|

|

|

|

|||||

|

|

Looking back on drug development inputs & services stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Charles River Laboratories (NYSE:CRL) and its peers.

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

The 7 drug development inputs & services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.1%.

In light of this news, share prices of the companies have held steady as they are up 2.3% on average since the latest earnings results.

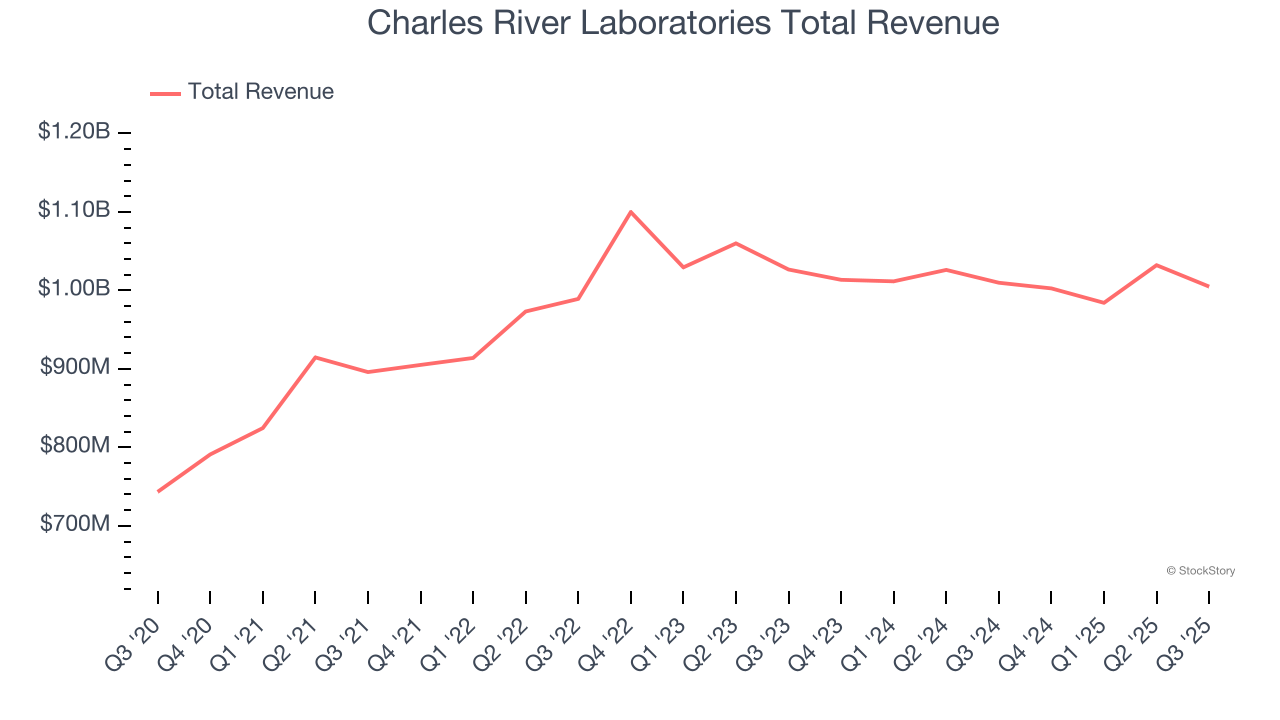

Named after the Massachusetts river where it was founded in 1947, Charles River Laboratories (NYSE:CRL) provides non-clinical drug development services, research models, and manufacturing support to pharmaceutical and biotechnology companies.

Charles River Laboratories reported revenues of $1.00 billion, flat year on year. This print exceeded analysts’ expectations by 1.1%. Overall, it was a satisfactory quarter for the company with a narrow beat of analysts’ organic revenue estimates.

James C. Foster, Chair, President and Chief Executive Officer, said, “Our solid third-quarter financial results demonstrate that the demand for our extensive portfolio of early-stage research and manufacturing products and services remains stable. We believe that positive signals are beginning to emerge which indicate that the industry may be on a path towards recovery; however, sustained improvement in our business will take time. There is still some uncertainty in the healthcare sector, so we are remaining cautious at this time.”

Charles River Laboratories delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 5.9% since reporting and currently trades at $167.29.

Is now the time to buy Charles River Laboratories? Access our full analysis of the earnings results here, it’s free for active Edge members.

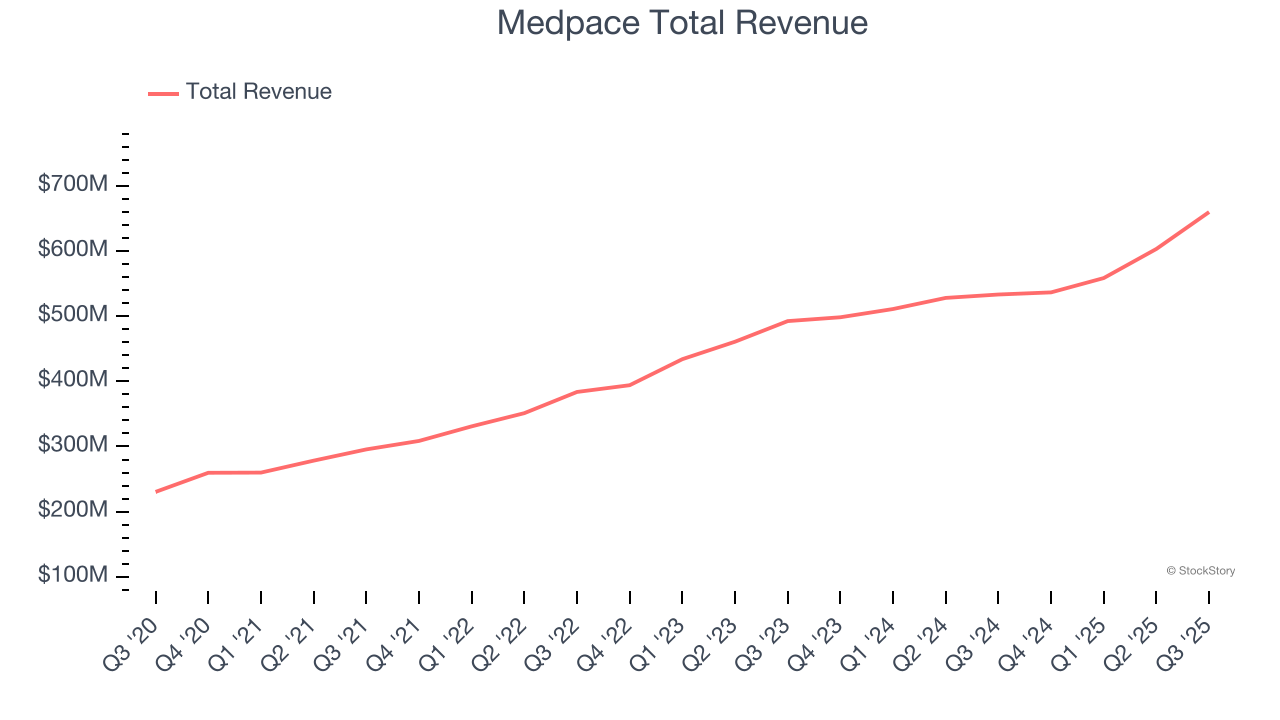

Founded in 1992 as a scientifically-driven alternative to traditional contract research organizations, Medpace (NASDAQ:MEDP) provides outsourced clinical trial management and research services to help pharmaceutical, biotechnology, and medical device companies develop new treatments.

Medpace reported revenues of $659.9 million, up 23.7% year on year, outperforming analysts’ expectations by 2.7%. The business had an exceptional quarter with a solid beat of analysts’ organic revenue and full-year EPS guidance estimates.

Medpace pulled off the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 7.9% since reporting. It currently trades at $589.88.

Is now the time to buy Medpace? Access our full analysis of the earnings results here, it’s free for active Edge members.

Created from the 2016 merger of Quintiles (a clinical research organization) and IMS Health (a healthcare data specialist), IQVIA (NYSE:IQV) provides clinical research services, data analytics, and technology solutions to help pharmaceutical companies develop and market medications more effectively.

IQVIA reported revenues of $4.1 billion, up 5.2% year on year, exceeding analysts’ expectations by 0.5%. Still, it was a mixed quarter because it struggled in other parts of the business.

IQVIA delivered the highest full-year guidance raise but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 1.5% since the results and currently trades at $220.59.

Read our full analysis of IQVIA’s results here.

With over 13 strategic acquisitions since 2012 to build its comprehensive bioprocessing portfolio, Repligen (NASDAQ:RGEN) develops and manufactures specialized technologies that improve the efficiency and flexibility of biological drug manufacturing processes.

Repligen reported revenues of $188.8 million, up 21.9% year on year. This number beat analysts’ expectations by 3.8%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ revenue estimates.

The stock is down 5.4% since reporting and currently trades at $152.42.

Read our full, actionable report on Repligen here, it’s free for active Edge members.

Spun off from Labcorp in 2023 to focus exclusively on clinical research services, Fortrea (NASDAQ:FTRE) is a contract research organization that helps pharmaceutical, biotech, and medical device companies develop and bring their products to market through clinical trials and support services.

Fortrea reported revenues of $701.3 million, up 3.9% year on year. This print topped analysts’ expectations by 8.2%. It was a strong quarter as it also recorded an impressive beat of analysts’ revenue estimates and full-year revenue guidance exceeding analysts’ expectations.

Fortrea scored the biggest analyst estimates beat among its peers. The stock is up 7.2% since reporting and currently trades at $10.40.

Read our full, actionable report on Fortrea here, it’s free for active Edge members.

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.

| 10 hours | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite