|

|

|

|

|||||

|

|

Eli Lilly and Company LLY is one of the two companies that dominate the booming diabetes and obesity space, driven by its successful GLP-1 therapies — Mounjaro for diabetes and Zepbound for weight loss, both comprising the same ingredient, tirzepatide, a dual GIP and GLP-1 receptor agonist (GIP/GLP-1 RA). Mounjaro and Zepbound face strong competition from Novo Nordisk’s NVO semaglutide medicines, Ozempic for diabetes and Wegovy for obesity.

The obesity market is expected to expand to $100 billion by 2030, according to data from Goldman Sachs, which means fierce competition is inevitable. Though Lilly and Novo Nordisk presently dominate the market, they are making rapid progress in the development of more potent and convenient GLP-1-based candidates in their clinical pipeline to beat future competition. Approvals for new indications can also drive sales of Mounjaro and Zepbound higher.

Lilly is investing broadly in obesity and has several new molecules currently in clinical development with a range of oral and injectable medications with different mechanisms of action. This includes two late-stage candidates, orforglipron, a once-daily oral GLP-1 small molecule, and retatrutide, a GGG tri-agonist and some mid-stage candidates, bimagrumab, eloralintide and mazdutide.

Orforglipron is being viewed as a key candidate in Lilly's obesity pipeline, which has the potential to transform the obesity treatment space as both Zepbound and NVO’s Wegovy are weekly injections. There is significant demand for convenient daily oral pills for weight loss that can be manufactured at scale to meet global demand. Lilly has scaled up its manufacturing capacity to meet potential demand for its novel obesity medicines.

Lilly has announced positive data across six studies on orforglipron in obesity and type II diabetes. Lilly plans to file regulatory applications for orforglipron in obesity later this year, setting up the timeline for a potential launch next year. It is believed that the 2026 launch of orforglipron should further boost Lilly’s top-line growth. For the type II diabetes indication, Lilly plans to file regulatory applications in the first half of 2026.

It is also evaluating orforglipron in late-stage studies in other disease areas like obstructive sleep apnea, osteoarthritis pain of the knee, stress, urinary incontinence and hypertension. These multiple late-stage studies on orforglipron can expand the candidate’s revenue potential beyond obesity/T2D. A key phase III study on orforglipron is ATTAIN-MAINTAIN, which is evaluating patients switching from injectable semaglutide/tirzepatide to oral orforglipron. The goal of the study is to inform what level of weight loss patients can maintain after switching from an injectable incretin to orforglipron. Data from the study is expected in late 2025/early 2026. Lilly believes this data will be important to establish orforglipron’s commercial opportunity.

Lilly is also evaluating another key candidate, triple-acting incretin, retatrutide (which combines GLP-1, GIP and glucagon), in type II diabetes and obesity, along with other indications like obstructive sleep apnea, knee osteoarthritis and chronic low back pain, in late-stage studies.

Lilly expects the first data readout from a phase III study on retatrutide in osteoarthritis of the knees later in 2025 and from seven more phase III studies in 2026 and 2027, including three phase III studies on obesity in the second half of 2026. Lilly believes that retatrutide can deliver deeper and more rapid weight loss than existing obesity medicines. It should be an apt drug for people with a very high BMI or with obesity-related complications for which significant weight loss will be required.

Several other companies, like Amgen AMGN and Viking Therapeutics VKTX, are also making rapid progress in the development of more potent and convenient GLP-1-based candidates in their clinical pipeline.

Viking Therapeutics’ dual GIPR/GLP-1 receptor agonist, VK2735, is being developed both as oral and subcutaneous formulations for the treatment of obesity.

NVO, LLY and VKTX are racing to introduce oral weight-loss pills. Novo Nordisk has already filed a new drug application (NDA) for an oral version of Wegovy and has several next-generation candidates in its obesity pipeline, like CagriSema (a combination of semaglutide and cagrilintide) and an oral pill, amycretin (a dual GLP-1 and amylin receptor agonist). The FDA is expected to decide on the Wegovy oral formulation NDA later this year.

Others like Roche, Merck and AbbVie are also looking to enter the obesity space by in-licensing obesity candidates from smaller biotechs, which could threaten Novo Nordisk and Eli Lilly’s dominance in the market. Pfizer is looking to buy obesity drugmaker Metsera to gain a foothold in the obesity space.

Amgen is developing MariTide, a GIPR/GLP-1 receptor, as a single dose in a convenient autoinjector device with a monthly and maybe less frequent dosing. This key feature differentiates it from Zepbound and Wegovy, which are weekly injections. In clinical studies, it has shown predictable and sustained weight loss and a clinically meaningful impact on cardiometabolic parameters.

As competition intensifies, Eli Lilly’s deep investment in next-generation obesity treatments positions it to extend its leadership, with orforglipron and retatrutide poised to define the next wave of innovation in weight management.

Lilly’s stock has risen 32.6% so far this year compared with the industry’s increase of 14.0%.

From a valuation standpoint, Lilly’s stock is expensive. Going by the price/earnings ratio, LLY’s shares currently trade at 33.37 forward earnings, much higher than 16.73 for the industry. However, LLY’s stock is trading below its 5-year mean of 34.54.

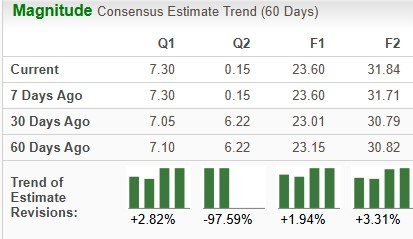

The Zacks Consensus Estimate for 2025 has risen from $23.01 per share to $23.60 per share over the past 30 days, while that for 2026 has risen from $30.79 to $31.84 per share over the same timeframe.

Lilly has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 7 hours | |

| 10 hours | |

| 11 hours | |

| 13 hours | |

| 13 hours | |

| 15 hours | |

| 15 hours | |

| 15 hours | |

| 16 hours | |

| 16 hours | |

| 17 hours | |

| 17 hours |

Novo Nordisk and Vivtex collaborate for oral medicines development

NVO

Pharmaceutical Business Review

|

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite