders for AI racks based on XPU demand. AVGO’s networking portfolio is gaining from strong demand for Tomahawk 5 and 6 products, as well as the Jericho 4 Ethernet fabric router.

AVGO expanded its portfolio with the launch of the industry’s first Wi-Fi 8 silicon solutions for the broadband wireless edge ecosystem, including residential gateways, enterprise access points and smart mobile clients. Tomahawk 6 - Davisson (TH6-Davisson), the company’s third-generation Co-Packaged Optics Ethernet switch, is now being shipped. TH6-Davisson is specifically designed for the accelerating demands of AI networking, as it delivers an unprecedented 102.4 terabits per second of optically enabled switching capacity.

In August, Broadcom announced the Jericho 4 Ethernet fabric router that has the ability to interconnect more than one million XPUs across multiple data centers. In October, the company announced Thor Ultra, the industry’s first 800G AI Ethernet Network Interface Card, capable of interconnecting hundreds of thousands of XPUs to drive trillion-parameter AI workloads. AVGO also announced the industry’s first Wi-Fi 8 silicon solutions for the broadband wireless edge ecosystem, including residential gateways, enterprise access points and smart mobile clients.

Moreover, Broadcom has a rich partner base that includes the likes of OpenAI, Lloyds Banking Group, Walmart, NVIDIA, Canonical, Arista Networks, Alphabet, Dell Technologies, Meta Platform, Juniper, Supermicro, among others. A strong portfolio and rich partner base are expected to drive top-line growth. AVGO expects fourth-quarter fiscal 2025 Semiconductor revenues of $10.7 billion, suggesting 30% year-over-year growth. Infrastructure Software revenues are expected to grow 15% year over year to $6.7 billion.

Broadcom’s fourth-quarter fiscal 2025 guidance indicates a 70 basis point sequential decline in gross margin due to a higher mix of lower-margin XPUs. A higher mix of lower-margin XPUs in the revenue mix is expected to keep gross margin under pressure throughout fiscal 2025.

Broadcom expects non-AI semiconductor revenues to grow in the low double digits sequentially to roughly $4.6 billion in the fourth quarter of fiscal 2025. Broadband, server storage and wireless are expected to improve, while enterprise networking is expected to decline sequentially. Sluggish non-AI business remains a headwind and Broadcom expects to see a U-shaped recovery by mid-2026 or late 2026.

The Zacks Consensus Estimate for fiscal 2025 earnings is pegged at $6.72 per share, unchanged over the past 30 days, indicating 38% growth from fiscal 2024’s reported figure. The consensus mark for fiscal 2025 revenues is currently pegged at $63.36 billion, suggesting 22.9% growth from fiscal 2024’s reported figure.

Broadcom Inc. price-consensus-chart | Broadcom Inc. Quote

AVGO stock is trading at a premium, as suggested by the Value Score of D.

In terms of the forward 12-month price/sales, AVGO is trading at 18.72X, higher than the sector’s 6.85X, NVIDIA’s 17.6X, Marvell Technology’s 8.31X and AMD’s 9.78X.

Broadcom’s expanding AI portfolio, along with a rich partner base, reflects solid top-line growth potential. These are good reasons to hold the stock for long-term investors. However, declining gross margin, along with a challenging macroeconomic condition, doesn’t justify the premium valuation.

Broadcom currently carries a Zacks Rank #3 (Hold), which implies that investors should wait for a more favorable point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Dow Jones Futures: Trump Tariffs Spark Stock Market Sell-Off; Apple, Nvidia, Tesla Are Key Movers

NVDA

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite